Unlocking Cash Flow Brilliance: Essential Strategies for Investors

Effective Income Strategies

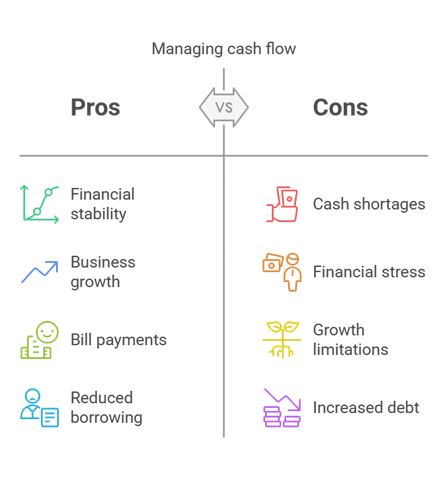

Importance of Cash Flow Management

Let's talk dough – cash flow, that is. It's pretty much the heart of any business, making sure everything runs like a well-oiled machine.

Think of cash flow as the money shuffle – it comes in, it goes out, and if you've got more rolling in than leaking out, you're on the right track. You're handling business, ticking off bills, and gearing up for growth without constantly borrowing a lifeline.

Handling your cash flow with finesse isn't just wise – it's vital. It helps you juggle unexpected costs and handle a few rainy days without going underwater. Many businesses meet their match due to poor cash flow management, never realising the ticking clock before it's too late. Keeping tabs on your financial in-and-outflow is, dare I say, a game-changer for long-term success.

Mess up here, and you're in for some rough patches – late fees, penalties, and not-so-happy suppliers can become regular guests at your table. No one wants that kind of stress, especially when times are tough.

Maximising Investment Income

Stepping into the investor's shoes? Making your money work harder for you is where it's at. Here's how you can stack the deck in your favour:

- Spread Your Bets: Variety is the spice of life – and investing too. Mix it up with stocks, some real estate, bonds, or equity income gigs to spread out the risk.

- Hunt for High Yields: Snagging high-yield dividend stocks or monthly payday ETFs can keep a steady cash flow into your pocket.

- Dabble in Covered Calls: Try your hand at option writing strategies like covered calls for some extra pocket change.

- Reinvest Wisely: Look into dividend reinvestment plans (DRIPs) to really watch your money grow over time.

- Consider Active Funds: Actively managed funds fixated on boosting income might just give you that extra kick.

Check out this breakdown of hypothetical yields (based on US stocks/assets – rough numbers) to stir some ideas:

|

Investment Type |

Annual Yield (%) |

|

High-Yield Dividend Stocks |

4.5 |

|

Monthly Dividend ETFs |

3.8 |

|

Covered-Call ETFs |

4.0 |

|

Real Estate Investment |

5.5 |

|

Bonds |

3.0 |

And if you're keen to dive deeper into predicting how these moves could pay off, our post on income stream predictability could be the jackpot you've been searching for.

Improving Cash Flow

Alright folks, I've been around the block a few times as an investor, and let me tell ya, if there's one thing I've learned, it's this: keeping a steady stream of cash coming in is the name of the game. The goal? Max out what you're rakin' in. I keep my eye on a few key areas like handling who owes what, what's sittin' in the storeroom, and makin' sure those invoices hit the post fast.

Managing Receivables and Payables

Here's my insider trick for keeping what comes in and goes out under control. First, I never skip a background check on customers.

It's like peeking at their report cards to make sure they won't leave me high and dry with late payments. Nobody wants to be the one left without a chair when the music stops. This keeps my pockets happy and the business floatin' with enough dough to pay the bills, even when folks with iffy credit come knockin' (Investopedia).

