Buy Bitcoin Safely: A Beginner’s 5 Step Guide to Buying

“Avoiding the ‘Bitcoin FOMO’ Trap”

So, you’ve heard about Bitcoin.

Maybe it was your mate bragging about his ‘crypto gains’ over a flat white, or you’ve seen headlines about Bitcoin soaring to insane heights such as ‘Bitcoin has hit over US$100,000!’.

Suddenly, you’re hit with FOMO: ‘Should I be buying Bitcoin? Am I missing out?’

Hold up. This isn’t a sprint to the moon – it’s about getting in smart, not fast.

Bitcoin can be a solid investment (my opinion only), but you don’t need to drop your life savings to start.

This guide will show you how to safely buy Bitcoin in small amounts, so you can dip your toes in without feeling like you’re diving into a shark tank.

You’ve heard of Bitcoin?

Maybe your mate Dave won’t stop bragging about how he "bought the dip," or you saw a TikTok influencer claiming Bitcoin is your ticket to buying a yacht.

But here’s the problem: you have no idea where to start, and the idea of losing your hard-earned dollars makes you break out in a sweat.

Relax mate.

You don’t need to throw thousands at Bitcoin or understand blockchain like some hoodie-wearing tech guru.

You can start small, start safe, and get your foot in the digital door without stress.

This is Bitcoin for beginners – no fluff, no scams, just simple steps to help you get started.

Let’s get you investing like a pro (without actually being one).

What is Bitcoin (And Why Should You Care - Recap)

First, let’s clear the air: Bitcoin is a digital currency that isn’t tied to any bank, government, or shady financial overlord.

Instead, it runs on a thing called a blockchain – a public digital ledger that keeps track of all transactions. Think of it like a giant, uncheatable Excel spreadsheet.

Unlike traditional money, there’s no printing more Bitcoin when governments feel like it.

There’s a fixed supply: 21 million Bitcoins. That scarcity is part of what makes Bitcoin valuable.

Why should you care? Bitcoin offers a new way to store, move, and grow your money.

It’s fast, secure, and – if you play your cards right – potentially profitable.

In conjunction with this perfectly written article ‘Bitcoin for Beginners’ I also suggest grabbing and reading a book like The Bitcoin Standard.

Step 1: Start Small (Dip Your Toes, Don’t Dive In)

Here’s the rookie mistake: thinking you need to drop a fortune on Bitcoin to get started. Spoiler alert: you don’t.

Unlike real estate or stocks, Bitcoin is divisible.

