107% Dividend Yield: My MSTY ETF Performance Insights from Inception

Understanding Investment Income Strategies

Introduction to Investment Income

Figuring out how to rake in that steady cash flow from investments sounds like music to my ears. I'm always poking around for different avenues that won’t just pad my wallet but keep a dependable cash stream flowing.

Finding the sweet spot where my investments grow while keeping a steady paycheck? That’s the dream.

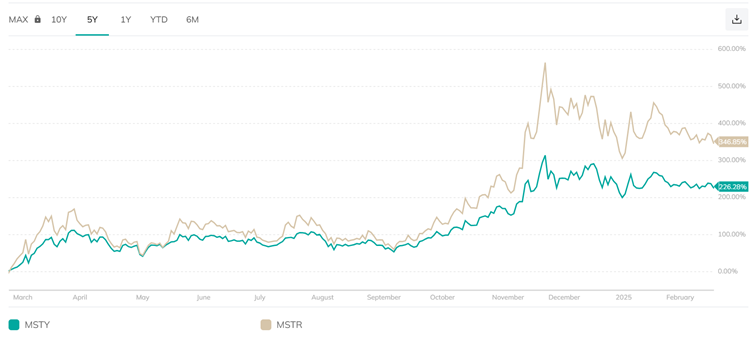

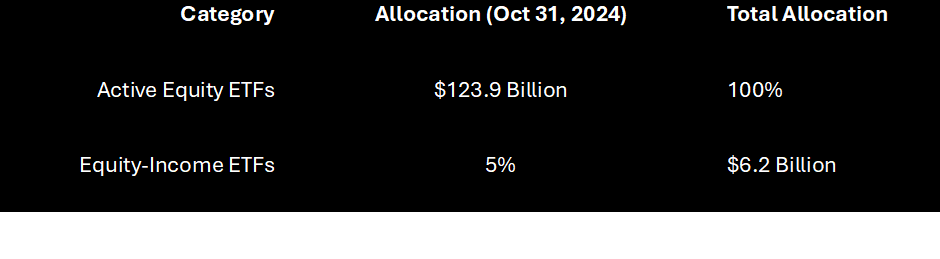

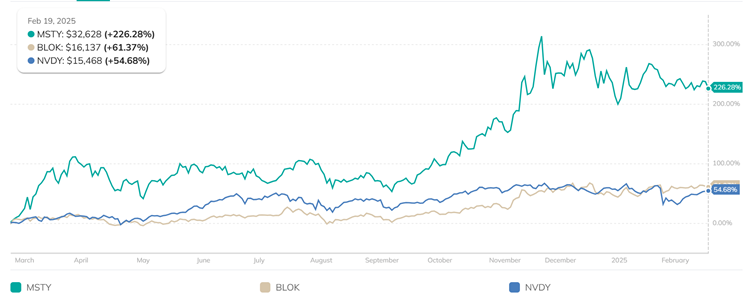

One nifty trick up my sleeve: equity-income ETFs, particularly the MSTY ETF. These little gems made up about 5% of the $123.9 billion tossed into active equity ETFs as of late 2024. What does this mean? These funds aren't just a passing trend – they’re turning heads and delivering the goodies. Peeking at the msty etf performance since inception February 2024 has given me a good grip on its growth groove. Since February 2024 until the time of writing this article – February 2025, MSTY has seen an overall return of approximately ~226% vs MSTR Microstrategy (now just called Strategy) stock of ~346%.

The graph shows the growth of $10,000 invested in MSTY YieldMax™ MSTR Option Income Strategy ETF and MSTR MicroStrategy Incorporated. Returns also include dividend distribution.

Importance of Maximising Returns

Getting those returns up as high as possible is the bread and butter of any money strategy I’ve got going. Those extra bucks make a world of difference, letting me either funnel more cash back into investments or splurge a bit when needed. I'm all about using whatever tactics get me the most bang for my buck. That means keeping a sharp eye on ETFs – including those neat covered-call ETFs and dividend-yield choices – makes my investment game strong.

