Exploring the Exciting World of Actively Managed ETFs

Maximising Investment Income

Understanding Actively Managed ETFs

When I think about actively managed ETFs, I sense a real shot at boosting my investment income. Just like their passive cousins, they bring transparency, liquidity, and tax perks to the table. But here’s the kicker: a professional fund manager is in the driver's seat, skillfully manoeuvring through market twists and turns.

In these actively managed ETFs, the fund manager's mission is to cook up some extra returns—going beyond the usual benchmark index. They pull this off by spotting undervalued or over-the-top assets, making tactical calls on stock picks, and choosing the best moments to pounce on opportunities while dodging risks. It’s all about letting a fund manager’s know-how work hard for me to aim for those sweet, juicy returns.

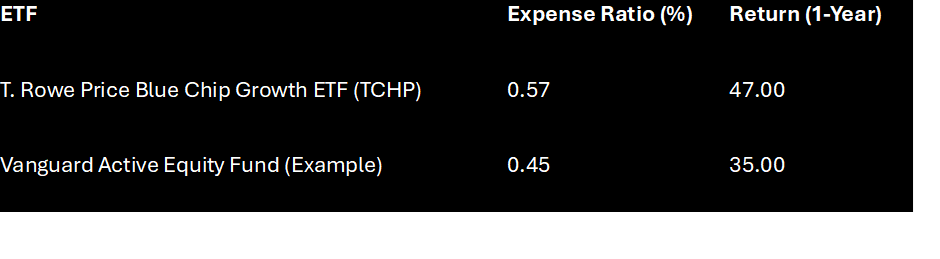

Here’s a quick rundown to help see what makes them tick:

If you're keen on getting the lowdown on handling cash flow with actively managed ETFs and want to wrap your head around the specifics, diving into these features is a must.

Benefits of Active Management

Dabbling in actively managed ETFs gives me quite a few reasons to smile. Here’s why they catch my eye:

- Expertise and Experience: With these ETFs, I ain’t just sticking to an index. A seasoned fund manager is actively running the show, leveraging their skills to ride out market bumps. This could mean juicier returns, as the manager tweaks the portfolio to ride the waves of the market.

- Diversified Strategies: These funds are like a Swiss army knife of strategies, always on the lookout to take advantage of market quirks. By pinpointing undervalued or overvalued gems, the fund manager tunes the portfolio to squeeze out the best returns.

- Increased Flexibility: Actively managed ETFs offer me a bunch of trading wiggle room. Since they trade on exchanges just like their passive pals, I enjoy liquidity and live pricing. Handy for snapping up short-term chances.

- Potential for Superior Returns: One big reason I might roll with actively managed ETFs is the chance to outshine the benchmark. Via thorough research and smart moves, fund managers aim for returns that do the benchmark one better. This can be a real draw, especially in rocky or bear markets.

- Lower Expense Ratios: When lined up against regular mutual funds, actively managed ETFs tend to ask for less in fees. This means more of my hard-earned cash heads straight into the investment pool. While the fees may outpace those of passive ETFs, the extra cash often goes toward the active expertise of financial gurus, which could be worth the price.

Fancy some advice on how to cleverly use dividends for reinvestment? Our guide on dividend reinvestment plans (DRIPs) is just what you need to bolster my tactics for solid income generation.

Grasping these perks lets me make smart decisions about slotting actively managed ETFs into my investment mix. Want more to fine-tune those investments? Check out our article on equity income strategies.

Factors to Consider

Alright, you're looking to dive into the world of actively managed ETFs to boost your cash flow? Let's get into the nitty-gritty of what you need to know to make savvy decisions.

Expense Ratios

First up, those daunting expense ratios. They’re like the cost of hiring someone to chase the stock market on your behalf. Think of these as the yearly fees that nibble away at your investments to pay for the fund's brainy operations. While actively managed ETFs flash the promise of higher returns due to their hands-on approach, they tend to have steeper expense ratios than their laid-back passive counterparts.

So, make sure those potential returns are worth the extra dough you're shelling out. Nobody likes throwing money down the drain, right?

Performance Expectations

Next, let's talk about performance expectations—what you're realistically getting for your buck. Those fund managers behind the curtain? They're trying to outsmart the market indices with their strategic shuffling of investments. But before you start dreaming of yachts and private islands, take a peek at how the fund has historically performed against heavyweights like the S&P 500.

Like, check out the T. Rowe Price Blue Chip Growth ETF spiking a 47% return in just a year up till March 31, 2024. Not too shabby, considering it left the S&P 500 trailing behind by a good 17%.

Investment Flexibility

Last but definitely not least, let's chat flexibility. This is where actively managed ETFs really get to strut their stuff. They can shift gears as market conditions change, keeping up with economic shifts or company performances like it's no big deal.

Dipping toes into different sectors or dancing around market volatility can serve you well in your quest for income. So, make sure you're on board with the fund manager's game plan and it lines up with what you're aiming for, whether that's cash flow from dividends or putting option writing strategies into action.

