Counting the Costs: Understanding Risks in MSTY Yieldmax ETF Investment

Here's my (highly secret) personal investment strategy and how I handle MSTY Risks - check out this banger - MSTY Risks and my $21,448 gain, what’s next?

Understanding Investment Risks

Alright, let's dive into the wonderful chaos of investments and pick apart those pesky risks. I'm going to zero in on what makes MSTY a bit tricky, especially when it comes to who's calling the shots.

Risks Associated with MSTY

If you're all about investments like MSTY, understanding risks isn't just a good idea – it's a no-brainer. The YieldMax MSTY Option Income Strategy ETF lives and breathes in a fast-paced market scene, with risk factors popping up like mushrooms after a rainstorm. One biggie to chew on is management risk.

Management Risk

Now, management risk is the star of the show when we talk about the YieldMax MSTY Option Income Strategy ETF. It's an actively managed ETF, and that means managers are making decisions like they're onstage. They're analysing, strategising, and trying to keep the investment train on the right track. According to the SEC, all those fancy techniques might not always hit the mark, which keeps investors on their toes about whether they're meeting their financial dreams.

The human touch is a double-edged sword here. Basically, the folks managing these portfolios have the power to make their own choices. Their success is all about how well they know the market and whether their plan-making brain is fired up and ready. A fumble in judgement or a not-so-great strategy can leave you less than thrilled with your returns.

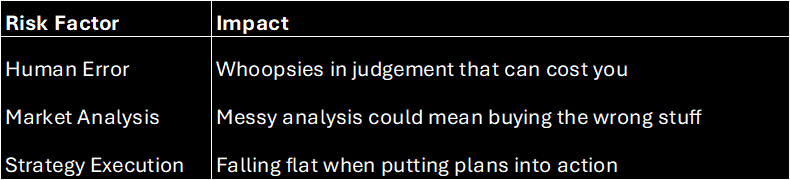

Here's a sneak peek of how management mishaps could mess things up:

So how do you dodge these curveballs? A bit of variety in your investments could do the trick or just keep your finger on the pulse of what those fund managers are doing.

Market & Industry Risks

When thinking of putting your hard-earned cash into the YieldMax MSFT Option Income Strategy ETF, it's smart to know what kind of bumps in the road you might hit. We're diving into the big worries, especially what's happening in the computer software world and the risk of too much competition.

Software Industry Challenges

So, the YieldMax MSFT Option Income Strategy ETF sticks its neck out in the info tech - app software game, hoping to mimic how MicroStrategy Incorporated (MSTR) moves on the stock roller coaster. But this industry’s got a few rough patches, like too many brands wrestling for your money, cutthroat pricing, tech evolving like lightning, and the dreaded 'obsolete' stamp on products. These hiccups can shake up profits and the worth of stocks like MSTR’s (SEC).

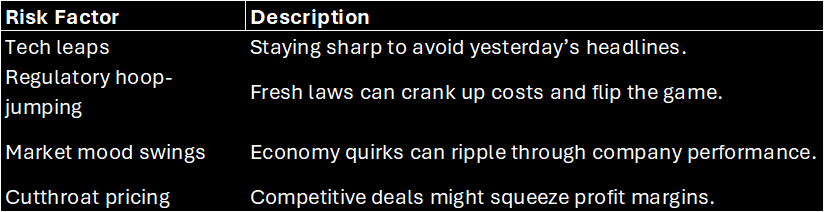

The software gang has to watch out for:

- Tech leaps: With tech galloping so fast, yesterday’s whiz-bang gadget might be tomorrow’s paperweight. Keep those ideas fresh!

- Regulatory hoop-jumping: New rules can mean extra dollar signs and changed ways of doing things.

- Market mood swings: When the economy sneezes, tech companies might catch a cold.

Here’s the lowdown on what's got folks biting their nails in the software biz:

Competition Risks

Another biggie to ponder is how other players in the sandbox might affect your investment in MSTY. The software turf is like a busy playground, chock-full of both old champs and fresh rookies, all hustling to snag market share with edgy products and tempting deals.

