Beware or Be Bold? Risks of Investing in MSTY Yieldmax ETF

Risks of Investing in MSTY

Understanding Investment Risks

Investing asks for a good dose of wisdom and a knack for sniffing out risks. That's the name of the game, folks. When I dip my toes into the world of MSTY ETF (YieldMax MSTR Option Income Strategy ETF), there are certain things I’ve got to watch out for.

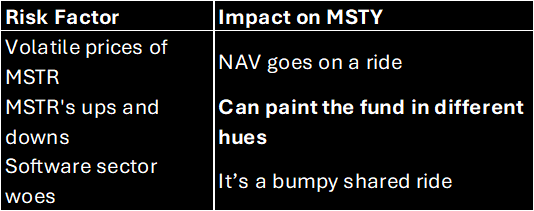

Betting on MSTY is like balancing on a tightrope where a lot depends on options tied to MicroStrategy (MSTR). The colourful nature of MSTR's trading can cause quite the rollercoaster effect on the Net Asset Value (NAV) of MSTY. Wild swings in MSTR's performance may have me biting my nails, wondering about my investment returns (SEC link for the curious).

But wait, there's more! The whirligig of broader market changes, like economic twists and public mood swings, add spice—or nightmares—to the scene. Calculating these risks helps me measure the delights against the dangers.

Concentrated Exposure Risks

Here's the kicker. MSTY is like putting all the vegetable patches in just one part of the garden. It leans heavily on MSTR, and that single-mindedness is a risk buffet. If MSTR ever hits a rough patch or storms roll in, MSTY's NAV could take a hit, leaving me feeling less than chipper (Another SEC link if you're feeling adventurous).

Now, sprinkle in the extra thrill of options-based investing with MSTY, and you've got a real spice blend. Options? They can double the fun—or not—so managing these little gems is key to avoiding a drain on investments.

Knowing the lay of the land means I can make smarter moves, keeping my income generation dreams alive and kicking.

Investing sure has its risky wrinkles, but being clued-up and spreading out my bets means I can smooth out those creases and aim for my investment high score.

Alternatives to MSTY

If you're an investor who's keen on mixing things up a little or just poking around for options beyond MSTY, you've hit the right spot. There's a bunch of other paths you can wander down to sprinkle a bit of flavour in your investment strategy and hopefully dodge some of those nasty risks that come out of nowhere.

Diversification Options

Spreading out your investments is a golden rule for dodging those unpredictable moments, especially if you've been tossing and turning over any potential risks with MSTY investments. By dabbling in different assets, you’re cutting down the chance of one pesky investment messing up your whole portfolio vibe. Here’s how you can shake it up:

- Equity ETFs: Plunge into a sea of equity ETFs and scoop up pieces from various sectors and corners of the world.

- Bond ETFs: Want a bit of calm in the storm? Bond ETFs might just serve you that.

- Commodity ETFs: Think of these as your insurance policy. They might help fend off inflation and save you from leaning too hard on stocks or bonds.

- International ETFs: Stretch your roots globally! International ETFs offer a sneak peek into markets beyond your backyard.

Curious about spreading around? Take a peek at income stream predictability.

Comparison with Other ETFs

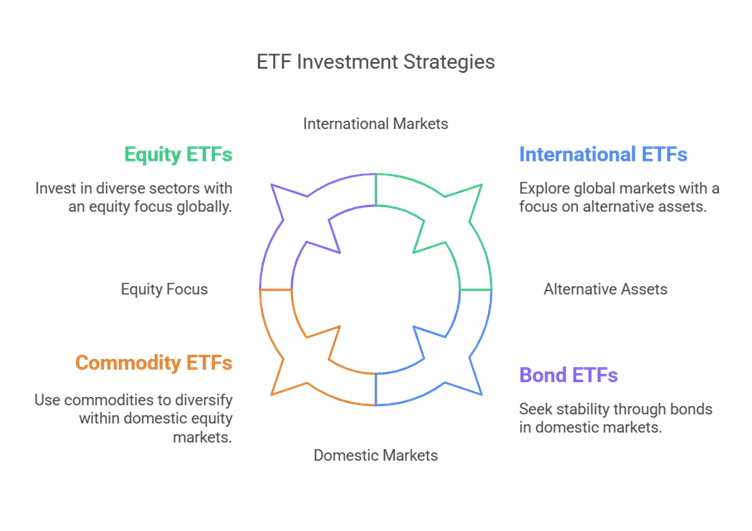

Sizing up MSTY against other ETFs ain’t just about numbers; you gotta sniff out aspects like how they’re doing performance-wise, the whole risk scene, how juicy the returns are, and what’s packed in their portfolio bags. Here, I’ve lined up some ETFs for a side-by-side look:

Sure, MSTY's got the high yield spotlight, but it’s charging you a nifty fee. For those craving a bit of peace, tossing in some bond ETFs like AGG or a golden touch with ETFs like GLD might just calm the financial storms and fend off inflation monsters, especially if you’re eyeing a steady cash flow every month.

