The Ultimate Guide to Monthly Dividend ETFs vs Quarterly Dividend ETFs Comparison

Exploring Dividend ETFs

Alright, so you're thinking about diving into this whole dividend ETF thing and wanna know which one’s the right fit for you, yeah? Whether you're looking to keep your cash flow nice and smooth or maybe squeeze a bit more outta your investments, it helps to get the lowdown on picking between monthly and quarterly dividend ETFs.

Monthly Dividend ETFs Overview

Let’s kick it off with monthly dividend ETFs. These are favourites for folks who like having their income clock in like regular paychecks. Imagine getting a little something every month to keep the lights on or take care of that Netflix subscription. According to what the folks over at Investopedia say, those monthly cheques not only help big time with budgeting but also give you a shot to reinvest those dividends and maybe even bump up your returns.

Monthly Dividend ETF Perks:

- Steady Cash: More frequent payday means your money management game can stay on point.

- Reinvestment: Reinvest each month and possibly give your returns a little boost (dividend yield).

- Predictability: Great for anyone who needs a dependable income, makes planning for bills easier (income stream predictability).

Wondering if monthly dividend ETFs are all they’re cracked up to be? Go check our insights on are monthly dividend ETFs better than quarterly ones.

Quarterly Dividend ETFs Overview

Now, for the quarterly dividend ETFs. These guys pay out four times a year, lining up with the end of fiscal quarters in March, June, September, and December. Even though you’ve got to wait a bit longer, they’re still good for reliable dosh. Over at SoFi, they reckon these are grand if you’re playing the long game with goals like saving for your nest egg or the kids’ college fund.

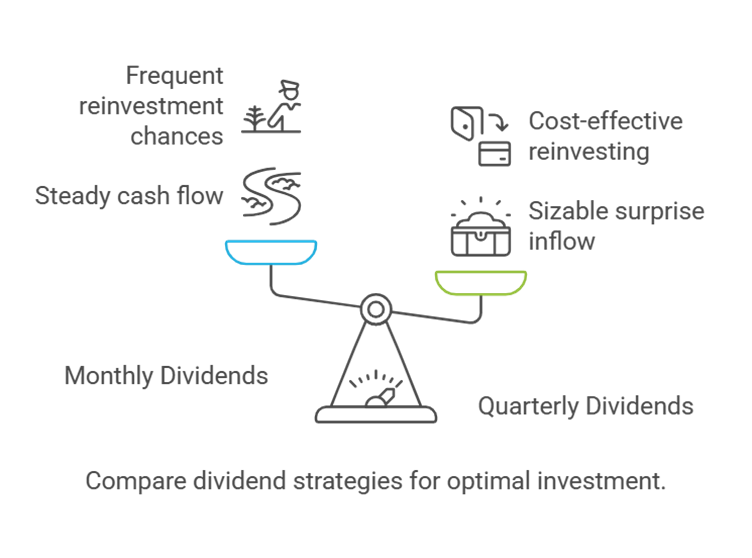

Quarterly Dividend ETF Wins:

- Easier to Manage: Fewer payments make tracking your dividends simpler.

- Reinvestment Bang for Buck: Lower transaction costs when reinvesting those dividends (dividend reinvestment plans (drips)).

- Heftier Payouts: End-of-quarter means you see a bigger chunk all at once.

Both these options bring their own flavour to the table, so don’t be afraid to weigh them up against your personal plans and what you need right now. Wanna tweak your approach with quarterly paydays?

Understandin' these choices can put you on track with your investment plans. For further comparisons and extra goodies, pop over to our pages on tax implications of investing in monthly dividend ETFs and income stream predictability.

Benefits of Monthly Dividend ETFs

Monthly dividend ETFs pack a punch for folks wanting to turbocharge their cash inflow. Let’s dive into why these bad boys are the go-to for those chasing consistent income and financial zen.

Cash Flow Management

Cash is king, right? With monthly dividend ETFs, you get that royal treatment. Unlike their quarterly cousins that only show up like a pizza delivery every three months, monthly dividend ETFs bring the dough every month. This dripping of steady income makes life smoother, especially if you're juggling bills, stacking savings, or stashing cash for future plans (SoFi).

With those monthly payouts in my corner, I can breathe easy knowing my expenses and income are rhythmically aligned. It's a lifesaver if I’m depending on dividends to pay bills, knock down debt, or toss some money into a rainy-day fund.

