Is MSTR (MicroStrategy) a Good Investment in 2025?

Is MSTR (MicroStrategy) a Good Investment in 2025?

Introduction

MicroStrategy (MSTR) is not a normal stock. It doesn’t just sit quietly in a portfolio, appreciating at a reasonable rate while offering modest dividends like some beige-walled, middle-management-approved blue chip. No, MicroStrategy is the stock market equivalent of a high-stakes poker player who keeps doubling down—on Bitcoin.

This may explain why the MSTR and MicroStrategy reddit threads/posts are so ... volatile.

Once upon a time, MSTR was a regular enterprise software company. It had revenues, clients, and a business model that made sense. Then CEO Michael Saylor had an epiphany: cash is trash, the dollar is dying, and the only way forward is to convert the entire company into a Bitcoin vault on steroids.

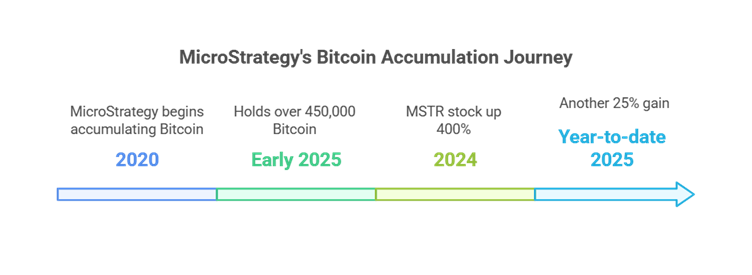

Since 2020, MicroStrategy has been accumulating BTC like a doomsday prepper hoarding canned beans. By early 2025, it holds over 450,000 Bitcoin, making it the largest corporate Bitcoin holder in the world. The result?

📈 MSTR stock up 400% in 2024.

📈 Another 25% gain year-to-date in 2025.

💰 Investors foaming at the mouth.

The question is simple:

Is MSTR a genius way to get Bitcoin exposure, or a reckless, over-leveraged bet that could collapse at any moment?

To answer that, we’ll break down:

- MicroStrategy’s actual business model (spoiler: it’s just Bitcoin)

- The ‘21/21 Plan’—a $42 billion strategy to acquire even more BTC

- The risks—because, let’s be honest, there are plenty

So buckle up. This is either one of the greatest financial moves of the decade or a corporate version of Icarus flying a little too close to the sun.

1. MicroStrategy’s Investment Strategy: Betting Big on Bitcoin

From Software to Bitcoin Cult Leader

Once upon a time, MicroStrategy built business intelligence software. Good, respectable stuff. Sold to corporations. Made a tidy profit. Everything was fine.

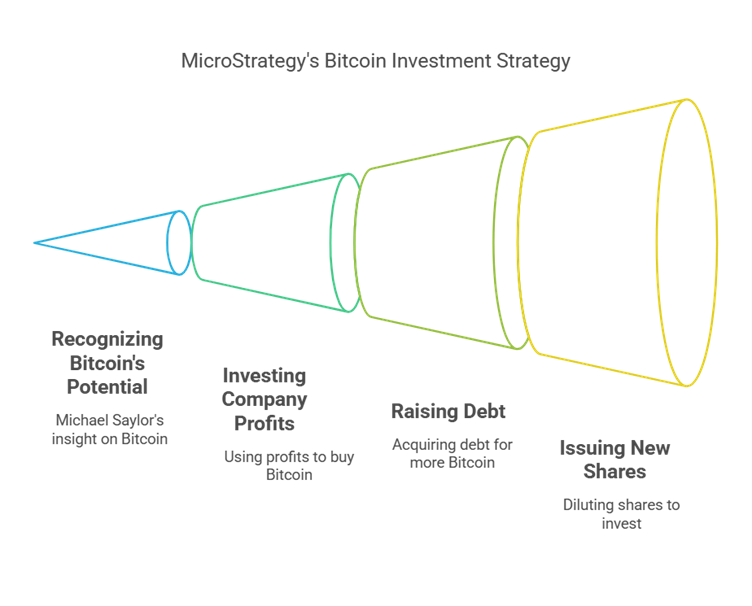

Then, in 2020, Michael Saylor saw the light—or more accurately, saw that Bitcoin was going to outpace inflation, fiat was doomed, and corporate treasuries were wasting away by holding cash.