Want to dig in more? Check out the deep dives on yieldmax mstr option income strategy etf and covered-call etf. Each choice offers its own little magic spell, from padding your wallet with stable dosh to jazzing up your investment deck.

Market Performance Insights

Recent Market Trends

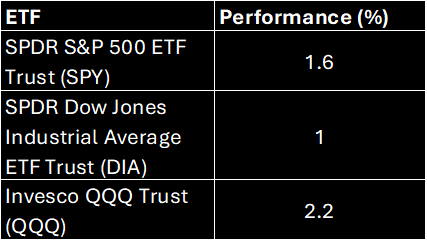

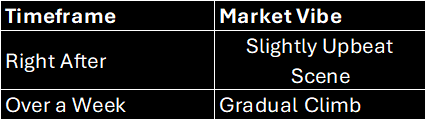

Wall Street's got a little spring in its step this week! The SPDR S&P 500 ETF Trust (SPY) popped up by 1.6%, and the SPDR Dow Jones Industrial Average ETF Trust (DIA) shuffled up by around 1%. But then there's the MSTY ETF, which is drumming its own beat. Aimed at generating income, MSTY carries its own set of quirks and smirks. Understanding these is vital, especially when eyeing how it might bop along with broader market chatter.

Technical Opinion Rating

According to Barchart, MSTY comes with a 56% "Sell" stamp, suggesting it might stroll down its current path a bit longer. While the market’s busting some moves, MSTY’s got its own rhythm. Here’s how recent figures stack up:

Examining these trends can give a peek into where MSTY is wandering next. If bumping up your investment bankroll is on your radar, it's pretty crucial to eyeball MSTY's indicators along with its juicy returns.

For a closer look and some savvy suggestions on plumping up your income, getting a grip on the bumps and turns of putting money in MSTY is paramount. Gaining some intel on other equity income maneuvers and mulling over the tax twists of diving into monthly dividend ETFs might offer a fuller picture for a robust investment game plan.

ETF Yield Strategies

Option-Based Yield Generation

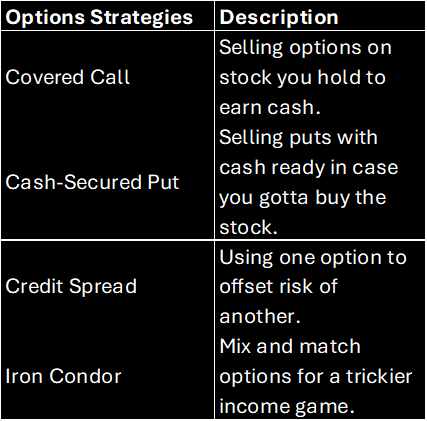

Want to add a little extra jingle to your pockets? One popular way to squeeze a bit more mileage out of your investments is option-based yield generation. It's like putting your assets to work overtime, especially if you crave a steady stream of monthly income. Here, the strategy involves selling call options on the stocks snugged up in an exchange-traded fund (ETF).

Understanding Options

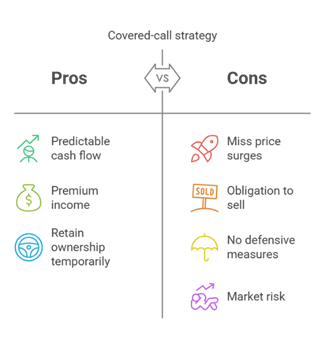

Okay, let's break it down. Options are those nifty contracts that give the buyer the right to wheel and deal at a certain price before time's up. When an ETF throws in some option-selling mojo, it usually does it with a "covered call" approach—selling calls on assets it already owns to grab some bonus bucks. Take, for instance, the YieldMax MSTR Option Income Strategy ETF, which thrives on this tactic for reliable income, though it might put a lid on potential windfalls.

The cash from selling these options boosts the fund’s yield—sweetening the income pot and keeping cash flow humming along nicely.

Risks and Rewards

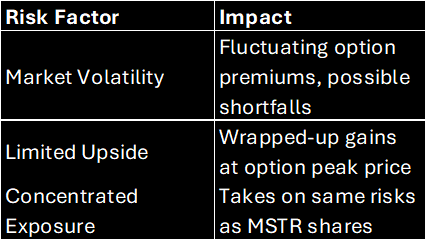

Sure, option-based yield strategies could be your golden goose, but don’t pop the champagne just yet. They carry a handful of headaches, kind of like onions: they make you cry if not handled right.