Total Return Potential

Another clever trick of monthly dividend ETFs is they can beef up your total returns. Touché! Especially when those dividends are reinvested. Rolling over my monthly dividends means I get to jump on the compounding train more often than with the quarterly ones. And the magic of compounding? That’s the gift that keeps on giving (SoFi).

Check out this compounding charm:

In this little game, my stash could swell quicker just by picking a monthly dividend ETF and consistently reinvesting. It's like finding money in an old coat pocket. For folks thinking of wealth that doesn't mess around, monthly dividend ETFs are gold.

By grabbing monthly dividend ETFs, I can ace both my day-to-day cash game and my far-off financial dreams. Need steady retirement checks? Check. Want to bulk up returns? Check again. Monthly dividend ETFs slide in perfectly to fit whatever investment game plan I'm cooking up.

Popular Monthly Dividend ETFs

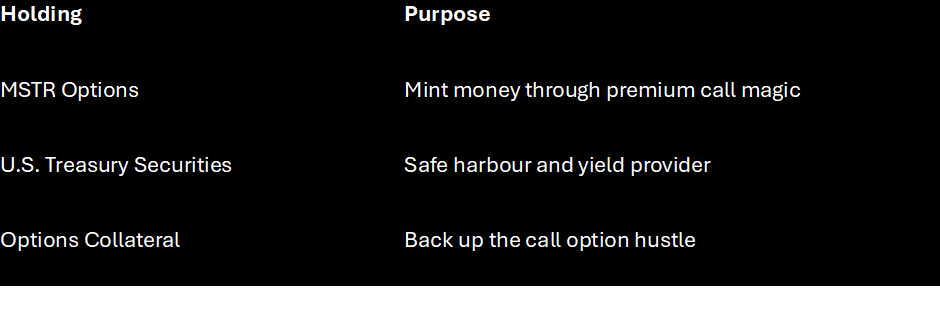

If you're aiming to bump up that monthly paycheck with ETFs, you've landed in the right spot. Here, I'll chat about three favourites: Invesco SPHD, WisdomTree DHS, and iShares PFF, and how they might tickle your income strategy the right way. But then there’s one more, MSTY YieldMax™ MSTR Option Income Strategy ETF that pays a monthly distribution of 10%, but is a risky fund.

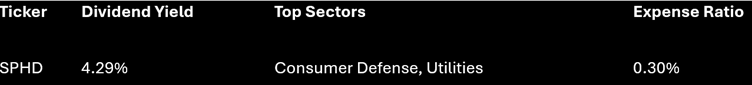

Invesco SPHD

Let's kick things off with the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD for those who love a good abbreviation). This one's all about stocks that dish out high dividends without causing heartburn from market ups and downs. Think of it as a safety net, focusing on stable sectors such as consumer defense and utilities. It’s like wrapping your investments in a warm, fuzzy blanket.

If predictable cash flow brings you joy, SPHD might be your jam. It’s got that nice, comfy vibe for folks who like to keep things steady.

WisdomTree DHS

Next up, we have the WisdomTree U.S. High Dividend Fund (yep, DHS is the shorthand). This one dances to the tune of the WisdomTree High Dividend Index. It’s got fingers in pies ranging from real estate and healthcare to utilities, IT, and consumer staples. It’s like a buffet where you don’t have to choose between the chicken or fish – you get to sample everything.

With DHS, you’re spreading the risk – a nifty strategy for playing it safe while aiming to plump up that dividend slice.

iShares PFF

Now, meet iShares Preferred and Income Securities ETF (yup, PFF for those keeping score). It sticks close to the ICE Exchange-Listed Preferred & Hybrid Securities Index. This one’s got a smorgasbord of goodies from banks and diversified financials to utilities. It’s like financial comfort food, dishing out steady streams of monthly dividends.

For those keen on padding their monthly income, PFF brings consistency and reliability to the table.

Picking your ETF buddy can make or break your cash flow and how well your portfolio parties. Consider what sectors they’re mingling with, their yields, and the costs involved to make it jive with your financial dreams.

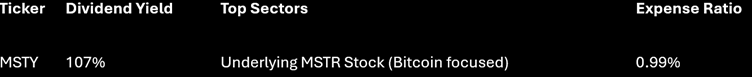

Now the EXTREME – MSTY YieldMax™ MSTR Option Income Strategy ETF

MSTY is on a mission—to dish out income while keeping a pulse on MSTR's share prices. Because it's actively managed, MSTY stays on its toes, ready to squeeze out returns, rain or shine. The approach keeps the fund on its A-game, sticking with its cash-cow philosophy, market turbulence or not.