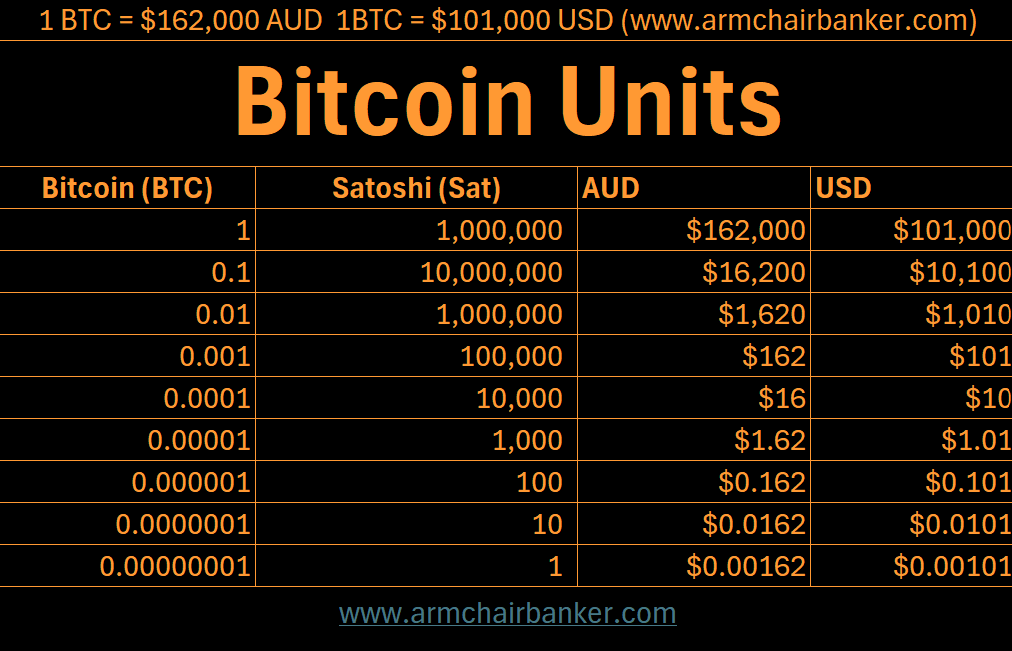

You can buy a fraction of a Bitcoin. Start with as little as $10 or $50. also known as 'sats'. A simple way to look at bitcoin below;

This lets you learn the ropes and get comfortable without risking more than you can afford to lose.

Real-Life Example: James, a 25-year-old marketing assistant, started with just $50 a month. It was money he usually blew on Uber Eats. Over two years, he built up $1,500 worth of Bitcoin. The bonus? He learned about investing without sweating every price dip.

Why It Matters: Small investments are manageable and safe for beginners. Think of it like learning to surf – you start on the smaller waves before paddling into the big stuff.

Step 2: Choose a Trusted Exchange (Because Scams Exist)

To buy Bitcoin, you need to use a crypto exchange – basically a digital marketplace for Bitcoin and other cryptocurrencies.

The catch? Not all exchanges are created equal.

Stick to reputable, trusted exchanges that are beginner-friendly and secure. Some top picks for Aussies include:

- CoinSpot: Super easy for beginners and popular in Australia (also used in the US). ‘This is the exchange I’ve been using since 2017’

- Swyftx: Great for small, regular investments.

- Binance: A global heavyweight for crypto buying and trading.

Pro Tip: Look for exchanges with good reviews, strong security measures (like two-factor authentication), and low fees.

Real-Life Example: Sarah, a nurse from Brisbane, nearly fell for a dodgy crypto app offering “low fees and instant riches.” Luckily, her brother steered her to CoinSpot, where she safely started her Bitcoin journey with just $100.

Why It Matters: Choosing the wrong exchange can leave you open to scams. A trusted exchange keeps your money and Bitcoin secure.

Step 3: Secure Your Bitcoin Like It’s the Crown Jewels

Congratulations!

You’ve bought your first Bitcoin. But here’s where most beginners trip up: they leave it sitting on the exchange.

This is like buying gold and leaving it at a stranger’s house. Don’t do it.

You need a crypto wallet to keep your Bitcoin safe. Here are your options:

- Hot Wallets: Digital wallets connected to the internet (convenient but more vulnerable).

- Cold Wallets: Offline wallets (like a USB drive) that keep your Bitcoin safe from hackers, such as the one I use – Tangem. It took me 5 minutes to setup and there’s an option where you don’t have to remember or store private keys.

For beginners, start with a hot wallet on your exchange and move to a cold wallet once you’re comfortable.

Real-Life Example: Matt, a uni student, bought $500 worth of Bitcoin and left it on an exchange without security settings. A hacker drained his account. Now, he uses a cold wallet (Tangem) and sleeps much better at night.

Why It Matters: If you lose access to your Bitcoin, it’s gone. Secure it properly and treat it like the valuable asset it is.

Step 4: Ignore the Hype (Bitcoin Is a Long Game)

Bitcoin’s price moves like a hyperactive kid on a sugar rush. One minute it’s up, the next it’s down. If you check the price every 5 minutes, you’ll lose your mind.

The key? Think long-term.

Bitcoin isn’t a get-rich-quick scheme; it’s a new way of thinking about money. Ignore the hype and focus on steady, small investments over time.

Real-Life Example: Jenny, a teacher, bought Bitcoin back in 2018 when it was around $10,000. When the price dipped to $5,000, she didn’t sell. Today, Bitcoin’s worth much more, and Jenny’s patience paid off. Her strategy? Buy small amounts regularly and ignore the daily noise.

Why It Matters: Panicking over price swings leads to bad decisions. Play the long game, and you’ll thank yourself later.

Step 5: Do Your Homework (Because Knowledge = Confidence)

Let’s be clear: Bitcoin isn’t a magic money tree. The more you understand it, the better decisions you’ll make.

Take the time to learn the basics:

- What is Bitcoin?