The MSTY ETF and its crew of equity-income pals come packed with perks, one being that tasty yield bump. Active ETFs are the hot topic right now, with surveys showing that 89% of investors plan to up their game with these funds (YCharts). This growing buzz isn’t just noise; it’s about the advantages these funds bring to the table with flexible management and beefy yields.

YieldMaxTM MSTY ETF Performance

Looking for ways to boost what I earn from investing? The MSTY ETF’s got my attention. Here's a snapshot of its main selling points that keep me hooked:

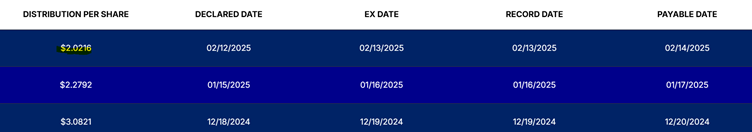

So the recent monthly payment was $2 (keep it round). Share price was trading around $25 per share, meaning the yearly rolling distribution yield is approximately 96% ($25/($2x12) = 96%) or 8% per month.

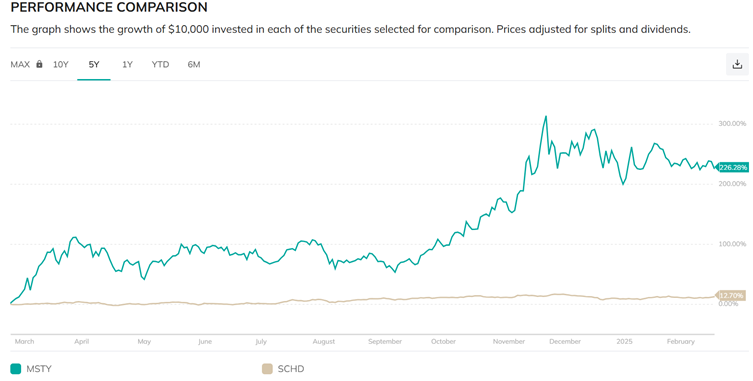

For the whole picture, I also size up other ETFs. Take the Schwab US Dividend Equity ETF™ (SCHD) which lured in $3.9 billion in assets in 2024, offering a 3.4% distribution yield with a teeny expense ratio of 0.06% (YCharts). We can also see the return on investment below, assuming $10,000 would’ve invested in MSTY and SCHD starting end of February 2024, returns include reinvesting your dividends.

The graph shows the return on investment in MSTY YieldMax™ MSTR Option Income Strategy ETF and Schwab US Dividend Equity ETF™ (SCHD). Returns also include dividend distribution.

Thinking about monthly income and what’s going on with dividend yield keeps my strategy sharp. By staying on top of things and making choices based on hard facts, I cleverly boost my returns while making sure the financial future is as rock-steady as a lighthouse on a stormy night. For anyone curious, checking the msty etf performance since inception February 2024 might just pair perfectly with your investment dreams.

Exploring MSTY ETF Performance

MSTY Inception and Growth

When I first stumbled upon the MSTY ETF, back when it hit the scene on February 21, 2024, I was pretty intrigued. Fast forward, and it's turning heads with a whopping 135.72% gain since it started (Globe Newswire).

Investors have flocked to it, swelling its net stash to $1.95 billion in no time by February 21, 2024. Clearly, it's making waves with its knack for boosting folks' investment income.

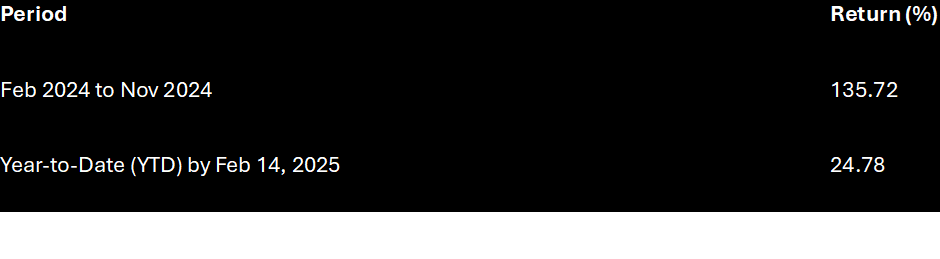

MSTY Trailing Returns Overview

I've got to say, the returns that MSTY ETF has delivered caught my eye, especially so soon after its launch. By February 14, 2025, it had racked up a year-to-date (YTD) return of 24.78% (Yahoo Finance).

