MSTR 2025 Stock Forecast: What do Investment Bankers Think?

“MSTR Stock Forecast for a Tech Titan or Bitcoin Time Bomb?”

“MicroStrategy might look like a software company on paper, but let’s be real – it’s practically a Bitcoin ETF in disguise.”

"Mate, with CEO Michael Saylor stacking BTC like it’s Vegemite on toast, this stock’s performance is tied tighter to Bitcoin than your uncle’s shorts at Christmas lunch."

"But does that make MSTR a clever diversification play or a ticking time bomb?"

Whether you’re a crypto convert or a sceptic looking for answers, we’ll help you decide whether MSTR deserves a spot in your portfolio or just a spot on your watchlist.

Why Is Everyone Talking About MicroStrategy?

MicroStrategy made headlines when its CEO, Michael Saylor, decided to treat Bitcoin like it was going out of fashion—buying billions worth of it and turning the company into one of the largest corporate holders of BTC.

As of December 23, 2024, MicroStrategy holds approximately 444,262 bitcoins, acquired at an average price of $58,219 per bitcoin, totalling around $23.41 billion in investment.

While some call this a masterstroke, others reckon it’s the equivalent of betting the farm on one racehorse.

So, what’s the deal? Is MSTR still a software company, or has it quietly rebranded as a Bitcoin ETF in disguise?

MicroStrategy Fundamentals—What’s Under the Hood?

Despite all the crypto hype, MicroStrategy is still a software company at its core, specialising in business intelligence solutions. It has:

- Stable Revenue Streams: Its software products continue to generate consistent income.

- Cash Reserves: The company’s Bitcoin holdings act as a digital treasury reserve, providing liquidity if needed.

- Debt Levels: MSTR has taken on significant debt to buy Bitcoin, which could be a double-edged sword if prices drop.

MicroStrategy has been on a Bitcoin buying spree since 2022 August, making several significant acquisitions:

- 2022: Between November 1 and December 21, MicroStrategy purchased 2,395 bitcoins at an average price of $17,871 per bitcoin. Interestingly, in December 2022, they sold 704 BTC at around $17,800 per coin, marking their first Bitcoin sale.

- 2023: The company continued its aggressive strategy:

- Between March 27 and April 5, they acquired 6,455 bitcoins at an average price of $28,016 per coin.

- From April to June, they added 12,333 bitcoins at approximately $28,136 per coin.

- By July, an additional 467 bitcoins were purchased at an average of $30,835 per coin.

- 2024: This year marked their most substantial acquisitions:

- In February, they bought 850 bitcoins at $43,764.70 per coin, followed by 3,000 bitcoins at $51,813 per coin later that month.

- Between October 31 and November 10, they acquired 27,200 bitcoins at an average price of $74,463 per coin.

- From November 18 to 24, they made a record purchase of 55,500 bitcoins for $5.4 billion, averaging approximately $97,297 per coin.

- In early December, they added 21,550 bitcoins at an average price of $98,783 per coin.

- Between December 16 and 22, they purchased 5,262 bitcoins at an average price of $106,662 per coin.

As of December 23, 2024, MicroStrategy holds approximately 444,262 bitcoins, acquired at an average price of $58,219 per bitcoin, totalling around $23.41 billion in investment. *All buying sources noted from KuCoin.

This aggressive accumulation underscores MicroStrategy's commitment to its Bitcoin-centric strategy, significantly influencing its stock performance and market perception.

The Issue: Is MSTR Too Dependent on Bitcoin?

Here’s the kicker—MSTR’s stock price has become tightly linked to Bitcoin’s performance. If Bitcoin sneezes, MSTR catches a cold. While this gives it massive upside potential when BTC rallies, it also leaves the company exposed to crypto’s infamous volatility.

For traditional investors, this feels a bit like dating someone who’s fun but unpredictable—you’re either having the time of your life or wondering why you didn’t just stay home. The big question is whether MSTR can deliver long-term value or if it’s too risky for conservative portfolios.

