Unlocking My Insights: MSTY ETF Performance Since Inception February 2024

Understanding Income Strategies

Let's talk cash: income maximisation is the ultimate dream for investors looking to turn their investments into a steady money-making machine. This part explores how smart moves and good planning can boost your income strategies.

Why I Care About Maximising My Income

As someone who's put money into investments, it's crystal clear why squeezing out every penny is so important. I aim to create a money waterfall that funds everything from my current expenses—think rent and groceries—to my golden years' adventures. Here's why making the most of investment income spells "winning":

- Keeping My Finances Rock-Solid: Maximising my income equals having a constant flow of money. It's like adding a security blanket, especially when I'm no longer working and counting on this cash to keep rolling in to meet monthly needs.

- Shovelling Money Back In: More income means more cash to throw back into my investment pool. That's the magic of compounding: your money starts making more money for you, and it's a big part of building seriously impressive wealth (look into dividend reinvestment plans (DRIPs) if you're curious).

- Mixing It Up: By picking income-focused investments from a mixed bag of goodies like stocks, bonds, or ETFs, I'm reducing risk and potentially scoring even better returns (check out actively managed ETFs to get what I mean).

- Putting Inflation in Its Place: Some investments, like covered-call ETFs, go the extra mile to offer higher payouts. These help me stay afloat when inflation tries to nibble at my savings and purchasing power.

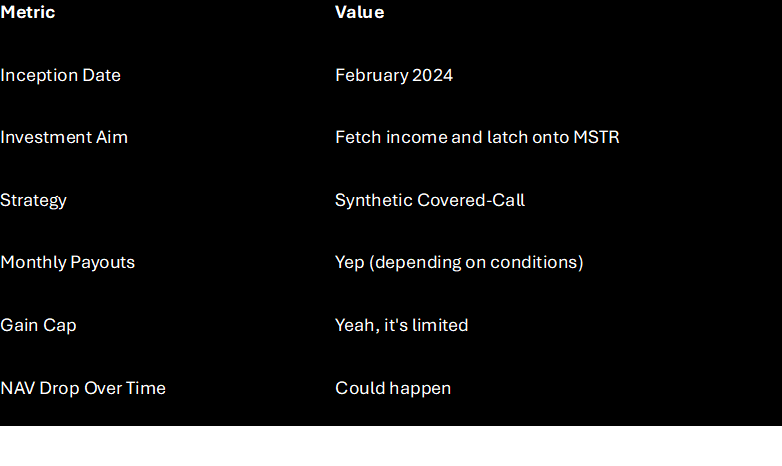

To really squeeze the most out of my earnings, one strategy I'm eyeing is checking out high-yield options like the YieldMax MSTR Option Income Strategy ETF. Kicked off in February 2024, MSTY ETF uses a fancy synthetic covered-call tactic to rake in income while riding the MicroStrategy Incorporated (MSTR) wave (see SEC Archives for more details).

Curious about how this bad boy has performed since it came onto the scene? Check out these highlights:

Wanna dig into how to really make these strategies work for your wallet? Look into option writing strategies and see how they can change your cash flow management game. Getting the hang of this stuff empowers me to drop the right money moves to meet my cash-flow dreams.

Comparing MSTY and NVDY ETFs

When I take a good look at the MSTY ETF also known as ‘YieldMax MSTR Option Income Strategy ETF’, versus the NVDY ETF (short for YieldMax NVDA Option Income Strategy ETF) , it's clear that focusing on return on investment and volatility gives me a good idea of which one lines up with my goal of bringing in some cash.

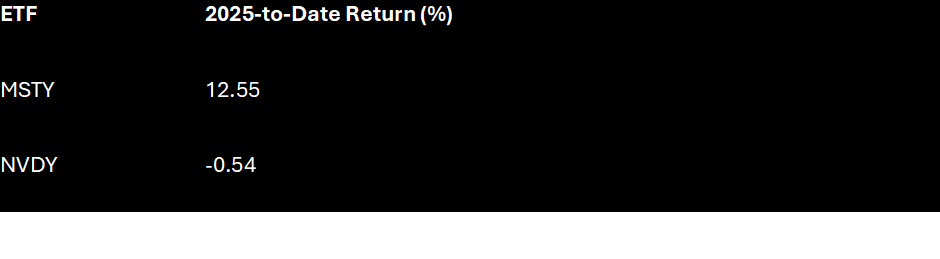

Return on Investment

Getting a handle on how well each ETF performs in terms of returns is key to boosting investment income.

