Creating a Safer Future: Mastering Income Stream Predictability

Exploring Passive Income Opportunities

So, I've always been on a quest to make my money work for me, and you might be in the same boat. Who wouldn’t want a little extra cash flow without having to break a sweat every day? Let’s go treasure hunting for some passive income ideas that can help us do just that.

Definition of Passive Income

You might be asking, "What's this passive income you're talking about?" Simply put, it's money that's rolling in without you having to clock in every morning. According to nerd central, Investopedia, think rental properties, stock dividends, or even nifty online courses you pop up for sale. Once you lay the groundwork, it’s all about sitting back and watching that mailbox money roll in, without constantly lifting a finger.

Diverse Passive Income Streams

The beauty of passive income is it comes in flavours, and who doesn’t love variety? Here are some options to spice up your money-making game:

- Rental Properties: Ever dream about being a landlord? Investing in properties might be your gold mine. The location of your nest egg, the size, and the bustling (or not so bustling) local rental scene determine the cash you pocket every month. Who knows, you might even meet some quirky tenants along the way.

- Stock Dividends: Dive into those dividend-paying stocks or go for the gusto with monthly dividend Exchange Traded Funds (ETFs). It’s like getting a paycheck from your stock, and as a bonus, your investment might grow over time too. It's like having cake and eating it too.

- Online Courses/E-books: Got a knack for something? Why not create an online course or write up an e-book? People pay for knowledge. You work once to create it, and it keeps on bringing in the dough while you're busy doing, well, anything else.

- Affiliate Marketing: If you’re a whiz with blogs or social media, why not promote others' products and earn a bit of commission? Your slice of the sale gets bigger the more you sell—and you didn't even have to make the product!

- Wind Farm Leasing: Got land sitting around doing nothing? Rent it out to wind energy companies. You'd be paid for letting turbines sprout up on your space, with annual cheques coming your way—tell me that doesn’t sound breezy.

- Vehicle Storage and Solar Farm Leasing: Have a knack for thinking outside the box? Well, you can earn by leasing land for solar farms or storing vehicles. It’s about turning that empty plot into a money-making factory.

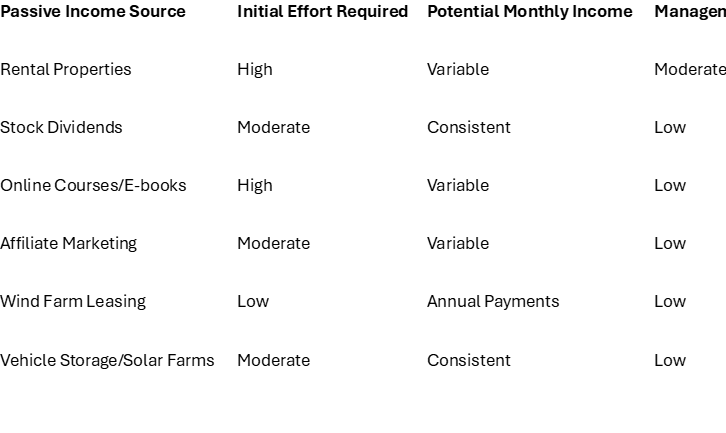

Let's put these options side-by-side to see what fits our style and helps us fatten those bank accounts:

Picking the right income stream is like finding the right rhythm with a dance partner. The trick, of course, is diversification. It’s about building a safety net so robust, it would catch anything life throws at me.

Real Estate as a Chilled Money Maker

So, let's talk moolah – the kind that rolls in while you're off doing more exciting things like binge-watching your favourite series. Yep, property investments are a pretty solid way to get that tasty cash flow happening. Owning a place and renting it out can mean a nice, consistent stream of dosh. Lately, chucking some money into renewable energy can also boost your passive income game. Here’s the scoop on making bank through renting out properties and the rising star of wind energy investments.