By keeping your eyes on expense ratios, having down-to-earth expectations, and taking advantage of the flexibility that comes with actively managed ETFs, you'll be geared up to hit those income targets. For more juicy insights, don't miss out on our other reads about covered-call ETFs and monthly income strategies. Happy investing!

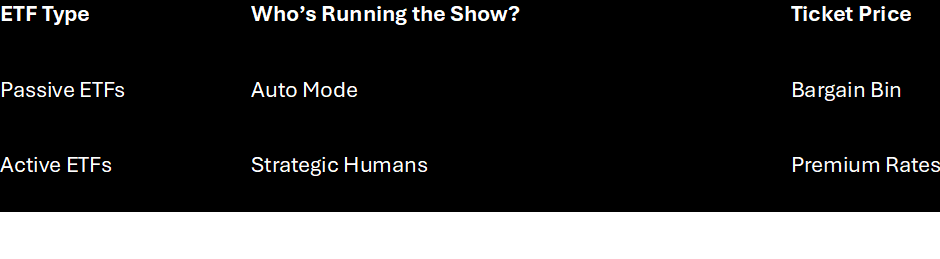

Key Differences from Passive ETFs

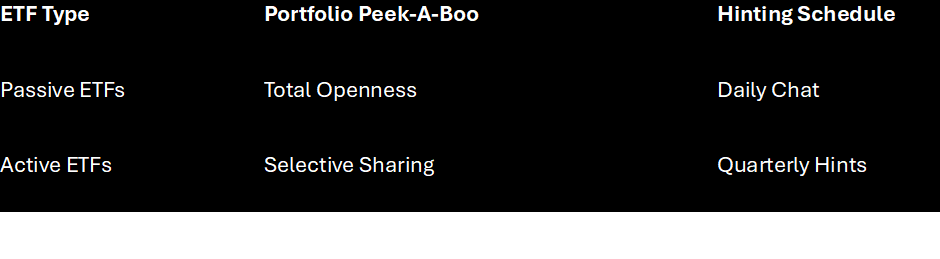

Let's chat about the trendy world of actively managed ETFs and how they stand apart from their more restrained cousins, passive ETFs. Two standout differences: how much they let you peek into their holdings and the brains behind the operations.

Portfolio Transparency

First up, let's discuss the transparency aspect. With passive ETFs, it's like they're shouting from the rooftops, "Look at all my securities!" They aim to mirror some index and freely show off their holdings day-to-day, letting investors know what they're dealing with at any moment. They're as open as a favourite book.

Now, toss active ETFs into the mix and things get a bit cloudy. These are the secretive types—always strategising. Fund managers behind active ETFs might not spill the beans as often, keeping their moves on the down-low to protect those slick strategies from copycats. Sure, you might have to wait a little longer, but regulations are pushing for at least a quarterly mystery reveal. Curious about mixing up your investment approach? Go check out our piece on equity income strategies.

Management Expertise

Next, let’s talk about who's calling the shots. Passive ETFs are like well-trained dogs, sticking to their tracks without much fuss. That's 'cause they’re just shadowing some market index, no real guidance needed. They practically manage themselves with auto-pilot adjustments, making their oversight a piece of cake.

Now, imagine active ETFs as the chess masters. They're all about strategy, with managers who dive deep into research, check the market like it's a weather app, and make tactical plays hoping to one-up the market. These funds don't just ride the waves—they aim to create them. Naturally, with all this expertise, the management fees take a hike. You're paying for those sharp minds doing the heavy lifting in research and strategy-moving.

Want to see how active management shakes up your earnings? Pop over to our insights on income generation.

To wrap it all up, actively managed ETFs bring their own flavour with both perks and pitfalls compared to the more vanilla passive ETFs. Getting the hang of these differences is a big deal for savvy investing. Keen on weaving active ETFs into your financial quilt? Dive into our reads on monthly income strategies and the nifty dividend reinvestment plans (drips).

Sure, let's make that content pop while still keeping it straightforward and easy to follow!

Cashing in with Smart Income Moves

Now, when you're chewing over how to supercharge your money-making game with actively managed ETFs, there's a couple of big hitters to think about – sniffing out golden investment chances and staying on your toes in the market. Nail these, and you've got yourself a winning plan for pulling in the dough.

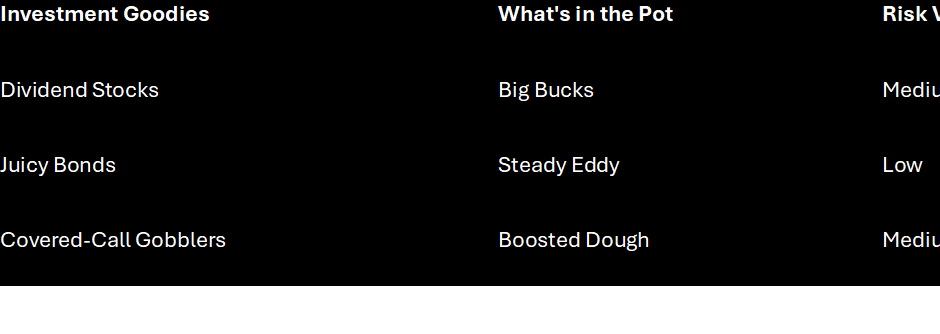

Sussing Out Investment Goodies

The beauty of actively managed ETFs? Well, it's like having a seasoned pro at the wheel. These brainiacs dive deep, hunting down golden nuggets and playing the market like a fiddle (Investopedia). Fancy tapping into market quirks and spotting the next big thing? This avenue's your playground.

