Riding the Wave: Making Money with Call Options

Understanding Call Options

Investing in call options can be a clever way to boost your investment returns. I'll unravel what call options are all about and why they might be your new favourite tool for making money.

What are Call Options?

A call option lets me buy an underlying asset at a certain price (called the strike price) within a set timeframe. According to Investopedia, if I'm banking on the asset's price to climb, snagging a call option helps me profit from its rise without actually owning it.

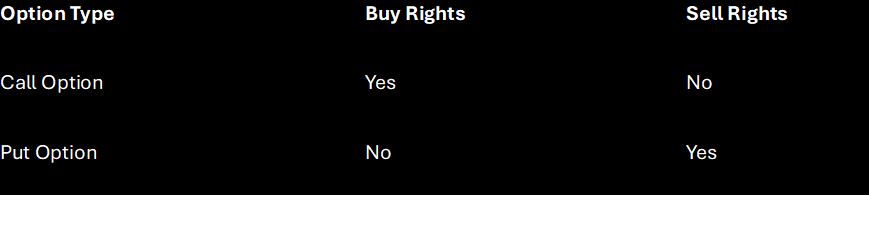

- Call vs. Put Options: A call option gives me buying rights, while a put option lets me sell an asset at a preset price.

Here's a quick table breaking down the difference:

Benefits of Call Options

- Leverage: Call options let me handle a bigger chunk of shares for way less money than buying them outright. This means I can ride on the ups and downs of the market with just a smaller starting budget.

- Risk Control: Investing in call options caps my losses to just the premium I pay for the option, rather than the full price of the asset. Pretty handy during those wild market phases.

- Regular Income: Selling call options - that's what the "covered call" strategy is all about - gives me a regular paycheck. It works like this: I own some stock, sell call options on them, and pocket the option premiums (Investopedia).

- Flexibility: Call options give me the wiggle room to cash in on market trends without going all in. If the market swings in my favour, my option's worth rockets, and I can either sell it for a profit or use it.

To sum it up, call options are a nifty tool for making money and managing risks.

Income Strategies with Call Options

If you're trying to wring the most out of your investments, call options might just be your jam. I'm gonna chat about two cool ways to make a few quid: the covered call strategy and writing puts for extra dosh.

Covered Call Strategy

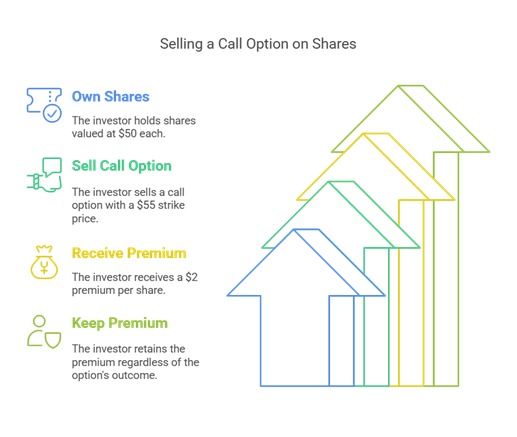

Picture this: you own a bunch of stocks and decide to sell call options on them. This trick's like having cake and eating it too—letting you pocket some cash while hanging onto your stocks. By selling these options, you snag a premium upfront, which can cushion you if prices dip a bit, giving your returns a nice boost, especially when the market's not doing the cha-cha slide.

Say you've got shares in a company trading at $50 a pop. You might sell a call option with a $55 strike price that expires in a month, bagging a $2 per share premium. Whatever happens, you keep the cash.

What This Might Look Like:

Writing Puts for Income

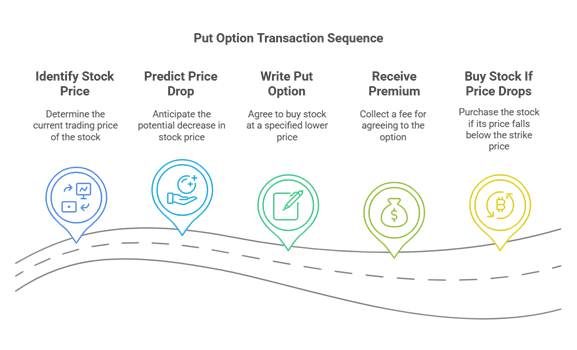

This is like the friendly kid at school who agrees to buy your snacks later – if it comes to that. You're agreeing to buy a stock at a certain price if it drops. In exchange, you nab a premium upfront. Sweet deal, eh? This works a treat if you're hoping to scoop up more stock on the cheap while picking up some bonuses along the way.