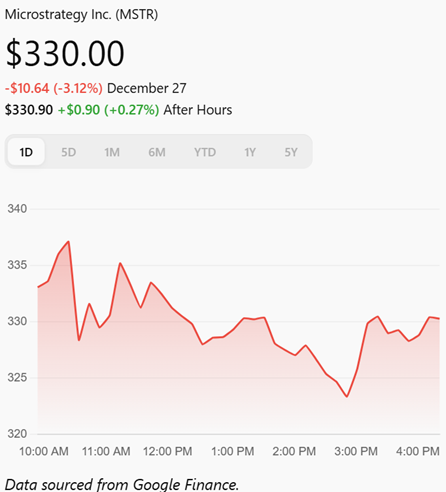

What about MicroStrategy's (MSTR) stock performance from 2019 to the present? Let’s paint a picture using data from Google Finance.

“Check out this craziness mate, 1 MSTR stock end of 2019 = $14 per share vs 1 MSTR stock end of 2024 $330 per share, I must say mate, that’s a pretty cool return for 5 years.”

Keep in mind all $ are denominated in US dollars or USD.

- 2019: MSTR's stock price fluctuated between approximately $14 per share, reflecting its operations as a business intelligence software company.

- 2020: In August, MicroStrategy began investing in Bitcoin, significantly influencing its stock performance. By the end of 2020, the stock price had risen to around $38 (31 Dec), marking a substantial increase.

- 2021: The stock experienced significant volatility, reaching a peak of approximately $96 in February, coinciding with Bitcoin's price surge. It then declined to around $54 by year-end, mirroring Bitcoin's fluctuations.

- 2022: MSTR's stock continued to exhibit volatility, with prices ranging from about $50 to $15, closely tracking Bitcoin's performance.

- 2023: The stock showed a general upward trend, starting the year around $16 and rising to approximately $63 by December, reflecting Bitcoin's recovery and increased institutional adoption.

- 2024: MSTR's stock reached an all-time high closing price of around $473 on November 20, 2024, before adjusting to approximately $330 by December 27, 2024.

This historical data underscores the strong correlation between MSTR's stock price and Bitcoin's market performance, highlighting the potential for significant gains as well as substantial risks.

For the most current stock price, here's the latest data:

The Bond Strategy—Funding the Bitcoin Bet

MicroStrategy has made headlines not just for buying Bitcoin, but for how it funds those purchases—primarily through convertible bonds and senior secured notes. Here’s how it works:

1. Convertible Bonds: MicroStrategy issues convertible bonds, a type of debt that investors can later convert into shares of the company at a pre-set price.

This approach allows the company to raise capital quickly without giving up equity upfront. It’s a win-win if the stock price rises because investors may convert bonds into shares, reducing debt obligations.

- Example: In June 2021, MicroStrategy issued $500 million in senior secured notes at 6.125% interest due in 2028 to buy more Bitcoin.

2. Low-Interest Borrowing: MicroStrategy capitalised on historically low interest rates, borrowing funds at attractive terms. These bonds allowed them to make aggressive Bitcoin purchases without selling existing assets or diluting shareholder value.

3. Leveraging Market Sentiment: Michael Saylor’s ability to attract risk-tolerant investors played a key role. Convertible bonds appeal to those betting on the company’s Bitcoin strategy and future share price growth. The option to convert debt into stock provides upside potential for bondholders while limiting downside risks.

4. Risks with Debt Accumulation: While debt has allowed MicroStrategy to build a massive Bitcoin reserve, it’s not without risks:

- If Bitcoin’s price drops significantly, the company may face difficulties repaying debt.

- Rising interest rates could increase refinancing costs if more debt is required in the future.

The Bullish vs Bearish Case for MSTR 2025 Stock Forecast

Im Bullish Because...