Here's the scoop on the returns:

Table illustrating the finger licking income from MSTY YieldMax™ MSTR Option Income Strategy ETF

These figures aren't just numbers; they're proof of the fund's knack for pulling in solid income and growing your dough over time.

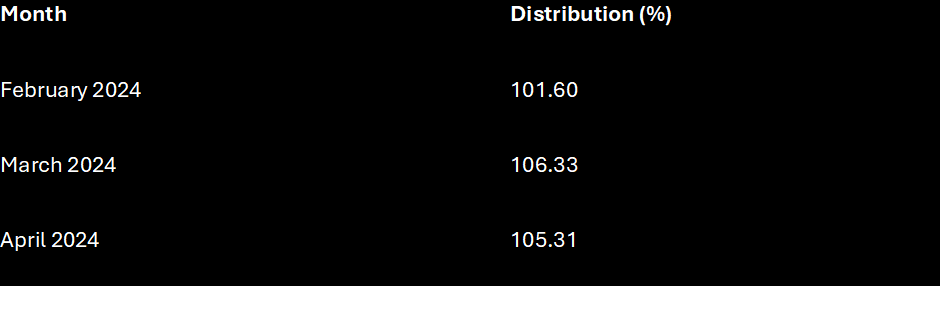

Monthly Distributions on MSTY – a 100%+ Dividend Yield?

What's really grabbed me about the MSTY ETF is the monthly income distributions. These monthly payouts are as appealing as a hot cuppa on a winter morning, and they're a hit with investors wanting regular cash flow. Just take a look at some of these juicy percentages: 101.60% and 106.33% (Yahoo Finance).

For me, these monthly drips are like manna from heaven, keeping my portfolio's thirst quenched with a dependable stream of income.

Jumping into the MSTY ETF is like getting a two-for-one special: plenty of potential for the value to shoot up and a steady drip of monthly earnings.

Benefits of YieldMaxTM ETFs

As someone who's knee-deep in the investment game, you might be wondering what's so special about YieldMaxTM ETFs, especially the MSTY ETF. It's got a nifty trick up its sleeve for bringing in some extra cash. Let's break down the money-making magic, goals, and investment tricks of this ETF.

Yield Potential of MSTY ETF

The Yieldmax MSTR Option Income Strategy ETF (MSTY) is like that friend who always picks up the tab—thanks to its smart investment tricks. Rolling into February 2024, they've pocketed a neat $1.95 billion in net assets. The game plan? Rake in the dough with a synthetic covered call gig on MicroStrategy Incorporated (MSTR) stock.

What's neat about MSTY is that it wants to drop monthly income right into its investors' laps. It does this by offering call options on MSTR shares and keeping short-term U.S. Treasury securities as backup. So, it's like a reliability machine for those craving that monthly payday.

You can dive into more juicy details on MSTY's payout, check out YieldMax’s main page for MSTY.

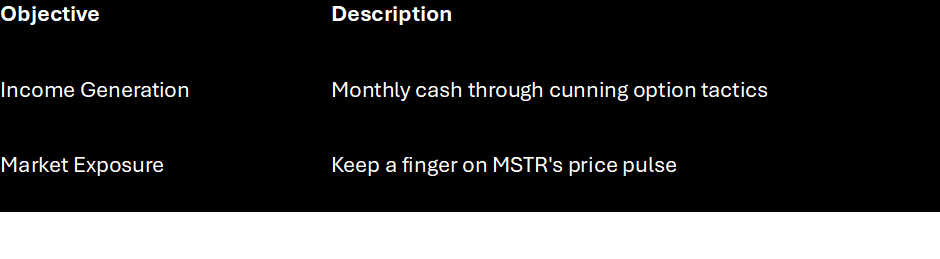

Fund Objectives and Management

MSTY is on a mission—to dish out income while keeping a pulse on MSTR's share prices. Because it's actively managed, MSTY stays on its toes, ready to squeeze out returns, rain or shine. The approach keeps the fund on its A-game, sticking with its cash-cow philosophy, market turbulence or not.