His solution?

🚀 Put every spare dollar into Bitcoin.

🚀 Use company profits to buy more Bitcoin.

🚀 Raise debt to buy even more Bitcoin.

🚀 Issue new shares, dilute existing shareholders, and—yep—buy more Bitcoin.

At this point, MicroStrategy is basically a leveraged Bitcoin ETF disguised as a software company, and investors are treating it as such.

450,000 BTC and Counting: The Largest Corporate Bitcoin Hoard

MicroStrategy isn’t just invested in Bitcoin—it’s all in.

With 450,000 BTC in its reserves, the company holds more Bitcoin than Tesla, Block, and any other public company combined. That’s 2.2% of all Bitcoin that will ever exist. If Bitcoin so much as sneezes, MSTR stock either explodes or implodes overnight.

The ‘21/21 Plan’—A $42 Billion Bet on Bitcoin

As if this wasn’t aggressive enough, in 2025 MicroStrategy unveiled the ‘21/21 Plan’, a strategy to:

💰 Raise $21 billion in equity (issuing more shares = dilution risk)

💰 Raise $21 billion in fixed-income securities (borrowing even more money)

💰 Use every single cent of that to buy more Bitcoin.

That’s right. While most CEOs try to diversify their businesses, Michael Saylor is literally making MicroStrategy the biggest Bitcoin hoarder in history.

If Bitcoin keeps climbing, this plan could make MSTR one of the most valuable companies on Earth.

If Bitcoin crashes? Well… let’s just say it’ll be a bloodbath.

Bitcoin Yield Strategy: Making BTC Work for Them

MicroStrategy isn’t just holding Bitcoin—it’s also earning yield on it. By Q3 2024, the company reported a 17.8% Bitcoin yield, meaning they’re effectively stacking sats on their sats.

How?

- Lending BTC to institutions for interest

- Using it as collateral to raise even more money

- Maybe some black magic—we’re still not sure

While this yield strategy boosts revenue, it also adds counterparty risk—if things go south, MicroStrategy could be on the hook for more than just a Bitcoin dip.

2. Stock Performance and Market Momentum

If you bought MicroStrategy (MSTR) in early 2024, congratulations—you probably feel like a financial genius. The stock went absolutely parabolic, climbing over 400% in a single year. And if you held onto it into 2025? You’re still up another 25% year-to-date. That’s the kind of price action that makes Tesla look sluggish and hedge fund managers sweat.

But let’s be real—MSTR’s performance isn’t about corporate innovation or earnings growth. It’s about Bitcoin.

MSTR: The Leveraged Bitcoin ETF That Pretends It’s a Tech Stock

MicroStrategy isn’t just correlated with Bitcoin—it’s practically tethered to it like an overleveraged yacht. The stock moves almost one-to-one with BTC, amplifying both the upside and the downside.

- When Bitcoin pumps? MSTR pumps harder.

- When Bitcoin dumps? MSTR faceplants.

- When Bitcoin trades sideways? Michael Saylor finds a way to buy more.

This Bitcoin-centric playbook has drawn serious interest from Wall Street. Analysts who love Bitcoin love MSTR—and that’s reflected in the latest price targets.

Wall Street is Paying Attention (And Some Are Betting Big)

- Cantor Fitzgerald just upgraded MSTR’s price target from $518 to $613, implying a 70% upside from current levels.

- MSTR ranks eighth on a list of the top stocks to hold in 2025, with bullish investors treating it as a high-beta Bitcoin exposure vehicle.

The momentum is undeniable. But here’s the billion-dollar question—does the stock deserve this valuation, or is it just riding Bitcoin’s coattails?

3. Financial Reality Check: A Disconnect from Fundamentals?

Okay, let’s take off the laser-eyed Bitcoin maxi glasses for a second and look at MicroStrategy’s actual financials.

Spoiler: it’s not pretty.

The Core Business is… Well, Not the Focus Anymore

Once upon a time, MicroStrategy was a respectable enterprise software company with steady revenues and a clear business model. Then, the Bitcoin obsession took over, and suddenly financial statements started looking like a crypto trader’s PnL sheet after a leverage binge.