1. Bitcoin Adoption Continues to Grow

o With institutional adoption of Bitcoin on the rise and ETFs making it more accessible, MSTR’s holdings could skyrocket in value.

o If Bitcoin hits projections of $100,000+ by 2025, MSTR’s balance sheet could look very attractive.

2. Michael Saylor’s Vision

o Love him or hate him, Saylor has positioned MSTR as a thought leader in corporate Bitcoin strategy. If his bet pays off, MSTR could be a trailblazer others follow.

3. Tech and Crypto Synergy

o As a software company, MicroStrategy can continue innovating while leveraging its Bitcoin treasury for strategic growth and acquisitions.

Im Bearish Because...

While the bullish case paints a bright future, the bearish side of the coin raises serious concerns:

1. Bitcoin Volatility Risks

o MSTR’s reliance on Bitcoin means any major downturn in BTC’s price could trigger significant losses. If Bitcoin faces regulatory crackdowns or negative sentiment, MSTR could mirror those drops, making it highly unstable.

2. Debt Overload

o MicroStrategy has taken on billions in debt to fund its Bitcoin purchases. If interest rates climb or Bitcoin’s price falls sharply, the company could struggle to service its debt obligations, leading to liquidity risks and even potential default scenarios.

3. Lack of Business Diversification

o While the software business generates revenue, it’s been overshadowed by Bitcoin holdings. Investors may question whether the company has lost focus, potentially impacting its software client base and long-term growth prospects.

4. Regulatory Threats

o Governments worldwide are ramping up crypto regulations. Sudden legal changes or taxation rules targeting Bitcoin could erode its value and hit MSTR’s core strategy.

5. Market Sentiment and Speculation

o MSTR’s stock has become a proxy for Bitcoin, attracting speculators instead of long-term investors. If sentiment shifts, the stock could experience extreme price swings unrelated to its fundamentals.

What’s Happening Now?

Case Study 1: The Bitcoin Boom and Bust Cycles

In 2021, Bitcoin soared to $69,000, taking MSTR along for the ride. But by mid-2022, Bitcoin dropped below $20,000, dragging MSTR down with it.

Investors who bought at the top were left reeling, but those who held on saw partial recoveries by 2023.

Case Study 2: The ETF Effect

With the approval of Bitcoin ETFs, institutional interest in crypto has surged. MSTR, often seen as a Bitcoin proxy, benefited from this momentum.

If ETFs continue to drive demand, MSTR could see further gains.

Case Study 3: Michael Saylor’s Strategy

Saylor’s relentless Bitcoin buying has attracted both praise and criticism.

In 2024, he doubled down on Bitcoin during a price dip, earning applause from crypto bulls and scepticism from traditional analysts.

By 2025, this strategy could either look brilliant—or reckless.

MicroStrategy’s 2025 Bitcoin Investment Strategy

MicroStrategy’s 2025 strategy focuses on maintaining its position as the largest corporate holder of Bitcoin while leveraging its reserves for growth. Here’s what I think will happen:

1. Accumulation Mode Continues

- The company plans to keep buying Bitcoin, reinforcing its long-term belief in the cryptocurrency as “digital gold.” Michael Saylor himself has said he will buy Bitcoin at the top, even at $1 million dollars per Bitcoin.

- Saylor has hinted that the firm could explore even larger acquisitions if favourable market conditions arise.

2. Balancing Software and Bitcoin

- While Bitcoin is the star of the show, MicroStrategy aims to grow its core software business to stabilise revenue streams. This dual approach appeals to investors who want both tech exposure and crypto upside.

3. Bonds and Strategic Financing

- Expect more bond offerings and debt strategies to fuel Bitcoin purchases. The company’s use of convertible debt lowers financing costs, making it attractive for continued accumulation.

- MicroStrategy could also refinance existing debt if rates remain favourable.

