My Investment Gameplan: Unveiling the Superiority of Monthly Dividend ETFs

Understanding Dividend Frequency

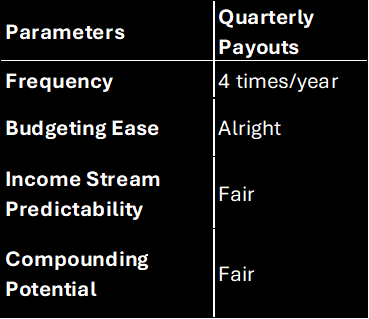

Quarterly vs Monthly Payouts

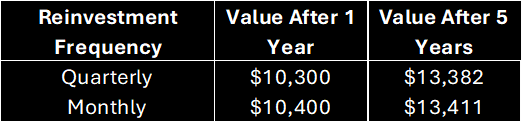

Let's chat about how the "when" of getting your dividends could play a part in your money game. The big deal between quarterly and monthly payouts? It's all about how often you're cashing in.

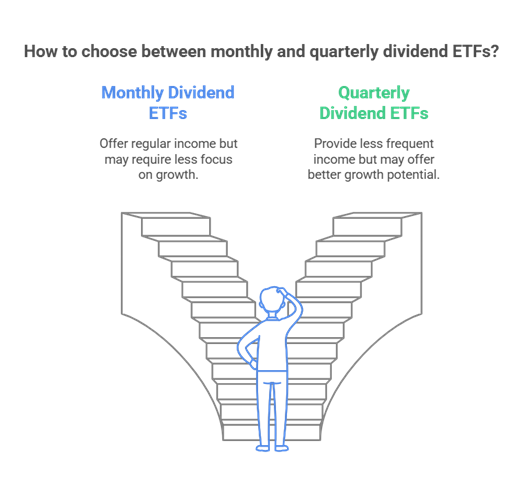

Here's the scoop to ponder: Are monthly dividend ETFs tickling your fancy more than quarterly ones?

Quarterly Payouts

The old-school way with many stocks is the quarterly hangout. You get your dividends four times a year. Quarterly can get you steady cash over time, but if you’re matching your incoming cash to those pesky monthly bills, they might not hit the mark.

Quarterly is like that old trusty bike — does the job for long rides, but not everyone’s cup of tea if you're after constant pocket money or trying to plough back into the pot more often.

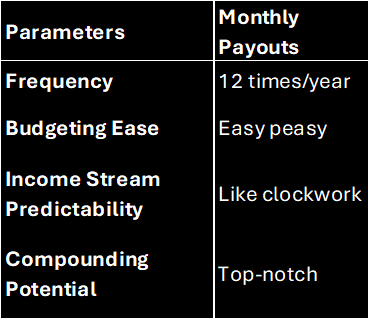

Monthly Payouts

Then there’s the fancy monthly dividend ETFs — twelve times a year, like clockwork. Perfect if your bills like visiting each month or you want to set your clock to a steady ding-ding of income.

SoFi chimes in noting that those monthly rhythms can make it way less of a headache to plan life. You get to reinvest often, giving a nod to bigger returns thanks to compounding.

Monthly checks make your income flow as predictable as my nan's famous Sunday roast, making life simpler for dealing with monthly costs like rent or loans. Plus, chuck those dividends back in quicker and watch your investments do a happy dance, thanks to dividend reinvestment plans (drips).

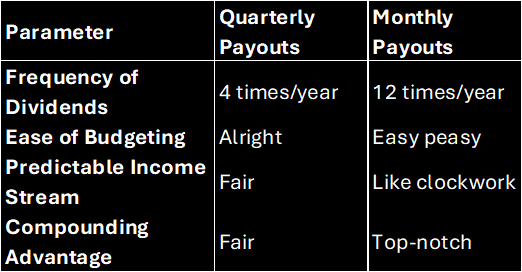

Comparative Analysis

Let’s lay it all out on the table:

Monthly dividend ETFs can feel like a dependable landlord, giving you consistent cash flow. Great for nailing those regular expenses and making the most of the magic of compounding. The trick is matching how often you want your dough with what you need financially.

Benefits of Monthly Dividend ETFs

When it comes to boosting my income, monthly dividend ETFs are like that secret weapon tucked under the mattress. The regular cash drop is always right there, poking its cheery face every month, unlike those quarterly loners. Let's dive into what makes monthly dividend ETFs tick and why they're the bee's knees for folks looking for a steady income and that sweet compounding action.