Q3 2024 Earnings Breakdown (Brace Yourself):

📉 Gross profit: $81.7 million (down from $102.8M in Q3 2023).

📉 Operating expenses: Up 301.6% year-over-year, mostly due to Bitcoin impairment losses.

📉 Net loss: $340.2 million (ouch).

So despite MSTR’s stock price soaring, its core business is actually deteriorating. And it gets better (or worse, depending on your risk tolerance).

Valuation: $86 Billion Market Cap… But Why?

MicroStrategy’s current market cap sits at $86 billion, which is… ambitious. For context, that’s roughly the same as Goldman Sachs—a financial institution with actual earnings and a business that doesn’t depend on the whims of a digital asset invented by an anonymous coder in 2008.

Then there’s the price-to-sales ratio, which is currently hovering around 200x. To put that in perspective:

- The average tech stock trades at 20x sales (and that’s already high).

- The S&P 500’s average is 2.5x sales.

- MSTR? 200x.

If you’re wondering whether that makes sense, the answer is no—unless, of course, you believe Bitcoin is going to $1 million.

4. Key Risks and Considerations for Investors

Alright, so MicroStrategy (MSTR) has had a ridiculous run, its stock chart looking like a Bitcoin-fueled SpaceX launch. But before you sell a kidney to go all-in, let’s talk risks—because MSTR isn’t some bulletproof blue-chip. It’s a leveraged Bitcoin rocket with no seatbelts and no eject button.

Here’s what could go wrong.

1. Bitcoin Volatility: MSTR Lives and Dies by the BTC Chart

Let’s be crystal clear: MicroStrategy is Bitcoin. There’s no separation, no hedge, no diversification strategy—it’s just pure, unfiltered BTC exposure with a corporate logo slapped on top.

- If Bitcoin moons to $250K? MSTR becomes one of the best-performing stocks in history.

- If Bitcoin tanks to $30K? MSTR shareholders are left holding the bag (and possibly their heads in their hands).

Even Tesla—another Bitcoin-friendly company—has an actual business to fall back on. MSTR? Just Bitcoin, baby.

2. Interest Rate Sensitivity: What Happens if the Fed Gets Nasty?

Michael Saylor’s obsession with leverage means MSTR is highly sensitive to interest rates. The company has borrowed billions to buy Bitcoin, which is fine when rates are low.

But what happens if the Federal Reserve decides to go full Jerome Powell mode and hike rates aggressively?

- Higher borrowing costs = MSTR’s Bitcoin-buying spree slows down.

- Debt repayments become more expensive = margins get squeezed.

- Risk appetite declines = Bitcoin (and MSTR) suffer.

If you’re investing in MSTR, you’re also placing a side bet on monetary policy staying loose.

3. Regulatory Uncertainty: Will the SEC Crash the Party?

The crypto industry is a regulatory minefield, and MSTR is marching through it wearing moon boots and no helmet.

Potential risks include:

- The SEC classifying Bitcoin as a security (unlikely, but not impossible).

- Stricter corporate crypto accounting rules, making MSTR’s balance sheet even uglier.

- Tax changes or restrictions on corporate Bitcoin holdings.

Saylor has been daring regulators to come at him for years, and so far, he’s walked away unscathed. But if the government ever decides to put a leash on corporate Bitcoin exposure, MSTR could feel the heat.

4. Share Dilution Risk: Saylor is Printing More Stock Than the Fed Prints Money

MSTR loves issuing new shares to fund its Bitcoin-buying addiction.

- The ‘21/21 Plan’ aims to raise $21 billion in equity, which means… you guessed it: dilution.

- The more shares they issue, the more existing investors see their ownership percentage watered down.

- This strategy works as long as Bitcoin keeps rising—but if BTC stalls or drops, the dilution becomes a major problem.

At some point, investors might start wondering: are they holding MSTR, or just Saylor’s personal Bitcoin ETF?

5. Conclusion: Should You Invest in MSTR?

Recap: High Risk, High Reward

MicroStrategy is the stock market’s most aggressive Bitcoin bet, no question about it. It’s got:

✅ Insane upside potential if Bitcoin keeps climbing.

✅ A CEO who is fully committed to the Bitcoin thesis.

✅ Massive institutional interest as a high-beta BTC play.