The bosses at MSTY are always analysing and evolving their game plan to keep that income train on the tracks. Being predictable when it comes to income stream predictability is their mantra.

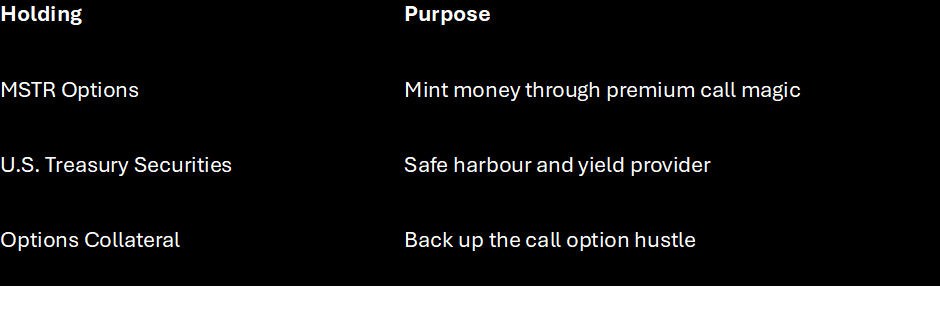

Investment Holdings and Strategies

The MSTY ETF plays it smart and simple: they hold short-term U.S. Treasury goodies and place call options on MSTR stock. This solid plan is about earning while keeping an eye on risk. Here's what they've got up their sleeve:

With this made-up of mixed strategy, the fund keeps the cash flowing, making it a bright spot for anyone wanting consistent income.

Getting to grips with the ins and outs of the MSTY ETF sets you up to make smarter investment moves. It's about seeing if this ETF ticks your boxes for bringing in the income you want. So if boosting your investment take-home is your vibe, YieldMaxTM ETFs are well worth a gander.

Comparison with Other ETFs

When looking into ETFs, there's a bit more to it than just throwing darts at a board and hoping for the best. It's about digging into trends, seeing how they're doing performance-wise, and sussing out the risks. I'll break down how the MSTY ETF stacks up against other top names in the game so you can make some smart choices about where your cash heads off to.

Equity-Income ETF Trends

Equity-income ETFs, they're like the rockstars in the investment world right now. As of October 31, 2024, they carry a good chunk of the $123.9 billion pie that makes up active equity ETFs. That's almost 5% of it! Investors are all about mixing that growth you get from stocks with the steady paycheck from dividends. It's like having your cake and eating it too, right?

Top Performing ETFs Insights

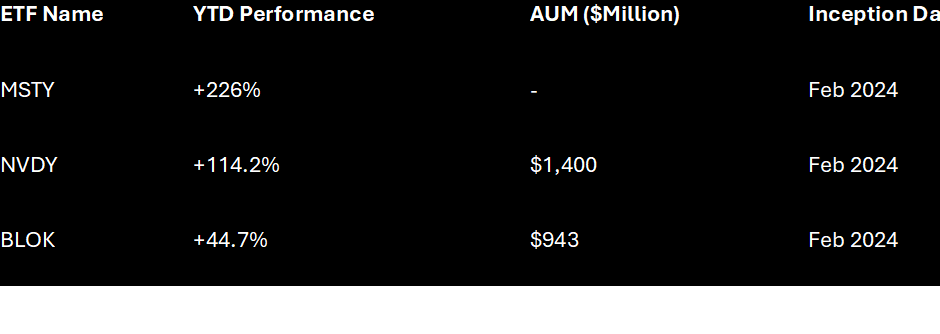

Let's see who's leading the pack and what's making them tick:

- Capital Group Dividend Value ETF (CGDV): It's been putting the S&P 500 in the rear-view mirror with 16.8% yearly gains since it kicked off. It's got a knack for catching the market's highs and not getting too bummed out when the lows hit hard.

- Schwab US Dividend Equity ETF™ (SCHD): This one is all about the Dow Jones U.S. Dividend 100 Index and raked in $3.9 billion last year with a decent 3.4% yield and pocket-friendly 0.06% fees.

- YieldMax NVDA Option Income Strategy ETF (NVDY): Talk about a blockbuster—114.2% up this year alone! Since February, it's been juggling $1.4 billion with gusto.