Consistent Income Streams

What gets my goat in a good way about monthly dividend ETFs is the predictable cash they toss my way. Regular and reliable, these dividends help me cover everything from the rent to stacking savings, even chipping away at any pesky debt. And if you're squirrelly about sticking cash aside, they're perfect for reinvesting straight back in. Monthly payouts make it so much easier to sketch out a budget and reach those big and small cash goals. I mean, who doesn't like knowing when their pay's coming, right? (SoFi).

Getting dividends on the regular means it's a heck of a lot easier to juggle my cash flow and keep things ticking smoothly. It's perfect for those of us who lean on investments to foot the bill for everyday expenses.

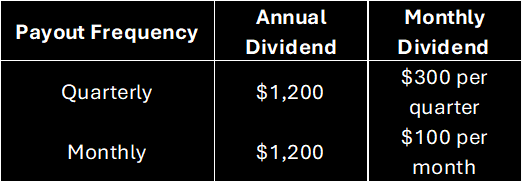

Potential for Compounding

Then there's the magic of compounding with monthly dividend ETFs. When I plough back those monthly dividends, it's like giving my cash a cheeky head start, letting compounding do its thing. It's a classic case of making money work overtime without feeling the pinch (SoFi).

Doing this monthly rather than quarterly means more frequent hustle from compounding, adding layers to my cash like a financial lasagna. The result? More dosh and spiffier returns over the years.

By reinvesting those monthly smidgens, I'm pushing my portfolio to grow faster and more robustly. Curious about strategies? Peek into dividend reinvestment plans (DRIPs).

So, in a nutshell, these monthly dividend ETFs shower me with a steady cash stream and offer that extra compounding kick, making them my go-to for keeping things stable and shooting for growth. For more food for thought, check out income stream predictability and how it fits snugly into a rock-solid investment plan.

Evaluating Dividend ETFs

Top Dividend ETFs to Consider

While trying to squeeze the most bang for my buck from investments, I stumbled upon some pretty impressive monthly dividend ETFs. Here are a few big hitters:

- Vanguard Dividend Appreciation ETF (VIG)

- Vanguard High Dividend Yield ETF (VYM)

- Schwab US Dividend Equity ETF (SCHD)

- SPDR S&P Dividend ETF (SDY)

- iShares Select Dividend ETF (DVY)

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

- YieldMax™ MSTR Option Income Strategy ETF (MSTY)

These ETFs are like buying a basket full of well-known companies, which means you're not putting all your eggs in one stock basket. They spread the risk and can keep the cash register ringing with regular dividends (Read more here). Sounds neat, right? Especially if I'm eyeing something to cover the bills like clockwork or stash some savings (More intel on that).

Factors to Assess in Selection

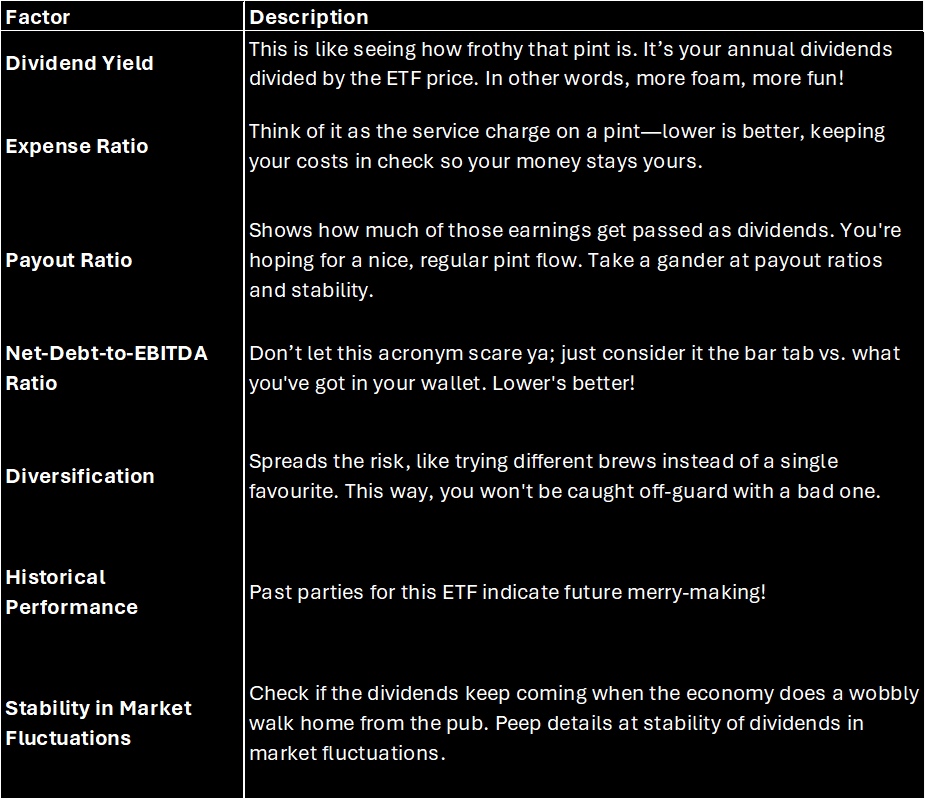

Picking the perfect monthly dividend ETF is a bit like choosing a good pint at the local pub. Here's what to ponder:

Taking all these into account, I reckon I'll have a better handle on whether these monthly dividend ETFs hold the key to keeping the cash coming compared to their quarterly pals.