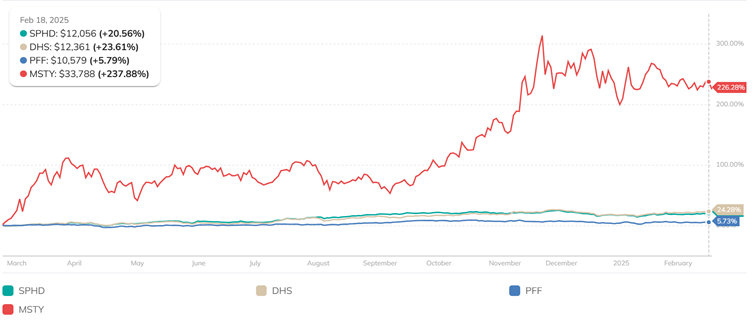

Investment Holdings and Strategies

The MSTY ETF plays it smart and simple: they hold short-term U.S. Treasury goodies and place call options on MSTR stock. This solid plan is about earning while keeping an eye on risk. Here's what they've got up their sleeve:

Reinvesting Dividends

I've always thought that letting those dividends do some extra heavy lifting could really pump up the returns on my investments. You see, by putting the dividends you get from those monthly or quarterly dividend ETFs back to work, you'd not only keep the income flowing, but you'd watch your investment grow like a snowball rolling downhill, picking up speed and size.

Compounding Perks

So, here's the deal, reinvesting those monthly payouts means your money gets to grow faster. It's like planting seeds that keep sprouting up new plants in your garden every month. You're not just banking on what you initially planted, but also on those new little guys growing from reinvested dividends.

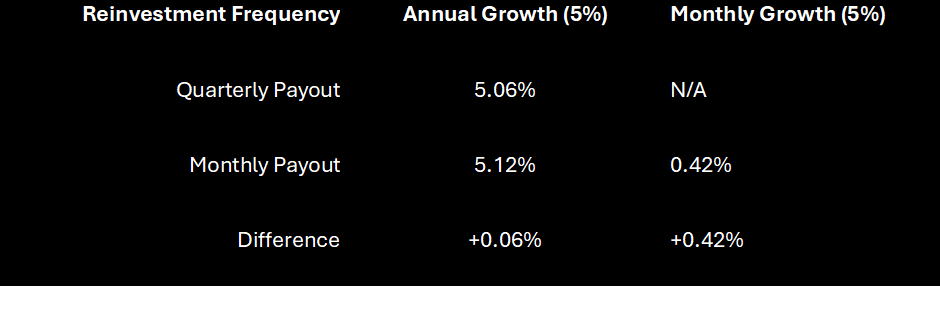

Now look at this:

Turns out, those monthly dividends just edge out the quarterlies (SoFi). This little difference might not seem like a big deal, but over time it could add up to a pretty penny.

Look at the S&P 500 Index, for example. A whopping 85% of its total return since 1960 came from dividends getting reinvested, tweaking the compounding magic to its full potential (Hartford Funds). So, those reinvested dividends are not just some minor detail; they’re a powerhouse for building wealth over the long haul.

Climbing the Income Ladder

Over time, if you keep tossing those dividends back into the mix, you're really setting the scene for some serious growth. Every time you reinvest, you pick up more shares, pumping more dividends back to you when the next payout rolls around. Like a never-ending cycle, your portfolio gets a steady income boost (Investopedia).

Imagine you start off with $10,000 in a fund that pays a 5% dividend annually. By reinvesting those dividends, you're in for different results depending on whether you reinvest monthly or quarterly. But trust me, you'll spot that difference if you hang in there.

Consider using dividend reinvestment plans (DRIPs) to take the guesswork out of reinvesting. This way, those dividends keep rolling back into your investment automatically, saving you time and effort while boosting those compounding goodies.

By being smart about where and when you’re reinvesting—be it monthly or quarterly—and picking the right ETFs.

Quarterly Dividend ETFs Strategy

Alright, let's chat about how to get those dividend bucks rolling in with a little more predictability and flair using quarterly dividend ETFs.

Staggering Dividend Payments

Imagine this: each month, like clockwork, some extra cash drops into your account. That's the magic of staggering dividend payments with quarterly dividend ETFs. Let's break it down. You pick a trio of ETFs that pay out dividends at different times. For instance, snag one that does its thing at the start of the quarter, another midway, and a third as the quarter wraps up, and boom! You're getting a payment each month.*

Here's a bite-sized plan for ya:

Keep this combo in your tool belt, and watch your account get a little fatter every month.