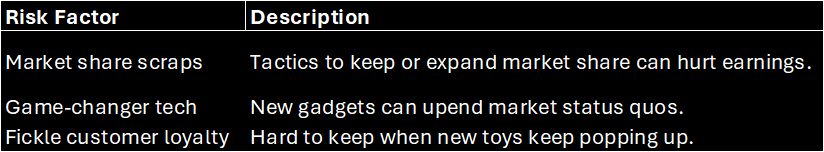

A few competition headaches to think about:

- Market share scraps: Everyone’s scheming to hang onto or snatch more market slice, potentially bruising profits and growth.

- Game-changer tech: Newbies or rivals with killer new tech tricks can shake up the scene.

- Fickle customer loyalty: With the constant debut of bright and shiny options, customers could easily jump ship.

Here's a side-by-side of what's got the competition sweating:

These hurdles and rivalries underline why doing your homework is key before diving in. Check out our pieces on monthly income and covered-call ETF for more savvy tips on sizing up these risks.

Specific Fund Risks

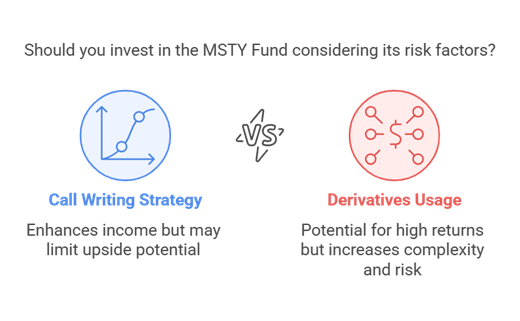

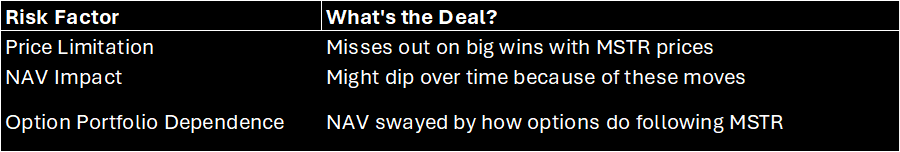

Alright, let's chat about the risks hanging around the MSTY Fund. If you're thinking of diving in, it’s good to give these risks a quick once-over. Today, I’ll highlight some quirks in the call writing strategy and the whole derivatives gig – both are pretty important if you’re eyeballing income generation.

Call Writing Strategy

The MSTY Fund has this thing for call writing, where they sell call options on what they hold. Sounds intriguing, right? The catch is, it might put a bit of a dampener on how much you cash in on any upward swing of shares like MSTR stocks. This sort of puts a limit on the potential returns and, at some point, could even push the net asset value (NAV) down as time ticks on by. The NAV leans mostly on the value of this options portfolio that's tied to MSTR's performance (SEC.gov link if you're curious).

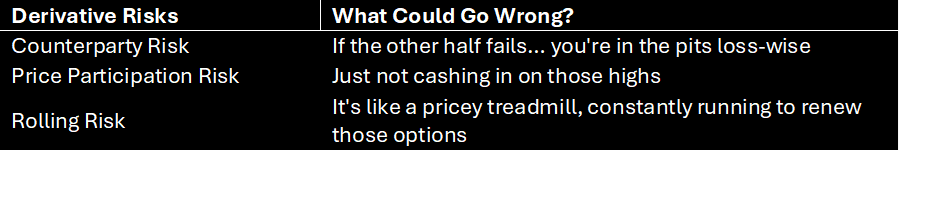

Derivatives Risk

Let's have a little natter about derivatives. Options and the like sound fancy, but they tote a bag full of risks too. Here's what to chew on:

- Counterparty Risk: Imagine the other side of your deal doesn’t play ball. Yikes! That'd mess with returns rather a lot.

- Price Participation Risk: Just like the call writing scenario, might put a lid on the gains when your stocks go up.

- Rolling Risk: Constantly having to "roll" or renew contracts as they hit expiry can rack up costs and sometimes bring losses.

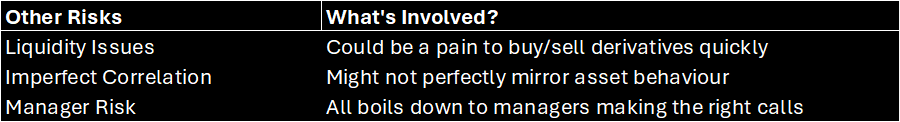

Getting cozy with derivatives also tosses in other curveballs like liquidity hiccups, issues stemming from not matching up perfectly with underlying assets, and valuation head-scratchers. Then, the fund being actively managed leans a lot on whether the managers know what they’re doing (Peep this SEC link if interested).