On the other side of the coin, I can’t forget about payin’ the folks I owe. Timing is everything. Pay too soon, and there goes your lunch money; pay too late, and you're on someone's naughty list. I make sure to strike a balance that keeps cash handy while still being on the good side of my suppliers (Tipalti).

|

Trick |

Perk |

|

Customer credit check |

Dodge late bills |

|

Timing payments just right |

Keep cash in the bank |

Efficient Inventory Management

Alright, let's dive into the backroom where the magic happens—or it just collects dust. Excess or slow-selling inventory is like a ball and chain on your cash flow. You want stuff flying off the shelves, not gathering cobwebs. Using sales forecasts and liquidation channels, I keep things moving and cash flowing (Business.com).

|

Trick |

Perk |

|

Sales guessing game |

Keep shelves lean and mean |

|

Liquidation shortcuts |

Fast cash back |

Immediate Invoicing for Better Cash Flow

Let's talk about the big 'I' – invoicing. Doing it right after a sale is like sending your bills on a fast track. The sooner it’s out, the quicker the cash comes in. It’s an easy way to prevent tie-ups in the money-a-go-round (Investopedia).

Using these tricks keeps me on the path to a plump cash flow and gets me the most bang for my buck.

External Influences on Cash Flow

Impact of Market Factors

So, you're looking to invest, huh? Well, let’s chat about how stuff like interest rates, the ups and downs of the stock market, and inflation can tinker with your cash flow. Markets are a bit like weather in that they can switch gears real quick, affecting when and how much money rolls in or out of your pockets.

Interest Rates

Let’s break it down: interest rates are like the bad or good angels on the shoulders of your finances. When they go up, borrowing money becomes pricier, which can squeeze your cash flow tighter than your jeans after Thanksgiving. On the flip side, when rates drop, your wallet might get a little breathing room as borrowing costs fall and investment earnings perk up.

Market Volatility

The stock market is like a rollercoaster. A thrill ride, but sometimes it makes you queasy. As stock prices rise and fall, they can throw your investments and liquidity into a bit of a spin, impacting your cash flow’s nice, steady beat. To keep from getting seasick, it’s smart to have a solid plan for dealing with rocky waters. Think along the lines of adding a dash of variety to your investments.

|

Market Factor |

What It Means for Your Money |

|

Interest Rates |

Impacts borrowing costs & investment love |

|

Market Volatility |

Shakes up investment value & liquidity |

|

Inflation |

Messes with buying power & costs |

Government Policies and Cash Flow

Governments sure like to throw a wrench or two into the economy every now and again, and this can have a pretty direct impact on your cash flow, whether you're running a business or just managing your personal finances.

Tax Policies

Changes in tax laws can feel like having a surprise visitor who eats all your snacks. If corporations get hit with higher taxes, profits shrink, leaving less money in the piggy bank for reinvestment or those beloved dividends.

Subsidies and Grants

In contrast, when Uncle Sam decides to hand out subsidies or grants, your finances can feel a bit more bearable. They can help slice off some of those pesky operating costs or even throw in extra streams of income. Keep an eye on what goodies the government’s offering, and you might find some unexpected bonuses.

|

Government Policy |

What’s the Deal with Your Dough? |

|

Tax Policies |

Nudges net income & investment capabilities |

|

Subsidies & Grants |

Can cut costs or add fresh earnings |

Want a deeper understanding of how these elements shape your cash stream? Consider diving into strategies like dividend reinvestment plans (DRIPs) and their effects on your finances.

Grasping how these outside forces work is key to keeping your cash flow healthy. Stay up to date on market shifts and government decisions, and you'll be better armed to make savvy choices and build strategies that plump up your wallet and boost your investment income.

Utilising Cash Flow Statements

Right then! If you're playing the money game like me, getting your head around cash flow statements (CFS) is a must. These little beauties give you a peek into a company's financial soul by showing you every quid that's come and gone.