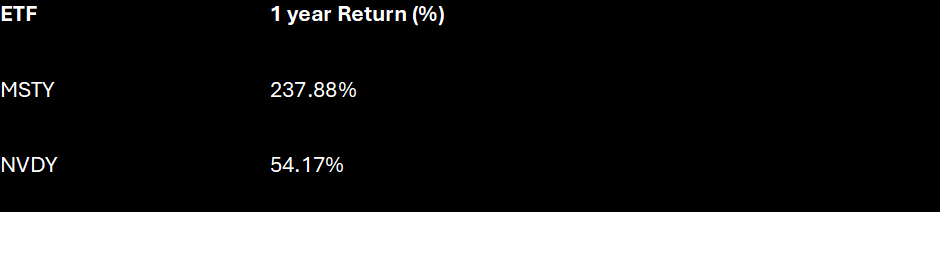

As per the latest numbers from PortfoliosLab, MSTY's return stands at a snappy 12.55% this year. Meanwhile, NVDY is dragging with a -0.54% return. With those numbers, MSTY clearly pulls ahead, making it a more tempting option for my money-making scheme, keep in mind all distributions are re-invested.

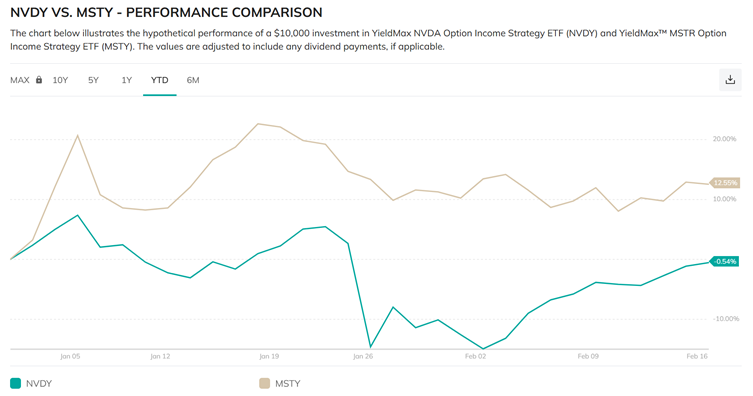

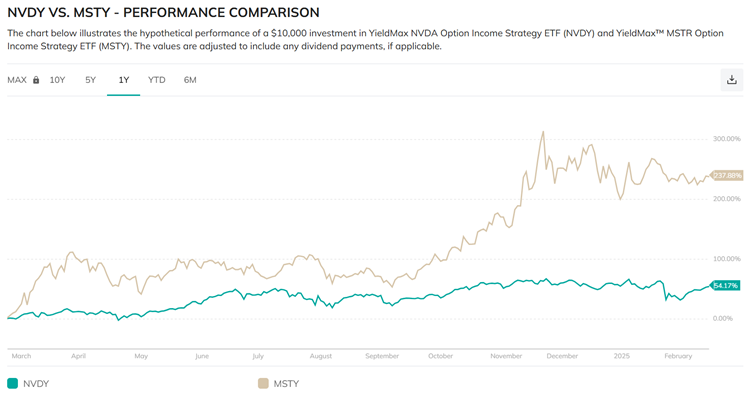

However the return at the 1 year mark, shows MSTY’s return stands at a whopping 237.88% vs NVDY at 54.17%. The chart below illustrates the hypothetical performance of a $10,000 investment in YieldMax NVDA Option Income Strategy ETF (NVDY) and YieldMax™ MSTR Option Income Strategy ETF (MSTY). Remember, this is with all distributions re-invested.