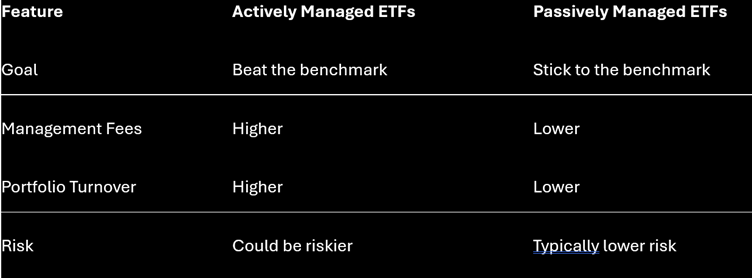

Management Comparison

Now, before you jump in, here’s a bit of wisdom on the folks managing these ETFs. Not all play the same game. We've got the busy bees (active managers) who try to beat the market and sometimes come with higher fees. Then there are the chill ones (passive managers) who follow the market rhythm, generally asking for smaller fees.

Here's a little cheat sheet for you:

It’s kinda crucial to know who's steering your investment ship. Wanna get knee-deep into specifics? Our section on actively managed ETFs has got all the details.

Using the stagger technique along with picking the right management style can turn your investment into a sweet, consistent money-maker. It’s a pretty good tool for keeping that cash flowing nice and steady. Swing by our cash flow management page for more on handling your dough, and for the inside scoop on income generation and dividend yield, check out our treasure trove of info. Keep that wallet happy!

Tax Implications and Considerations

Choosing between monthly dividend ETFs and quarterly ones? It's key to get your head around the tax stuff. Each type carries its own quirks, and knowing these can lead you smarter investment moves, however always check your tax affairs with your accountant!

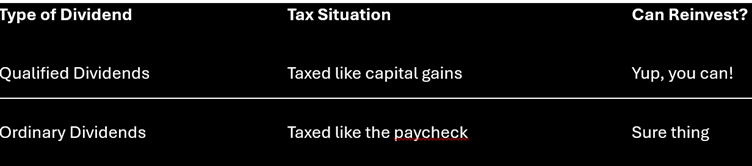

Taxation on Dividends

When dividends from ETFs roll in, Uncle Sam's ready for his share. They’re usually taxable the year you get them (general rule of thumb), even if you’re plowing them right back into the ETF (Investopedia).

If you’re into using dividend reinvestment plans (DRIPs), remember to keep track of what you're reinvesting. Tax is still a thing the moment you get the dough, whether it's monthly or quarterly. So, better factor this into your income generation game plan.

Differences with Mutual Funds

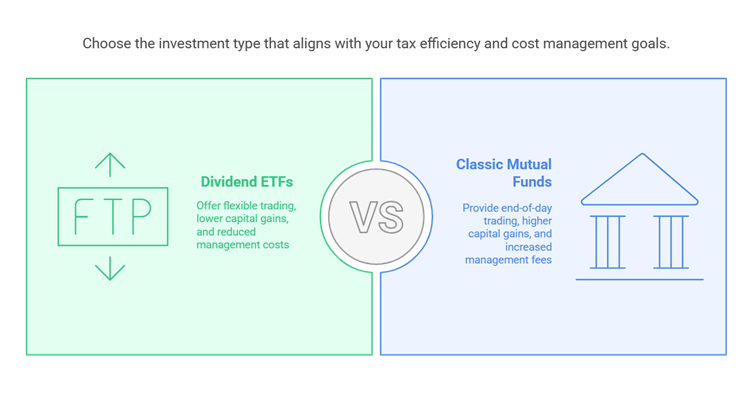

Dividend ETFs and classic mutual funds might seem tax-wise twins (Investopedia). But wait—there're some wrinkles worth noting.

- Flexibility: With ETFs, you're getting stocks-style trading anytime. Mutual funds? Only when the day’s done.

- Capital Gains Distributions: Mutual funds like to scatter capital gains among shareholders, sometimes hiking up your tax bill. Thanks to how they’re built, ETFs often hand out way fewer.

- Management Costs: Notice how mutual funds love their chunky management fees compared to ETFs.

Which one's your pick? It boils down to your personal scene and goals. Fancy a steady monthly income ride? Monthly dividend ETFs might be your jam. Prefer making fewer changes? Quarterly dividend ETFs or mutual funds could hit the sweet spot.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.