Imagine a scenario with stocks trading at $30 and you reckon they won't tumble far below $25. You write a put option with a $25 strike price and pocket, let’s say, $1 per share in premium.

What This Might Look Like:

Both covered calls and writing puts let you jazz up your returns while keeping risks in check. Mixing these moves into your playbook, you're on your way to fostering a more reliable income stream. Check out more deets on call option strategies through our posts on equity income and cash flow musings.

Maximising Profit with Call Options

Trying to score big with call options? It's about making smart choices. Let me walk you through the two biggies: picking a strike price and handling risks with covered calls.

Strike Price Selection

Nailing that strike price is like choosing the right gear for a mountain bike ride—not too easy, not too tough. The strike price is where you get to buy the asset if things go your way. Here's how choosing differently can shake up your gains:

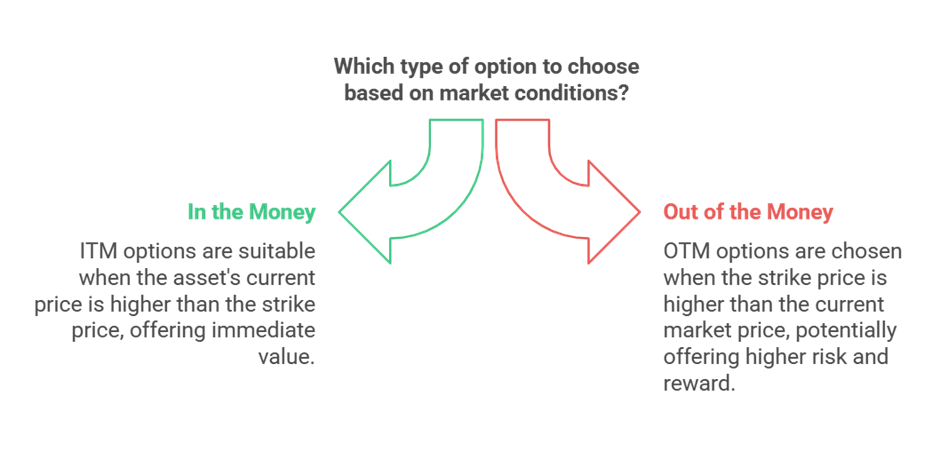

In The Money (ITM) vs Out Of The Money (OTM)

Options come in two flavours: "in the money" (ITM) and "out of the money" (OTM). ITM options have strike prices that are lower than what the asset is going for right now. Picture this: you have a call option priced at $15, and the asset is cruising along at $16—your option's ITM (SoFi). Flip-side, OTM options have strike prices set higher than the current market numbers.

Cost and Profit Considerations

Now, ITM options aren't cheap because their value is sky-high (Investopedia). Meanwhile, OTM options won't break the bank, but you need to hope the price takes a leap for them to pay off.

There's also the premium you hand over and the breakeven point—basically, what you need to reach price-wise to start pocketing some dough. Hit the expiration date without clearing this line, and you're losing just the premium (The Motley Fool).

Selecting the Strike Price

Choosing a strike above the current price with a covered call means you're setting the goal for gains but getting ready to sell if things rise beyond your mark (Investopedia). Make sure this decision jives with your money plans and risk vibes.

Managing Risks in Covered Calls

Owning the asset and selling call options in a covered call approach creates some extra cheddar on the side. But, balancing risk is key here.

Minimising Downside Risk

If your stock's worth dips, the cash from those sold call options might soften the hit. Still, your hardest fall is the stock's buy price minus what you got from the options sale. Diversifying what you own and keeping your cash flow steady can help keep chaos at bay.

Opportunity Cost Management

One bummer you might face is if the stock soars past your strike price, meaning you'll have to let go of it at a lower value, missing some sweet gains. Think about this when you set your strike price to find that sweet spot between what you want now and what you think you'll want later.

Adjusting Positions

Tweak your positions often, like tuning a guitar, to keep risks in check. This might mean bumping up (raising strike price) or giving more time (extending expiry) to your calls as markets swing.

Head over to our other resources about covered-call ETFs and equity income strategies. Master these, and you could turn hedging and income into a real outcome-boosting combo.