Risk and Volatility Levels

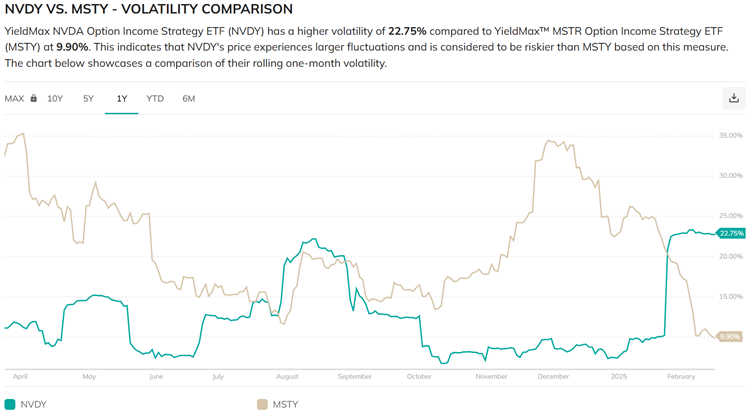

When comparing ETFs, risk and volatility are big factors to mull over. If something's more volatile, that generally means more ups and downs in price.

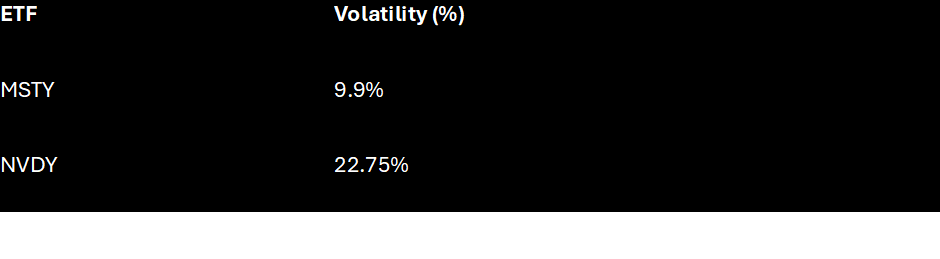

Again, looking at PortfoliosLab, MSTY's volatility sits at a manageable 9.9%, while NVDY is bouncing around with 22.75%. This means MSTY is less of a wild ride when it comes to price changes. The below graph shows that NVDY's price experiences larger fluctuations and is considered to be riskier than MSTY based on this measure, it also showcases a comparison of their rolling one-month volatility

For anyone thinking about how volatility might mess with your returns, taking a look at the maximum drawdown analysis could be beneficial.

By piecing these bits together, I can make a solid call on which ETF fits my aim for squeezing out the most income. If you’re into more detailed info and investing strategies, have a peek at sections like monthly income management, or dive into the world of covered-call ETFs.

Exploring MSTY ETF Performance

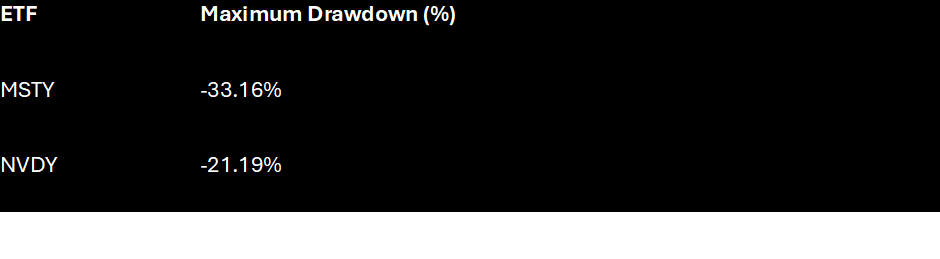

Maximum Drawdown Analysis

When you're checking out the MSTY ETF since it kicked off in February 2024, keep an eye on maximum drawdown. That's just a fancy way of saying the biggest drop in value from a peak to a dip—showing how much an investor might have lost during a rocky period.

For MSTY, the max drop-off since we started clocks in at -33.16%. Now, that might sound like a lot, but comparing it with similar ETFs, like NVDY ETF, which slid down by -21.19% during the same time, can provide some comfort.

The bigger dip for MSTY could be linked to how it's playing the market with its synthetic covered-call approach. It's not all doom and gloom though; the way MSTY structures its investments could be a win for income seekers.