- How does blockchain work?

- Why does Bitcoin have value?

Blogs (like this one), YouTube tutorials, and books like The Bitcoin Standard. Knowledge helps you avoid scams, understand market trends, and invest with confidence.

Real-Life Example: Liam, a tradie, spent a weekend learning about Bitcoin before buying his first $50 worth. Now, he explains Bitcoin to his mates at the pub and has a solid plan for growing his investments.

Why It Matters: The more you know, the less you’ll fall for hype or bad advice. Bitcoin rewards the informed.

My Opinion on Why Bitcoin Makes Sense for Beginners

If you’re new to investing, Bitcoin is a great way to get started because:

- It’s accessible: You can buy a small amount (even $10).

- It’s decentralised: No banks, no government interference.

- It’s global: Send and store Bitcoin anywhere.

- It’s scarce: Unlike regular money, no one can print more Bitcoin.

For beginners, Bitcoin offers an exciting way to invest without needing a finance degree or deep pockets.

Start Small, Stay Safe, and Take It Slow

Buying Bitcoin for the first time might feel like jumping into the unknown, but it doesn’t have to be.

Start small, use trusted platforms, secure your Bitcoin, and ignore the short-term hype.

This guide has given you the tools to invest safely and confidently.

Now it’s your turn to take that first step. Who knows? That small investment could be the beginning of something big.

So go on, buy your first Bitcoin and tell Dave at brunch that you’re officially in the game.

Resource Recap - Bitcoin for Beginners

· Read blogs, watch YouTube videos, or even grab a book like The Bitcoin Standard. Educating yourself helps you make better decisions and not fall for scams.

· Cold Wallets: Offline wallets (like USB drives or cards) that keep your Bitcoin safe from hackers, such as the one I use – Tangem.

· In terms of exchanges, some good options for beginners include Binance, Coinbase, or CoinSpot (a local Aussie favourite – this is also the one I use and have been using since 2017).

· IBIT: Blackrock’s Bitcoin ETF – ishares Bitcoin Trust (Australia/US) this is listed on the NASDAQ (IBIT) and I’m invested in this ETF, along with holding a small amount of bitcoin via the exchange Coinspot (been on here since 2017) and majority of my bitcoin via cold storage wallet – Tangem wallet (use my link an get 10% OFF automatically).

Slug: buy-bitcoin-safely-beginners-guide

Meta Description: Learn how to buy Bitcoin safely with this simple beginner’s guide. Start small, secure your investment, and avoid scams with step-by-step tips

Here are some straightforward metrics that beginners can use to assess Bitcoin (see below).

CoinMarketCap illustrates many of the below metrics on one page - https://coinmarketcap.com/currencies/bitcoin/

- Price: The current market value of Bitcoin, indicating how much one Bitcoin is worth in fiat currency (e.g., USD).

- Market Capitalisation: Calculated by multiplying the current price by the total number of Bitcoins in circulation, this metric reflects the total market value of Bitcoin.

- Trading Volume: The total amount of Bitcoin traded within a specific period, showing the level of market activity and liquidity.

- Hashrate: Measures the total computational power used to mine and process transactions on the Bitcoin network. A higher hashrate suggests a more secure and robust network.

- Mining Difficulty: Indicates how challenging it is to mine a new block. The network adjusts this periodically to ensure blocks are added at a consistent rate.

- Transaction Volume: The total number of transactions processed over a certain period, reflecting the network's usage and adoption.

- Number of Active Addresses: Represents the count of unique addresses participating in transactions, serving as a proxy for user activity.

- Fees per Transaction: The average fee users pay to have their transactions processed, which can indicate network congestion and demand.

- Mempool Size: The aggregate size of unconfirmed transactions waiting to be added to the blockchain. A larger mempool can signal higher network congestion.

- Supply Metrics: Includes the total supply of Bitcoin, the number of Bitcoins mined, and the remaining supply to be mined, highlighting Bitcoin's scarcity.

For beginners, focusing on these metrics can provide a foundational understanding of Bitcoin's market dynamics and network health.

This is Part III of your Bitcoin for Beginners: The Quickest Way to Learn About Bitcoin series

By Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video.

Full Disclosure: Stevo holds Bitcoin at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights on mate.