4. Institutional Partnerships

- The company is positioning itself as a pioneer in integrating Bitcoin with traditional finance. Partnerships with institutions and ETFs could drive adoption and validate its strategy.

5. Hedging Against Inflation

- With inflation concerns still lingering, Bitcoin’s appeal as a hedge remains central to MSTR’s thesis. MicroStrategy’s focus on this narrative could attract more investors looking for protection against currency devaluation.

Is MSTR a Buy in 2025? What does the Investment Bank think

MicroStrategy is as bold as they come—part software company, part Bitcoin whale.

Its future hinges on Bitcoin’s performance, but that’s not necessarily a bad thing. For investors with a long-term outlook and an appetite for risk, MSTR could deliver significant returns.

That said, this isn’t a stock for the faint-hearted.

Do your homework, consider your risk tolerance, and keep an eye on Bitcoin’s trajectory.

Whether MSTR turns out to be a jackpot or a rollercoaster, one thing’s for sure—it won’t be boring.

Now, who’s ready to ride the Bitcoin wave?

Resource Recap - Bitcoin for Beginners

· Read blogs, watch YouTube videos, or even grab a book like The Bitcoin Standard. Educating yourself helps you make better decisions and not fall for scams.

· Cold Wallets: Offline wallets (like USB drives or cards) that keep your Bitcoin safe from hackers, such as the one I use – Tangem.

· In terms of exchanges, some good options for beginners include Binance, Coinbase, or CoinSpot (a local Aussie favourite – this is also the one I use and have been using since 2017).

· IBIT: Blackrock’s Bitcoin ETF – ishares Bitcoin Trust (Australia/US) this is listed on the NASDAQ (IBIT) and I’m invested in this ETF, along with holding a small amount of bitcoin via the exchange Coinspot (been on here since 2017) and majority of my bitcoin via cold storage wallet – Tangem wallet (use my link an get 10% OFF automatically).

Here are some straightforward metrics that beginners can use to assess Bitcoin (see below). CoinMarketCap illustrates many of the below metrics on one page - https://coinmarketcap.com/currencies/bitcoin/

- Price: The current market value of Bitcoin, indicating how much one Bitcoin is worth in fiat currency (e.g., USD).

- Market Capitalisation: Calculated by multiplying the current price by the total number of Bitcoins in circulation, this metric reflects the total market value of Bitcoin.

- Trading Volume: The total amount of Bitcoin traded within a specific period, showing the level of market activity and liquidity.

- Hashrate: Measures the total computational power used to mine and process transactions on the Bitcoin network. A higher hashrate suggests a more secure and robust network.

- Mining Difficulty: Indicates how challenging it is to mine a new block. The network adjusts this periodically to ensure blocks are added at a consistent rate.

- Transaction Volume: The total number of transactions processed over a certain period, reflecting the network's usage and adoption.

- Number of Active Addresses: Represents the count of unique addresses participating in transactions, serving as a proxy for user activity.

- Fees per Transaction: The average fee users pay to have their transactions processed, which can indicate network congestion and demand.

- Mempool Size: The aggregate size of unconfirmed transactions waiting to be added to the blockchain. A larger mempool can signal higher network congestion.

- Supply Metrics: Includes the total supply of Bitcoin, the number of Bitcoins mined, and the remaining supply to be mined, highlighting Bitcoin's scarcity.

For beginners, focusing on these metrics can provide a foundational understanding of Bitcoin's market dynamics and network health.

Have you just started your Bitcoin journey? You’ll thorough enjoy the Bitcoin for Beginners: The Quickest Way to Learn About Bitcoin series

Slug: mstr-2025-stock-forecast-investment-insights

Meta Description: Is MicroStrategy (MSTR) a smart investment for 2025? Explore our expert stock forecast covering fundamentals, risks, and growth potential.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video.

Full Disclosure: Stevo holds Bitcoin/Microstrategy (MSTR Stock) at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights on mate.