Sizing up these money-spinners means digging into things like dividend yield and covered-call strategy. These ETFs often zero in on stuff that keeps the cash taps flowing, like dividend-giving stocks and meaty high-yield bonds.

Wrap your noggin around these ideas, and you can tweak your plan to match your risk-taking flair and money dreams. Take dividend stocks – fab potential returns but they can make you bite your nails sometimes. Those juicy bonds, though, are like a trusty old pal with hopefully less heartburn. For a little extra, those covered-call ETF choices might take the cake by bumping?up yields using an option-writing trick.

Rolling with the Market Punches

Keeping up with those market curveballs is gold dust for making the most of actively managed ETFs. With a sharp manager at the helm, they flex, duck, and dive by realigning the money playbook to fit the daily drama (Investopedia). That means they're primed to grab chances and kick pesky risks to the curb.

Mastering this nimbleness means tweaking asset mixes and spotting assets that are kinda stealing the show or being the wallflower at the party. Say the market's jittery? A wise head might swing towards safe bet sectors or ones that keep churning out the cash.

Being able to pivot through the ups and downs is a biggie for keeping the cash flowing consistently. When the market's throwing shade, being slick at making sure the cash flows and not bleeding capital is the name of the game for staying in it for the long haul.

Wrapping it up, for all things actively managed ETFs and drum up your income plan, honing in on those investment opportunities and riding the market wave is the bee's knees. By doing this, you'll be pocketing the good stuff, keeping the nightmares at bay, and riding the perks of having pro moneyminders watch your back. For more gems on cranking up your income strategies, swing by our two cents on equity moneymaking moves and drip-feed investments.

Case Studies

Top Performing Active ETFs

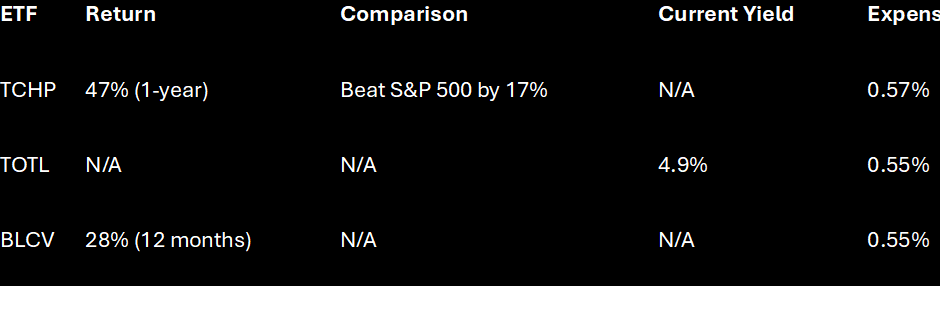

I've found that active ETFs can really jazz up your investment game, offering chances to boost your earnings. Let's check out some stellar performers:

- T. Rowe Price Blue Chip Growth ETF (TCHP)

- Return: 47% (over the last year till March 31, 2024)

- Comparison: Beat the S&P 500 by more than 17%

- Expense Ratio: 0.57%

- This one uses skilled management to pick top-tier growth stocks, raking in impressive returns beyond the usual index.

- SPDR DoubleLine Total Return Tactical ETF (TOTL)

- Current Yield: 4.9%

- Expense Ratio: 0.55%

- The strategy here is to outdo the Bloomberg US Aggregate Bond Index by snapping up bonds that are likely to rise in value with the ups and downs of interest rates and markets.

- Blackrock Large Cap Value ETF (BLCV)

- Return: Around 28% in the last 12 months as of March 31, 2024

- Expense Ratio: 0.55%

- This pick focuses on undervalued stocks from the Russell 1000 Value Index, following classic value investing to get solid returns.

Here's a handy table to sum up the key points:

Source: U.S. News

Investment Insights

In my view, ETFs like TCHP, TOTL, and BLCV have the perks of active management, such as strategic asset picks, staying alert to market changes, and expert guidance. They allow quick decisions based on what's happening in the market, giving them a leg up on passive investing.

Take TCHP's win over the S&P 500 as a peek into the potential when skilled managers steer the wheel. TOTL shows how they can adjust bond investments when interest rates are swinging, highlighting the flexibility of active ETFs.

To bump up your income game, check out our articles on dividend yield and monthly income. Learning about covered-call ETFs and dividend reinvestment plans (DRIPs) will give more depth to your investment strategies, letting you set up a steady income stream.

Also, peeking into the nav (net asset value) and how these ETFs perform can tell you a lot about their long-term potential. For instance, MSTY ETF performance since inception February 2024 provides a clear picture of the returns and market action over time.

Digging into these investment strategies, you can be sure you're making well-informed choices, steering your portfolio toward stable income and growth.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.