In The Money vs Out of The Money

So, you're figuring out how to make some dough from call options, eh? Well, you've got to get the hang of "In The Money" (ITM) and "Out of The Money" (OTM) options. These aren't just fancy terms but keys to knowing if your option has a little bonus built in or zilch.

In The Money Call Options

Call option get the "In The Money" (ITM) title when the current market price of the underlying thingamajig is higher than the option's strike price (Investopedia). Basically, you could buy at a lower price and sell at a higher one. Sweet deal, right?

Imagine I have a call option with a $15 strike price, and the stock is trading at $16. This one's ITM. I can scoop up the stock for $15, flip it at $16, and pocket the extra dollar (SoFi).

If you're into the covered call strategy, ITM options are like your underrated pals—potential profits from selling the call and a nice little stock bump too (Investopedia).

Out of The Money Call Options

On the flip side, an "Out of The Money" (OTM) call option happens when the strike price digs deep above the current market price. Basically, isn't doing you any favours right off the bat.

Here's how that pans out: Say, I have an option at a $20 strike price, but the stock’s chillin’ at $16. This option’s OTM. I’d have to pay $20 for the $16 stock. No thanks, right?.

Though OTM options won’t make you an instant winner, they're not all bad. They can still be worth a punt if you're expecting the stock’s price to soar. Great for wheeling and dealing if you've got a knack for the option writing strategy.

Keeping tabs on whether your option’s ITM or OTM can shape your game plan and help rake in the cash. Learn more tricks about these strategies in our income generation playground.

Practical Tips for Call Options

Diving into call options can be a bit like finding your way through a maze. The goal is to come out the other side with your pockets heavier. Let me break it down for you with some handy tips for exercising and selling options before they hit that expiration date.

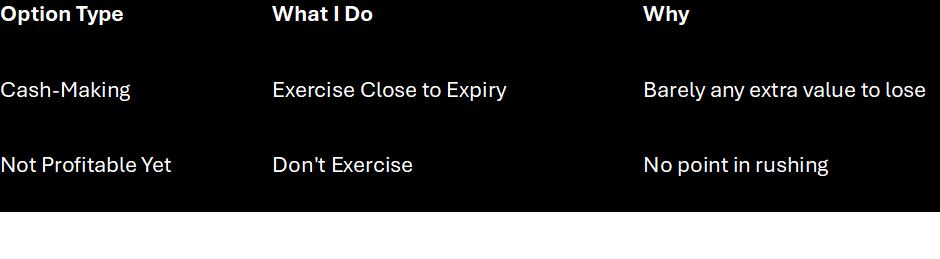

Exercising Options

When I make the call to exercise an option, I'm essentially snagging the underlying goods at the price I agreed on from the get-go. You want your option to be deep in the cash—and I mean real deep. Why's that? Because that's when it really pays off.

I usually hold off on exercising options till the last minute unless that sucker is swimming in profit. Jumping the gun means waving goodbye to any extra value just hanging out, waiting for the clock to run out.

The time when things change, that's where the magic—or misery—happens. As the end date gets closer and the clock starts sprinting, grabbing hold of your option may start to make more sense.

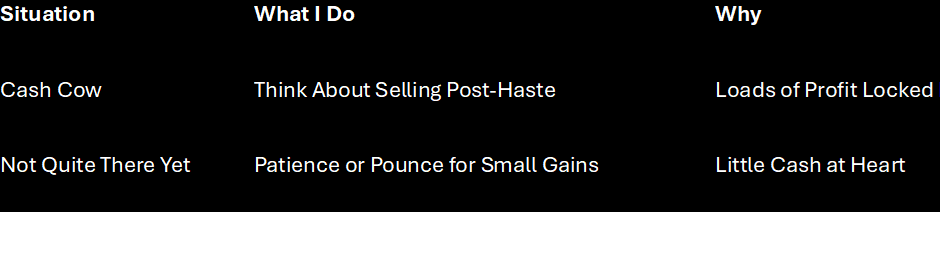

Selling Options Before Expiration

Let me level with you—selling those calls before they expire can be a game of "come out on top" more so than exercising them. Here’s the scoop:

- Keep Extra Cash: Sell early and you might pocket some leftover value. Exercising means you're only cashing in the what's worth at its core.

- Skip the Wallet Hit: Selling won't drain your bank account like exercising can, which makes it a favourite move for those with tighter budget strings.