Importance of Dividend Yield

Yield Growth vs High Initial Yields

In terms of dividend ETFs, is regular income a trade-off for less capital growth?

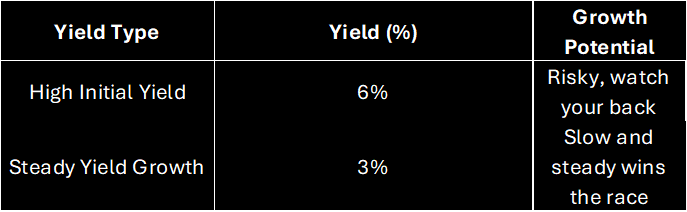

When I'm scratching my head, trying to figure out if monthly dividend ETFs are better than their quarterly buddies, the dividend yield is always on my radar. Think of it as the treasure map guiding me to a pot of gold—it's that little number that shouts out how much income my investment might spit out. But here's the catch. It's not just about gunning for the highest yield like a dog chasing its tail. A nice juicy yield is cool, but let's not forget about the growth part.

Imagine a high initial yield as a shiny new toy, let's say 6%, screaming for attention like a kid hopped up on sugar. Sounds tempting, right? But, like my granny always said, don't count your chickens before they hatch. A fancy yield can turn sour if it’s perched on shaky ground. The folks at Investopedia back me up—they say going after the highest yield can backfire. Sometimes, a modest 3% yield with steady uptick is the winning ticket, instead of a whopper 6% that's teetering on the brink of a trim.

So, when I'm cooking up a plan to rake in some dough, I try to whip up a combo of instant cash and future gold. Those companies with a good shot at growing and handing me a steady yield seem like a swell idea, even if they don't promise the moon right off the bat.

Significance of Average Yields

Figuring out the average dividend yield—like, what does a regular Joe yield look like?—keeps me grounded. It's like aiming for a decent wage that lets me pay the bills without selling my prized baseball cards. The average yield for S&P 500 companies doing the dividend dance usually waltzes around 1% to 3%, says Investopedia. This sweet spot sends out enough dividends to tempt investors while leaving room for the companies to plough dough back into growth.

Picking dividend ETFs kicking around this average ballpark or maybe swinging just a bit higher can hit a home run. It's kinda like enjoying an ice cream that’s both tasty and not gonna melt all over my shirt. And, the cool part? This approach keeps the long-term dream of growth alive and kicking.

Etching out a plan that sends regular cash my way fits my lifestyle like a glove. Monthly dividend ETFs knock it out of the park with that. Plus, watching dividends climb leads to a bonus round—a compounding effect that sweetens my stash over time.

To up my game, I keep an eye out for payout ratios and stability. The key is to hunt for ETFs or stocks flexing strong financial muscles, 'cause they've gotta keep the cash flowing without breaking a sweat. Juggling average yields with growth potential gives me a foolproof playbook to ramp up my investment gains.

Grabbing hold of these bits of wisdom and tossing in some nifty tactics like dividend reinvestment plans (DRIPs), I can fine-tune my plan for current cash and future growth. This way, my portfolio stays sprightly, no matter what the market rollercoaster throws at me.

Sustainable Dividend Strategies

When I look at dividend-paying ETFs, I always check out two things: payout ratios and the net-debt-to-EBITDA ratio. These numbers aren't just stats; they're a peek into the stability and the future of ETFs that pay out monthly dividends versus the ones that pay quarterly. So, what’s the deal with monthly dividend ETFs? Are they worth it?

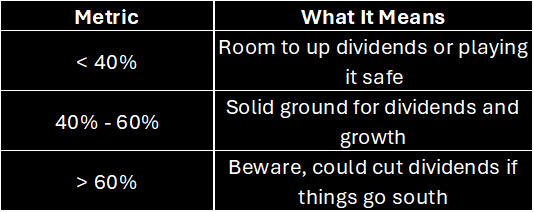

Payout Ratios and Stability

The payout ratio is pretty much a big deal in dividend speak. It tells me what chunk of a company's earnings gets paid out as dividends. Ideally, a payout ratio between 40% and 60% hits the sweet spot (Investopedia). Companies sitting in this range can keep sending that dividend cash while still having a little left over to grow.