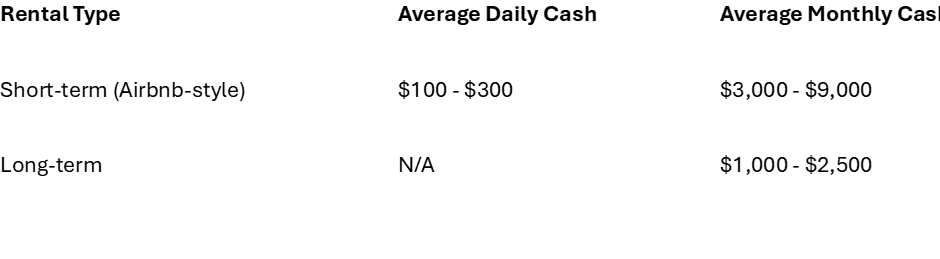

Making Dough with Rental Properties

Rentin’ out properties can be a real dough generator, like a magical ATM that pays you every month or, for the more adventurous, every day.

- Long Stays: Letting your place out for a stretch can bring in the bacon steadily – think of it as a monthly payday, just like clockwork. But you can crank up the amounts a bit when the economy shifts or demand spikes.

- Short Getaways: Things like Airbnb have totally flipped the script on short stays, getting you money each night your place is booked. Perfect for those hotspots everyone wants to crash at for a few nights.

Let's break down the potential dough from these rental options:

Big props to Investopedia for the numbers.

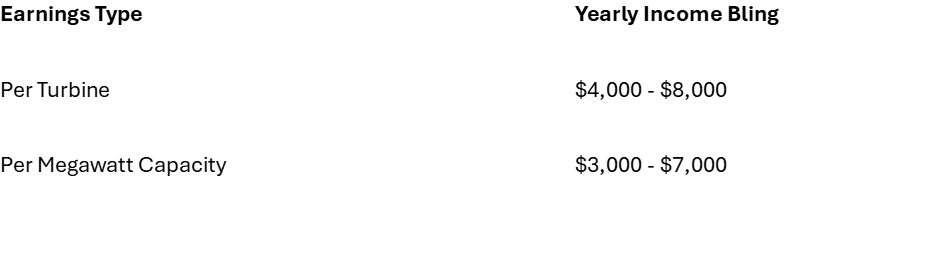

Windy Earnings: Investing in Wind Energy

Now, onto wind energy – a hot pick for pocketing some low-effort cash. Those gigantic fans you see in fields aren’t just nice to look at. You can rake in money by letting off your land to wind farms.

- Spin & Win: You could pocket $4,000 to $8,000 per wind turbine every year just sitting there looking lovely. Super consistent, those projects tend to stick around for years.

- Megawatt Magic: By the megawatt, you’re looking at $3,000 to $7,000 in cash each year, making your land work for you.

Here’s your look at what wind investment could add up to:

Massive thanks to Investopedia for the insights.

Mixing things up with rental gigs and wind power investments can beef up your income and make it super stable. Yearning for education on spreading out those investments and keeping the money flowing?

Leveraging Recurring Revenue Models

When I’m on a mission to beef up my investment returns, dipping into recurring revenue models feels like putting on financial armour—they help make income streams more predictable and my bank account less wobbly.

Benefits of Recurring Revenue

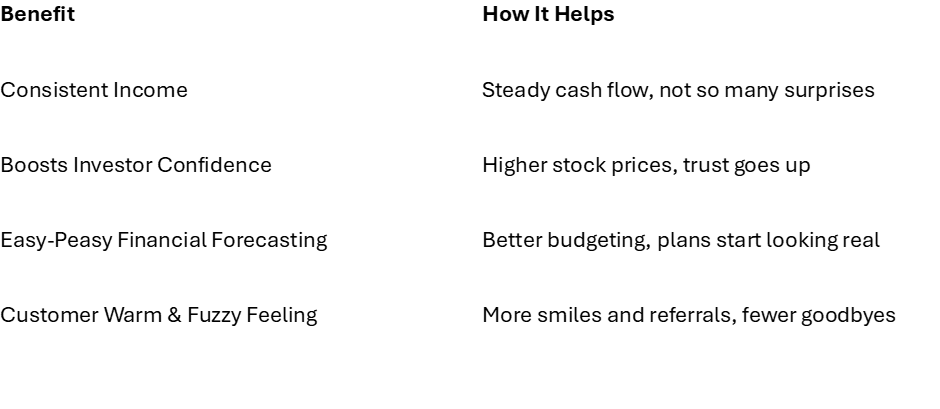

Recurring revenue models are like the steady paychecks of the business world, keeping everyone happy and forecasts spot on (Business Appraisal Florida). When I get into these types of models, it’s like hitting the jackpot for a few reasons:

- Consistent Income Stream: Like a trusty old car that doesn’t break down, you know the cash is coming in regularly, unlike the rollercoaster of one-off sales.