- Amplify Transformational Data Sharing ETF (BLOK): It boasts a warm and fuzzy 44.7% lift this year and runs a $943 million show since it kicked off in February 2024.

Risk Analysis and Considerations

So, what's the catch with investing? Well, there's always some risk over the horizon. When it comes to checking out how the MSTY ETF has done since it started in February 2024, here are a few things to mull over:

- Volatility: When things go wild on returns, it can be a bit of a rollercoaster. Take NVDY, for example—it shines bright but could give you a few jitters. Same with MSTY, if MSTY or Bitcoin take a hit then the price and also distribution can fluctuate

- Expense Ratios: The lower, the better, since it leaves more for you at the end of the day. SCHD's 0.06% expense ratio is worth shouting about. On the other hand, MSTY’s expense is 0.99%

- Exposure: Spread the love across different sectors. Focusing too much in one space could spell trouble if it goes south.

- Yield Consistency: Regular monthly income distributions are pretty comforting as they give you a solid stream of cash from your investments.

If you keep an eye on this stuff, it helps sort out the cash flow management and gives a hand with making sure your income streams are predictable. For more on how MSTY has been doing since it got rolling in Feb 2024, keep these points front and centre.

Investing in Emerging Technologies

Diving into emerging tech can be like hitting a gold mine. It's loaded with chances for making a buck and seeing your money grow over time. Let’s have a look at how Bitcoin-related ETFs are performing, what tech transformation ETFs are up to, and some smart ways to size up growth opportunities.

Bitcoin-Related ETF Performance

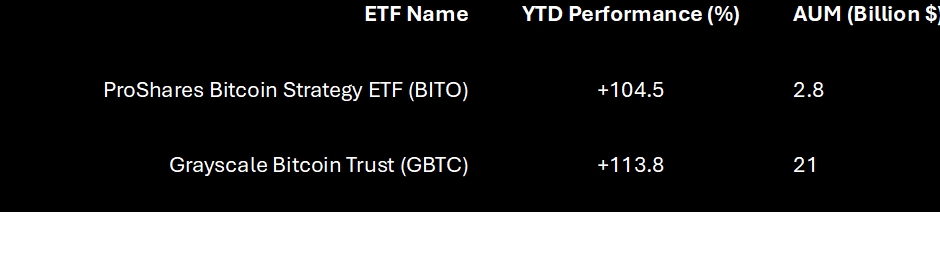

Bitcoin-related ETFs are really in the spotlight as cryptocurrencies become all the rage. Two heavy hitters that come to mind are the ProShares Bitcoin Strategy ETF (BITO) and the Grayscale Bitcoin Trust (GBTC).

- ProShares Bitcoin Strategy ETF (BITO): Launched in February 2024, BITO has been on a roll with a Year-To-Date (YTD) performance of +104.5%. It’s got $2.8 billion under its belt (US News).

- Grayscale Bitcoin Trust (GBTC): This one’s been beating BITO with a YTD performance of +113.8% since day one. It’s loaded with $21 billion in assets (US News).

Technology Transformation ETFs

These tech-centric ETFs cover areas like artificial intelligence, biotech, robotics, and beyond. They’re all about cashing in on tech breakthroughs, making them a magnet for anyone looking for growth in the long run.

Check out the YieldMax NVDA Option Income Strategy ETF (NVDY).

- YieldMax NVDA Option Income Strategy ETF (NVDY): It’s been killing it with a YTD performance of +114.2% from the get-go, managing $1.4 billion (US News).

Evaluating Growth Strategies

Want to get the most bang for your buck in emerging tech? Here’s what you need to know:

- Diversification: Spread your bets across different tech arenas to keep risk at bay.

- Analysis of Fund Holdings: Peek inside the ETF to see what makes it tick and find the potential winners within.

- Investment Horizons: Play the long game to weather the ups and downs.

- Regular Monitoring: Keep an eye on monthly income and yearly reports to make sure you’re on track with your financial dreams.

Jumping into emerging tech is all about balancing risk and reward. Get a handle on the shining prospects and the bumps in the road to make solid choices, giving your portfolio a boost.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.inc