Risk Factors

- Market Volatility: Picture a rollercoaster—yeah, that’s how options feel when the market’s on a bender. If the market dances wildly, your collected premiums may not cushion every fall.

- Limited Upside: Selling covered calls is like putting a ceiling on your cash vault. If the stock rockets skywards, you won’t pocket beyond what you planned.

- Concentrated Exposure: The YieldMax MSTR Option Income Strategy ETF ties its fortunes to MicroStrategy Incorporated (“MSTR”). That means double-dipping into MSTR’s ups and downs, risks included (SEC.gov).

But let's not dwell on the negatives. There's a silver lining:

Reward Factors

- High Yield: Playing the option game can crank up returns more than traditional methods. Some funds flaunt yields creeping close to 100% annually through the art of option trading (Barchart).

- Steady Income: Regular payments from selling options mean investors can count on a stable cash flow, a trusty piece in the monthly finance puzzle.

- Enhanced Cash Flow: The option premiums can really get cash moving, smoothing out the bumps of routine expenses. Curious minds can check out more on cash flow management.

If your interest is piqued by these cunning money-making tactics, the YieldMax MSTR Option Income Strategy ETF is a prime case study. Always give a nod to potential risks and keep a keen eye on what you're putting your money in.

Impact of Fed Rate Cuts

Market Reaction to Rate Cuts

Wall Street's been buzzing this month with the latest scoop: a Fed rate cut. The Federal Reserve hit us with a 25-bp rate chop to give the economy a nudge. Usually, rate cuts spark a market party, but this time, the wider market wasn't exactly in a celebratory mood. Barchart (check it out) tells us the market had a slight bounce, but nothing too wild.

Let’s break down some market moves after the rate adjustment:

These numbers help us figure out how similar investments, like the YieldMax MSTR Option Income Strategy ETF, might behave when Uncle Sam tweaks rates.

Analysis of Market Behaviour

Digging deeper, we see a few patterns in how the market skitters around after a rate cut. Dropping rates tends to make borrowing cheaper for both folks and businesses, which should theoretically kickstart more economic action. But this time, the market was only mildly jazzed by the news.

Investors had a reasonably good time with the usual suspects like SPDR S&P 500 Trust and Invesco QQQ Trust seeing decent returns. But the half-hearted cheer stems from bigger economic question marks and underlying market vibes.

For strategies like the YieldMax MSTR Option Income Strategy ETF, Fed cuts can shift gears significantly. Cheaper loans make it easier for companies to grab more cash, which could give their stocks, and ETFs holding them, a lift.

If you’re eyeing the YieldMax MSTR Option Income Strategy ETF, keeping tabs on market antics during such rate cut episodes is a smart move. It’s all about weighing the see-saw of risks and goodies of investing in income strategies, especially when rate cuts are playing the tunes.

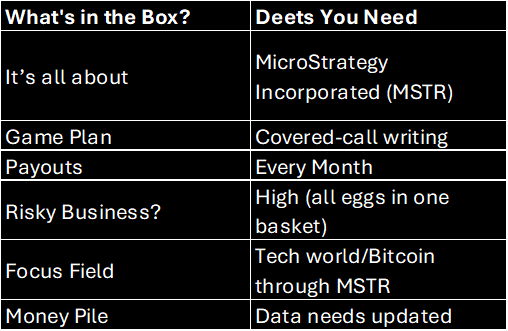

YieldMax MSTR Option Income Strategy ETF

Investment Strategy Overview

Looking to up your investment game and snag some extra cash? The YieldMax MSTR Option Income Strategy ETF might just be your ticket. This ETF is all about boosting your wallet while giving you a slice of the action with MicroStrategy Incorporated (MSTR). It's all woven around a plan that turns the wheels on option writing—a bit like renting out your shares whenever the rent check comes due.

The twist here is a covered-call strategy. Think of it like promising to sell your car at a certain price in the future while you still get to drive it today. You pocket the premium (the rent), rolling in a predictable cash flow. The catch? If the future price takes off, you might miss the rocket, as you'll have to sell the shares if the call is exercised. U.S. News mentions that the ETF won't put up any defensive walls during stormy weather, so watch out if you're not into riding the waves.

Remember, it's not diverse—it's an all-or-nothing spin on MicroStrategy stock. More about risks?

Fund Characteristics and Objectives

Who is this ETF best for? Let's break it down:

The fund’s mission—put dollars in your pocket while playing the highs and lows of MicroStrategy shares. Cute little premiums trickle in regularly, though sky-high gains are capped.

If comparing how apples and oranges stack up in the ETF world tickles your fancy, have a look at 'monthly dividend ETFs vs quarterly dividend ETFs comparison' and dive into good ol’ covered-call strategies.

By keeping your eyes on these details, you can decide if the YieldMax MSTY ETF jiggles your jar and fits your income dreams and risk radar.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.