- Boosts Investor Confidence: Regular income is like comfort food for investors, making them believe more in a company's stability.

- Easy-Peasy Financial Forecasting: With a predictable income, my crystal ball doesn’t have to work overtime—budgeting and growth plans are a breeze.

- Customer Warm & Fuzzy Feeling: Recurring revenue often involves subscriptions which keep customers coming back for more, like when they just can’t get enough of their favourite TV series.

Here's a nifty table showing what these benefits actually do:

Recurring Revenue in SaaS Companies

In the wild world of Software as a Service (SaaS) companies, recurring revenue models have made them a magnet for investors. These folks are obsessed with things like Annual Recurring Revenue (ARR), Customer Lifetime Value (LTV), and Customer Acquisition Cost (CAC) (Business Appraisal Florida).

Things SaaS Companies Drool Over:

- Annual Recurring Revenue (ARR): This is like a financial yearbook, showing the predictable yearly income from subscriptions.

- Customer Lifetime Value (LTV): This is the moolah you expect from a customer throughout your happy business relationship.

- Customer Acquisition Cost (CAC): The budget you blow through to snag a new customer, covering everything from ads to sales pitches.

Giants like Netflix and Salesforce play this game like pros—they’ve tuned these metrics to skyrocket their worth. Their secret sauce includes solid growth, keeping fans hooked, and rock-solid subscription models (Business Appraisal Florida). This kind of steady, reliable income is like candy to investors like me.

For those who want to dive into keeping income steady and making their investment game stronger, hopping onto recurring revenue models is your golden ticket.

Maximising Income Predictability

Let's chat about making your income as steady as a rock. It's all about using smart strategies and cool tools, like data crunching, to keep your cash flow coming. I'll share a few tricks to help you make the most of your investments.

Predictable Income Strategies

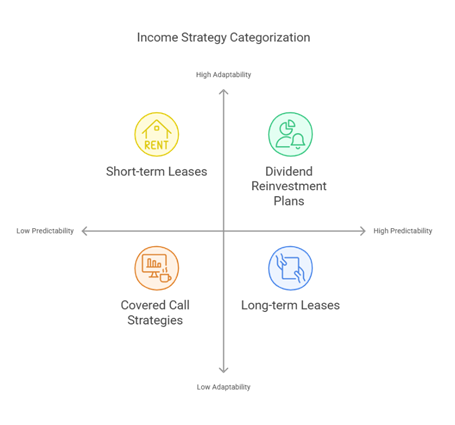

- Mix It Up with Different Revenue Streams: Don't put all your eggs in one basket. Create a mix of money sources—maybe some from renting out property, picking up dividends with equity income plans, or earning interest from bonds. The more streams, the better the flow.

- Getting That Regular Cash Flow: Embrace the joy of regular income. Options like dividend reinvestment plans (DRIPs) or monthly income ETFs work wonders. They're your ticket to making money rain consistently, without much hassle (Business Appraisal Florida).

- Covered Call Strategies: This is all about playing it smart with your stocks. You hold onto them while making extra cash from the options market. It's like having your cake and eating it too.

- Long-term Leases: Find comfort in the predictability of long-term leases—it’s like knowing when the next bus will arrive. But, if you’re the adaptive type, short-term leases offer more spice and can make you some fast cash. Learn more in our section on Navigating Short-term vs. Long-term Leases.

Using Data for Better Revenue Predictions

Data isn't just numbers; it’s a trusty ally to make your income reliable. It shows where you can up your game financially and make smarter choices (Business Appraisal Florida).

- Forecasting Your Money Future: Dig into past trends and numbers to see what’s coming down the road. This approach fits well for things like actively managed ETFs.

- Know Your Audience: Break down who’s spending and why so you can target them better. For instance, folks hooked on monthly income plans can teach you a thing or two about solid customer groups.

- Price Tweaks for More Cash: Try out different pricing strategies with A/B testing. A small change can create a large impact on income forecasts, especially in subscription setups.