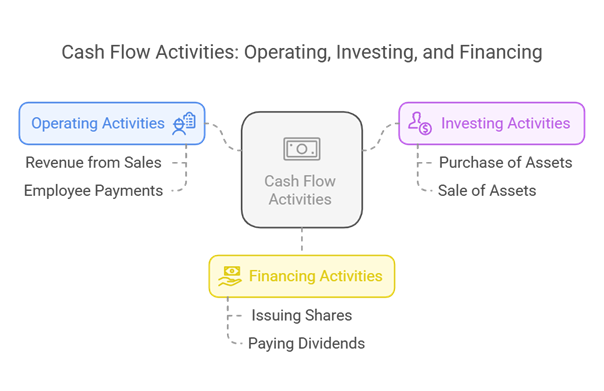

Understanding Cash Flow Statements

A CFS is part of the financial holy trinity: the income statement, the balance sheet, and our star player, the cash flow statement. It's like the no-nonsense mate of the group, focusing solely on the money changing hands, which offers a no-frills look at a company's financial health. You can ditch all that accounting mumbo jumbo and see what's really going on with the cash (Vena Solutions).

Here’s the stuff I poke around for in a cash flow statement:

- Operating Activities: This bit spills the beans on cash from everyday business stuff, like flogging products or paying the workers.

- Investing Activities: Here, you see what dough's been splashed on investments—buying buildings, gear, or maybe selling some old junk.

- Financing Activities: This side of the story tells you about the cash coming from or going back to outside money interests, like whipping up shares or dishing out dividends.

Types of Cash Flow Reports

There are a few flavours of cash flow reports, and each gives you different takes on a business's financial status. Here are the main ones I keep an eye on:

- Direct Cash Flow Report: No beating around the bush here—this report lists out every cash transaction. You see exactly what’s coming in, like from selling stuff, and what’s flying out, such as supplier bills. Easy peasy.

| Cash Transactions | Amount ($) |

|------------------------|-------------|

| Cash Inflows | |

| - Sales Revenue | 50,000 |

| Cash Outflows | |

| - Supplier Payments | 30,000 |

| - Employee Wages | 10,000 |

| Net Cash Flow | 10,000 |

- Indirect Cash Flow Report: This report takes the net income at the start, then tweaks it for balance sheet changes to figure out the cash flow from running the joint.

| Adjustments to Net Income | Amount ($) |

|----------------------------|-------------|

| Net Income | 20,000 |

| + Depreciation | 5,000 |

| - Increase in Inventory | 2,000 |

| Net Cash Flow from Ops | 23,000 |

- Free Cash Flow Report: Free cash flow (FCF) shows you the cash a company drums up after splurging on necessary expenses. It's handy for spotting if there's spare change to grow the biz or line your pocket with some extra dosh.

| Free Cash Flow Calculation | Amount ($) |

|-----------------------------|-------------|

| Operating Cash Flow | 30,000 |

| - Capital Expenditures | 10,000 |

| Free Cash Flow | 20,000 |

By working with CFS, investors (like you and me) can make wise choices on where to park our money.

Enhancing Cash Flow Predictions

Knowing where your money's coming from and where it's headed is the bread and butter for any investor looking to boost their returns. A good forecasting recipe makes sure we've got enough dough to keep things rolling and to make those smart moves. Here's a couple of ways I spice up my cash flow predictions: peeking at past trends and letting machines do some of the heavy lifting.

Historical Trends for Insights

Digging through old financial records isn't just for history buffs. It’s a treasure map for investors wanting to predict cash flow. By focusing on what's been and gone, I can spot patterns and hiccups that might trip us up in the future. Things like seasonal upswings, marketplace hiccups, and past revenue challenges give me a full picture of our cash game.

Say, for example, doing a little detective work on customer credit before transactions helps stop late payments in their tracks, especially from those ol' shaky credit folks (Investopedia).

Here's what I do to stay fashionably informed by history:

- I flick through financial snapshots from yesteryears.

- Pin down any yearly swings or market shockwaves that rocked our cash vibe.