But it also comes with:

❌ Extreme volatility tied to Bitcoin’s price movements.

❌ Rising debt and dilution concerns.

❌ Regulatory risks that could shift the entire game.

Who Should Consider Investing in MSTR?

🚀 The Bitcoin Bull – If you already believe BTC is going to $500K, MSTR is a leveraged way to play that thesis.

⚡ The Risk-Tolerant Trader – If you love volatility and live for massive swings, this stock delivers.

🧐 The Institutional Investor Who Can’t Buy Bitcoin – Some funds can’t hold crypto directly, so they use MSTR as a proxy.

Final Thoughts: MSTR is Not a Stock—It’s a Bitcoin-Leveraged Rollercoaster

At the end of the day, MSTR is not a traditional stock investment. It’s not about revenue growth, profit margins, or software innovation.

It’s a high-stakes gamble on Bitcoin, wrapped in a corporate balance sheet, led by a CEO who might just be the ultimate Bitcoin maximalist.

If you’re bullish on BTC, MSTR offers turbocharged upside.

If you’re not? You’re better off watching this chaos from the sidelines.

Strap in. Whatever happens, MSTR is going to be one hell of a ride. 🚀

FAQ: Frequently asked questions

1. Is MicroStrategy (MSTR) a tech company or a Bitcoin investment vehicle?

Technically, MicroStrategy is still a business intelligence software company, but in reality, it has become a leveraged Bitcoin holding company. With over 450,000 BTC on its balance sheet and an aggressive Bitcoin acquisition strategy, MSTR is essentially a high-volatility Bitcoin ETF in disguise.

2. How does MSTR’s stock price correlate with Bitcoin?

MSTR’s stock moves almost one-to-one with Bitcoin’s price, but with added leverage. This means:

- When Bitcoin rises, MSTR outperforms BTC.

- When Bitcoin falls, MSTR crashes even harder.

- If Bitcoin stagnates, MSTR’s stock can struggle due to dilution concerns.

If you’re investing in MSTR, you’re making a highly leveraged bet on Bitcoin’s future.

3. What is the biggest risk to investing in MSTR?

The biggest risks include:

- Bitcoin price volatility – MSTR is completely dependent on BTC’s value.

- Share dilution – The company keeps issuing new shares to fund its Bitcoin purchases.

- Interest rate hikes – Higher rates could make MSTR’s debt-financed Bitcoin strategy less effective.

- Regulatory changes – Governments could impose stricter rules on corporate Bitcoin holdings.

4. How does MSTR’s ‘21/21 Plan’ impact shareholders?

MicroStrategy’s ‘21/21 Plan’ aims to raise $42 billion ($21B in equity + $21B in fixed-income securities) to buy more Bitcoin. While this could drive huge upside if BTC appreciates, it also increases dilution risk, meaning existing shareholders will own a smaller percentage of the company.

5. Is MSTR a good investment for someone who wants Bitcoin exposure?

If you believe Bitcoin will continue to rise, MSTR offers an amplified way to play that upside. However, if you’re simply looking for Bitcoin exposure without the risks of corporate debt, dilution, and regulatory uncertainty, you might be better off buying BTC directly or investing in a Bitcoin ETF.

Want more resources?

Have you just started or want more from your Bitcoin journey? You’ll thorough enjoy the Bitcoin for Beginners: The Quickest Way to Learn About Bitcoin series

Resource Recap to understand/buy Bitcoin or MSTR

· Read blogs, watch YouTube videos, or even grab a book like The Bitcoin Standard. Educating yourself helps you make better decisions and not fall for scams.

· Cold Wallets: Offline wallets (like USB drives or cards) that keep your Bitcoin safe from hackers, such as the one I use – Tangem.

· In terms of exchanges, some good options for beginners include Binance, Coinbase, or CoinSpot (a local Aussie favourite – this is also the one I use and have been using since 2017).

· IBIT: Blackrock’s Bitcoin ETF – ishares Bitcoin Trust (Australia/US) this is listed on the NASDAQ (IBIT) and I’m invested in this ETF, along with holding a small amount of bitcoin via the exchange Coinspot (been on here since 2017) and majority of my bitcoin via cold storage wallet – Tangem wallet (use my link an get 10% OFF automatically).

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video.