Others risks involved in MSTY ETF include liquidity risks, not correlated to MSTR and manager risk.

These pointers might be handy when thinking about the fund's income generation and cash flow management game plan.

Grasping these fund risks sets me up quite snugly to make smarter choices when it comes to MSTY Fund investments. For the nitty-gritty, there's more on the risks associated with investing in MSTY.

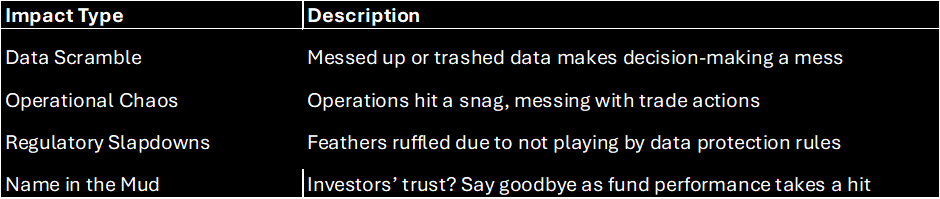

Cyber Security Risks

Getting a handle on the cyber security pitfalls that come with tossing your money into the YieldMax MSTR Option Income Strategy ETF is pretty darn important. These virtual mugging hazards can not only hit your pocket but might also give the fund a good shaking, mucking up the asset value and leading to some serious dough down the drain.

Data Breach Concerns

At the top of the worry list for the YieldMax MSTR Option Income Strategy ETF sits the looming threat of data breaches. When these sneaky break-ins occur, they have a knack for messing with data, shedding confidential info, and throwing a wrench in operations. Nowadays, these breaches can lead to:

- Data scrambling

- Halting operations dead in their tracks

- Wallet-busting losses

Plus, getting hit with one of these breaches isn’t just bad news for your bank account. It can also mean regulatory slapdowns and a tarnished reputation for the fund, which, you guessed it, doesn’t help its performance one bit.

Operational Impact

When it comes to operational smackdown, cyber security hits can throw the YieldMax MSTR Option Income Strategy ETF off its game. If the bad guys strike, say goodbye to smooth sailing on trading platforms, smooth data management, and seamless chats with investors. According to the SEC record, here’s what’s on the cards:

To stop these kinds of catastrophes in their tracks, investors need to scope out the fund’s cyber security guardrails. Knowledge of how a fund stands up to data breaches and keeps its wheels turning during chaos is key when thinking about where to stick your cash.

You want some pointers on keeping these wretched risks at bay and making your investments a fortified fortress? Check our brainstorm about keeping risks at bay and our BYOC (bring-your-own-caution) tips. These handy guides can help you make sure your moolah stays out of the cyber grip of danger and away from other risk-laden shoals.

In a nutshell, keeping tabs on the digital downfalls can steer you toward stronger investment moves. Knowing how outfits like the YieldMax MSTR Option Income Strategy ETF dodge these landmines is your ticket to keeping your hard-earned loot intact and ensuring a consistent flow.

For the big lowdown on the bumpy bits of investing in MSTY, plus other curveballs like derivatives risk and call writing shenanigans, glance at our write-up on comprehending the risks of investing in MSTY.

YieldMax ETF Risks

Let me chat with ya about the risks that come with hopping aboard the YieldMax ETF train, amongst them the jittery nature of the markets and the liquidity quirks that might pop up every now and then.

My (highly secret) personal investment strategy and how I handle MSTY Risks - check out this banger - MSTY Risks and my $21,448 gain, what’s next?

YieldMax ETF Volatility

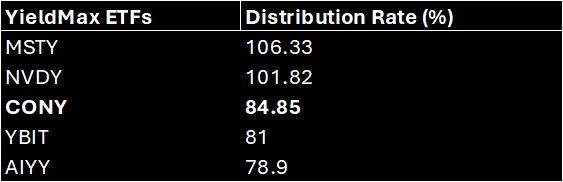

YieldMax ETFs, like the well-known MSTY, are enticing for their sweet, juicy returns. Take the Yieldmax MSTR Option Income Strategy ETF (MSTY). It's flaunting a massive 106.33% distribution rate, according to Yahoo Finance. Tempting, right? But hold your horses! Those big fat returns come with some baggage - namely, volatility. The value can swing like a merry-go-round, thanks to what the fund holds and its game plan.