- Keeping Risks in Check: Use data to dodge market potholes by adjusting your investments.

- Sharper Tools for Better Income: Use smart tools that fine-tune your asset choices and manage your income streams effectively. They help reduce ups and downs, giving you a smooth income ride.

These approaches are about syncing your strategies and using data to forecast like a pro.

Choosing Short-term vs. Long-term Leases

Dividing up how to rake in cash from real estate, I've found that choosing between short-term and long-term leases can wildly change the dollars coming in. Here, I’m breaking down the perks of each, so you can snag the lease type that fits your game plan best.

Perks of Short-term Leases

Short-term leases, which usually last a year or even less, keep things super flexible for me. I'm quick on my feet, ready to dance to the market's beat and swoop on new opportunities. Perfect for businesses needing a quick spot to dip their toes in or tackle a temporary project (Private Capital Investors).

Here's why short-term leases shine:

- Flexibility: Snap choice adjustments to fit what's happening in the market.

- Less Risk: If things turn sour, I'm not stuck with a long commitment.

- Bump Up Rental Rates: More shots at hiking up rents when the market's hot.

- Testing the Waters: Great for businesses trying to find their footing.

If you're looking to keep income flowing in while staying flexible, short-term leases can be your jam.

Joys of Long-term Leases

On the flip, long-term leases, beyond a year, offer me a nice safety blanket of stable cash. They’re like the steady heartbeat of my financial plans—predictable and reliable. They cut down costs related to endless tenant merry-go-rounds (Private Capital Investors).

Here's what makes long-term leases dreamy:

- Income Stability: Keeps the rent checks rolling in, like clockwork.

- Less Tenant Spin: Fewer goodbyes, less cash thrown out the door.

- Long Haul Commitment: Easy-peasy cash flow management.

- Steady Tenants: Solid, loyal tenant crew.

While steady and reliable, long-term leases can clamp down on changing rates or terms. Aligning them with cash flow goals is key, ensuring you’re reeling in returns while minimizing hiccups.

Deciding on short-term versus long-term leases is about meshing with your business vision, your wallet’s health, and the market pulse where your properties sit.

Building Resilience in Economic Downturns

Managing those pesky income streams isn't just about making a buck when times are good; it's about keeping that cash flow strong when the economy takes a nosedive. As someone who likes their investments to stand tall, I want to make sure they're earthquake-proof against market shocks.

Strategies for Resilience

When the going gets tough, I arm myself with a toolkit of strategies to keep my investments afloat.

- Mix Up My Income Streams: I don’t put all my eggs in one basket. Instead, I spread my money around in stuff like real estate, stocks, and those nifty dividend reinvestment plans (DRIPs).

- Trim the Fat: I get a kick out of managing costs without showing anyone the door—it works wonders for team spirit and saves a pretty penny in the long run (Investopedia).

- Cash Cushion: Keeping some cash handy and not drowning in loans is my go-to. Liquidity is my lifeline, helping me sail through financial storms unscathed.

- Quick-Change Artists: My team is ready to switch gears at the first sign of turbulence, seizing any chance that comes our way, even when the chips are down (Investopedia).

Impact of Recessions on Businesses

Recessions throw wrenches into different sectors' gears, hitting each one differently. Knowing how they play out helps me make smarter investment moves.

- Sales Slump: People tighten their belts during recessions, leading to falling sales. This can start a downward spiral where layoffs further dent demand (Investopedia).

- Credit Crunch: Uncertain times mean banks lock up the vaults. That’s bad news for businesses, especially the little guys already scrapping for cash.

- Bankruptcy Blues: Just take a look at the 244 big fish that sank in 2020’s bankruptcy sea. Worst hit? Energy, retail, and consumer services took it on the chin (Investopedia).

- Small Biz Struggles: Small businesses, making up a huge chunk of U.S. GDP, often lack the padding needed to survive rocky times. Unlike the big leagues, they can't score capital as easily during downturns (Investopedia).

Economic Impact Summary

Knowing these hiccups lets me spot bumps on the road and patch up my income safety net. For a deep dive into shoring up investments, swing by our option writing strategies.

Mixing these tricks into my money game plan guarantees my cash flows aren’t just a flash in the pan, staying steady even when the econ forecast is looking cloudy.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video.