- Keep tabs on changing revenue flows and outgoing funds.

|

Year |

Cash Inflow ($000) |

Cash Outflow ($000) |

Net Cash Flow ($000) |

|

2020 |

500,000 |

450,000 |

50,000 |

|

2021 |

550,000 |

520,000 |

30,000 |

|

2022 |

600,000 |

580,000 |

20,000 |

Knowing historical ebbs and flows helps me plan for sparse times and grab opportunities in flush months. It pays to mix in info from other finance docs to see the whole financial picture. Find out more about what makes cash flow statements tick here.

Automation for Accurate Predictions

Let’s be honest, manual cash flow details are a chore. Enter automation – the knight in shining algorithm to the rescue. Tools that make payments and collections a breeze also make our forecasts squeaky clean and spot-on.

Top-of-the-line stuff like Tipalti uses data magic to sharpen cash flow predictions, leading to smarter moves (Tipalti). Automation doesn't just move papers around; it turns the accounts payable process into a well-oiled machine so that payments happen like clockwork and forecasts are accurate as a fortune teller's ball.

Here's why smart tech tools are my cash flow sidekicks:

- Always-On Data Crunching: These nifty tools keep the numbers ticking so predictions are always fresh.

- Smooth Operation: Makes payment cycles a breeze and maximises both ingoing and outgoing cash streams.

- Penny Savers: Things like electronic payment methods can offer sweet cashback perks, giving your cash flow a little extra juice (MineralTree).

Using these smart gadgets means I’ve got more time for big thinking and less for tedious tracking. =

Bringing together past wisdom and machine muscle forms a power-packed combo for accurate cash flow predictions, keeping my investments on the up and up.

Comprehensive Financial Health

Incorporating Financial Statements

For folks like me, getting a grip on financial statements is like having a crystal ball for managing cash flow. I find diving into the details of the income statement, balance sheet, and the big player, the cash flow statement (CFS), paints the full picture of a company's financial health.

According to Vena Solutions, the CFS is the go-to for a quick look at where the cash is comin' and goin', giving a snapshot of a company's liquidity standing. All these financial statements swap stories—offering game-changing insights that keep investors' gears turning smoothly.

Here’s a cheat sheet of the main financial statements:

|

Financial Statement |

Key Focus |

Importance |

|

Income Statement |

Revenue and expenses |

Measures profitability |

|

Balance Sheet |

Assets, liabilities, and equity |

Assesses financial position |

|

Cash Flow Statement |

Cash inflows and outflows |

Evaluates liquidity |

Using these statements, I can pretty much guess my cash flow needs to a T. They offer the inside scoop on how best to shuffle around resources, handle debt, and spot stellar investment opportunities. Keeping an eye on that fancy term, the net asset value (NAV), means I stay on top of my investment evaluations.

Cash Flow in Strategic Decision Making

Making smart money moves means having those financial statements, especially the CFS, by my side, making sure my investments line up with what’s in my wallet. Bad cash flow management can trip up small businesses faster than you’d believe, spotlighting why getting a handle on those cash flows is top dog.

To keep my cash flow game strong, I’m all about managing Accounts Receivable (AR) and Accounts Payable (AP) like a boss—making sure credit policies click, transactions zip by in no time, and insights are sharp. Tips from experts like Bridgepoint Consulting have been like gold dust, smoothing out my AR and AP handling.

By combining income statements, balance sheets, and cash flow statements in a three-way forecasting model, I can peek into the future of financial trends and line up investment shots like a pro. Here’s a quick cash flow projection model I use:

|

Month |

Cash Inflows ($) |

Cash Outflows ($) |

Net Cash Flow ($) |

|

January |

10,000 |

8,000 |

+2,000 |

|

February |

12,000 |

9,000 |

+3,000 |

|

March |

15,000 |

11,000 |

+4,000 |

Nabbing insights from these strategies ups my income game, smooths out how I chuck resources around, and gets me marching toward financial awesome-sauce. Hungry for more on investment income tactics? Check out my take on equity income strategies and the scoop on option writing strategies.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video.