Consistency is key, though. If you chase companies with payout ratios hopping in and out of these ranges, you might end up in a rough patch. ETFs loaded with companies keeping a good track record here generally stream steady income. High payout ratios might sound like easy money, but they’re risky if earnings take a dive. And those low ratios? They might point to stodgy management or slim chances of any surprises, growth-wise.

For a deeper dive into how all this impacts dividend sustainability, check out our rundown on dividend yield.

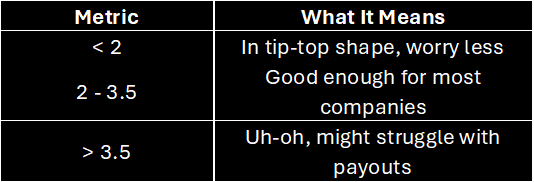

Net-Debt-to-EBITDA Ratio Evaluation

And then there’s the net-debt-to-EBITDA ratio. A mouthful, but it shows a lot about how a company can manage its debts and keep dividends flowing. Basically, it's checking how much debt a company’s lugging against its earnings before all the accounting mumbo jumbo. The lower, the better for keeping up with payments.

ETFs that keep an eye on companies with neat and tidy debt ratios usually serve up stable dividends. Keeping tabs on this is a must if you want that steady income stream.

Factoring these strategies into my own investment moves gives me the heads-up for picking ETFs that don't just throw out tempting yields but also keep those dividends on the rise.

With all this lined up, I’m all in on monthly dividend ETFs, as long as they tick the right boxes on these checks. I reckon they outshine quarterly ones in keeping my income nice and steady.

Historical Performance Insights

Having a peek into the past performance of dividend funds gives us a good sense of the pros and cons when it comes to picking monthly dividend ETFs versus quarterly ones.

Impact of Dividend Funds on Returns

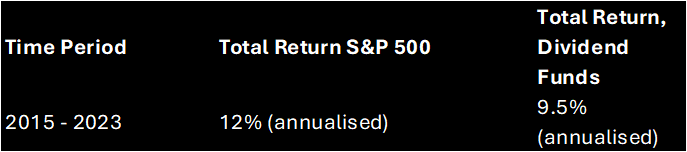

Dividends have been a real game-changer when looking at total returns. Since the 1940s, they've chipped in around 34% to the S&P 500's total gains. If you were to reinvest those dividends, they would make up about 85% of the total returns since the 1960s (Bankrate). This shows just how crucial dividend-paying assets can be for the long run.

Yet, some recent number-crunching suggests dividend-paying stocks don’t always outshine those that don't pay dividends. From October 2015 to December 2023, the S&P 500 gave a better performance compared to three well-known dividend ETFs (Of Dollars And Data). This might cause some to question the appeal of dividends, but it’s worth remembering they can provide some steadiness, especially when the market's throwing a wobbly.

Data from Of Dollars And Data

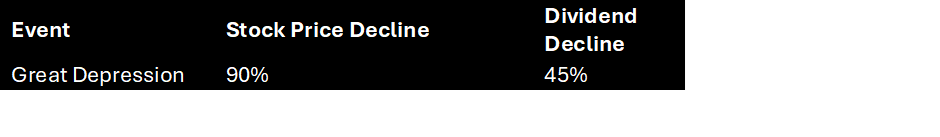

Stability of Dividends in Market Fluctuations

Dividends' true value shines through when the economy takes a hit. During the Great Depression, while stock prices plunged almost 90%, dividends didn't even cut in half (Of Dollars And Data). This kind of steadiness is a lifeline for anyone needing a reliable income, making monthly dividend ETFs quite a catch for income generation.

In bumpy times, the regular drip from monthly dividends can keep your financial boat afloat and boost your cash flow management. Plus, you can jump on those dividends right away with dividend reinvestment plans (DRIPs), letting your returns snowball even more.

Choosing ETFs with monthly payouts provides more consistent cash flow, which is golden for anyone deciding if monthly dividend ETFs are better than quarterly ones.

Looking back at a 20-year span from 1969 to 1989, stocks paying higher dividends regularly outpaced their lower-yielding counterparts, boasting a compound annual return of 18.49% in local currencies (Of Dollars And Data)

From 1969 to 1989, stocks paying higher dividends regularly outpaced their lower-yielding counterparts

To dig deeper into understanding dividend yields, like yield growth and why average yields matter, check out our other articles. Getting familiar with these topics can put you in better stead to fine-tune your investments and amp up your monthly income strategy.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.