Let's break it down. These guys try to rake in some dough by selling call options. It's kind of like betting on a seesaw. When the market's all bullish, your potential gains might get clipped a bit since you're trading off some highs for steady income. But if everything takes a nosedive, those call option premiums might not do the trick and cover the downturns on the stocks they're holding.

So, if you're signing up for this rollercoaster, buckle up for those price swings. Knowing how that covered-call ETF strategy fits into your big picture can save you from some headaches down the road.

Liquidity Concerns

Next, we gotta tackle liquidity like a pesky mosquito at a barbecue. With net assets tipping the scales at $1.95 billion, according to Yahoo Finance, YieldMax ETFs’ liquidity can sway like a hammock in the wind. It's about market cravings and what the ETFs own in their treasure chests.

Under pressure, liquidity can be like finding snow in the desert – scarce. This makes buying or selling without playing ping pong with the prices a bit of a ride. Funds like MSTY park investments in a salad bowl of call options, a dash of T-bills, and a sprinkle of stocks, as noted by Forbes. Depending on the combo, you might have to hopscotch your trades.

For investors, making sense of these liquidity antics is the secret sauce for managing your cash flow. If you’re counting on regular income, say, from monthly income, it’s vital to sniff out these quirks and prevent potential shake-ups.

To tackle these twists and turns, rolling up your sleeves on some due diligence and diving into risk mitigation strategies can be your compass to enjoying the bounty of these high-yield funds without falling off the cliff.

Considerations for Investors

When thinking about diving into options income strategies like MSTY, it's key to acknowledge potential pitfalls. To help dodge some of these, here are a few survival tips for navigating the investment jungle.

Doing Your Homework

Before you take the leap into MSTY, chew on these bits of advice:

- Get to Know the Fund Properly: Delve into the meat of the strategy behind MSTY. If you're wondering what's cooking in the Fund's kitchen, it's all about derivatives and options contracts. Now, these come with their own spicy risks—think of things like them not quite matching up with the initial investments, the shaky counterparty risk, and those pesky liquidity worries (SEC).

- Keep Tabs on the Managers: Since MSTY doesn't just coast along—it’s actively managed—how well it does relies on the folks steering the ship, aka the portfolio managers. Have a peek into their past exploits and tactics (SEC).

- Scope Out the Market Risks: MSTY wades through Bitcoin waters by way of options hooked up with MSTR, linking you to Bitcoin's rollercoaster ride and some wild cards like regulation ups and downs (SEC).

- Check the Scoreboard: Keep an eye on how MSTY's been doing from its debut and stack it up against the benchmarks for a reality check. Updated insights are waiting for you on the fund's performance page.

- Think Ahead About Taxes: Tangling with options can weave its own tax web. Chat with the pros or hit up resources to grasp the tax angles coming your way.

Smart Risk Tactics

To fend off the risk beasts while playing the MSTY game, mull over these moves:

- Spread Your Bets: No reason to go all-in; spread your dough over different assets to dodge being snagged by a single snare. Poke around for fresh income strategies too.

- Guard Rail Your Investments: Use stop-loss cushions to shield your portfolio if things tumble too far down. This tactic can be your buddy in tackling options trading twists.

- Stay on the Gossips: Keep your ears to the ground on market murmurs. Spotting industry waves early gives you a head start on sipping some risk management magic.

- Keep a Close Eye: Be like a watchdog over your investment's health. Tune into how MSTY's doing, adjust to any new manager tricks or market twitches (SEC.gov).

- Play the Options Game: Know your way around options? Try a stroll down writing technique street to pick up some extra coin.

- Call in the Pros: Sometimes it pays to call in the cavalry. Advisors can untangle the snarl of derivatives and line up the wins based on your goals and guts.

Investing in those tempting high-yield monthly dividend ETFs isn't all roses, but with the right know-how, it's a garden you can thrive in. For a deeper chat on risk, nose around what are the risks associated with investing in msty?.

Following these pointers can help me glide through the MSTY investment dance floor, topping up my pocket with some juicy returns, all while dodging the banana peels along the way.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.