Selling Deep In the Money and Out of the Money Options

Folks trying to not just get by but to thrive should consider selling options ahead of time to stack the odds (and returns) in their favour. Wrapped around all this is a fine understanding of how those market mood swings and ticking clocks bump up an option’s price tag. Selling options isn’t just about going through the motions; it can churn out a steady income stream if you’ve got your timing right.

Ready for more wildcard moves?

By smartly using these pro tips, I can seriously bump up what I pull in from my call options. Want more nuggets of wisdom?

Advanced Call Option Strategies

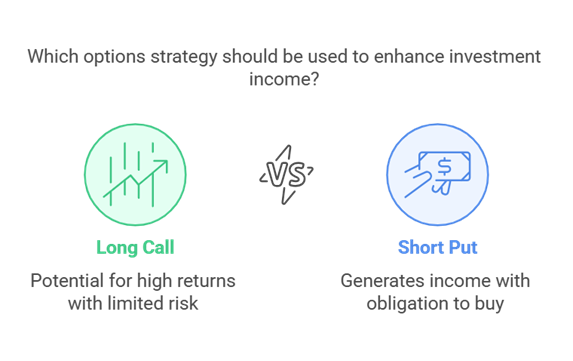

So, I've got the lowdown on some advanced tactics for juicing up investment income with call options. A few sneaky techniques can make all the difference: the trusty long call and long put, and that cheeky short put strategy.

Long Call and Long Put

The long call is like that quiet friend with a loud surprise. All you're doing is buying a call option, hoping the stock will leap over the strike price before the clock runs out. Pretty sweet deal if it works, as the risk is capped to the premium you paid (NerdWallet).

- Why Bother with a Long Call?

- You could see big bucks with just a small punt.

- Best mate in bullish markets or when you reckon the stock's gonna pop.

- The max you stand to lose is what you paid to get in.

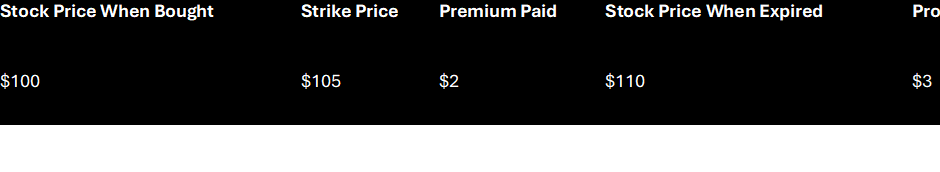

Quick story:

Here’s the gist: your win is the gap between the stock price at the end and the strike price, minus what you shelled out.

On the flip side, there’s the long put. It's your tool if you're betting on the stock taking a nosedive. Buy that put option, and you're crossing your fingers the stock skids below the strike price before it's too late (NerdWallet).

- What's the Deal with a Long Put?

- Hey, you make cash when a stock's nose-diving.

- Offers a safety net in a bearish scene.

- Again, your only risk is what you paid.

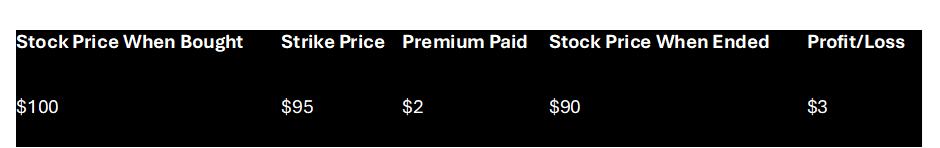

Here's how it might shake out:

Your prize comes from the space between the strike price and stock’s end value, chopped by the premium.

Short Put Strategy

Think of the short put as flipping the long put on its head. Sell off a put option, cross your fingers the stock either chills or climbs. If it doesn't nosedive past the strike price, the put fizzles out, leaving you with the whole tidy premium (NerdWallet).

- Why Roll with a Short Put?

- Reliable earner through premiums.

- Feels right in flat or lightly upbeat markets.

- If it drops below the strike, you could snag a bargain on the stock.

Here’s a peek:

|

Starting

Stock Price |

Strike

Price |

Premium

Snagged |

End Stock Price |

P/L |

|

$100 |

$95 |

$2 |

$100 |

$2 |

|

$100 |

$95 |

$2 |

$90 |

-$3 |

Pushing puts can pad your wallet, as long as the stock doesn’t do a deep dive beyond the strike by finish time.

Catching onto these nifty options strategies can really amp up your investment game while keeping risks checked.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may hold MSTY, MSTR, Bitcoin, cryptocurrencies at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.