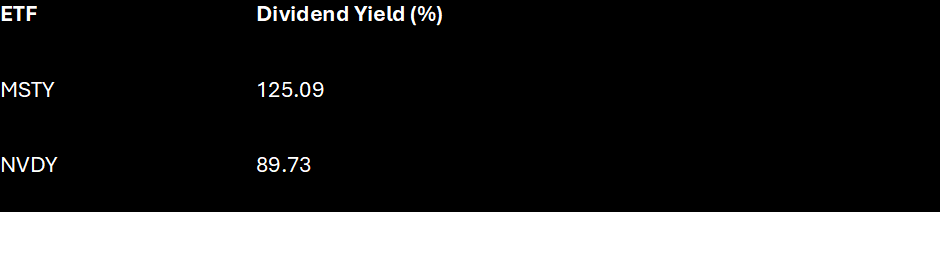

Dividend Yield Comparison

Peeking at another important metric, check out MSTY ETF's dividend yield. It's like finding out how much bang you get for your buck in income terms compared to the ETF's cost—a big deal for those hoping to boost their investment income.

Since it started, MSTY ETF has boasted a hefty 125.09% dividend yield over the past year. Compared to NVDY's 89.73%, that's a nice cushion for income-hunters.

This beefy yield can be a game-changer for those needing regular income, such as retirees. To dig into how it pulls off such a return, take a peek at its investment strategy or covered-call plans.

If you want to see how yields play into your investment mix, check out our dividend yield page.

By looking at maximum drawdown and dividend yield, you get a clearer picture of how MSTY ETF is performing and if it's right for your investment aims. For more on juicing up your income with ETFs, take a gander at our articles on raking in income and monthly cash flow strategies.

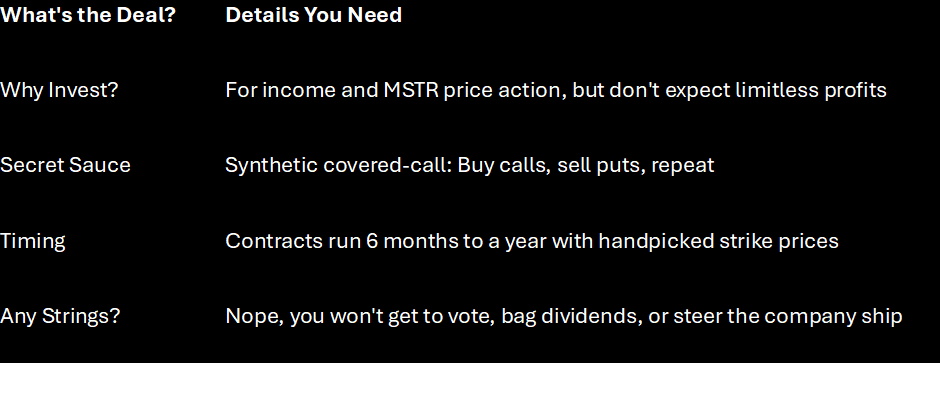

YieldMax MSTR Option Income Strategy ETF

Getting to grips with the YieldMax MSTR Option Income Strategy ETF is essential for anyone keen on getting the most out of their investment buck. Let me break down this beast's goals and how its fancy covered-call strategy ticks.

Investment Objective

So what's this ETF really gunning for? Its main focus is to rake in some regular cash flow while riding along with MicroStrategy Incorporated’s (MSTR) stock price. It's like aiming for a reliable paycheck, with a side of stock adventure. Keep in mind, it's not about skyrocketing your returns but more about keeping things steady and predictable (SEC Archives).

Synthetic Covered-Call Strategy

This bad boy uses a synthetic covered-call strategy, which is fancy speak for a method that's a bit different from the usual money-making moves. It's all about generating income and getting a piece of MSTR action, but the gains are kept in check thanks to some nifty options maneuvers (SEC Archives).

Here's the lowdown on how this works:

- Long Exposure to MSTR: Imagine picking up some MSTR call options. That means you're in a spot to reap the rewards if the stock price decides to do a little dance upwards.

- Selling MSTR Put Options: At the same time, you're letting go of MSTR put options. These are set with picks for strikes lasting from six to twelve months.

This play creates a win-win by combining bits of both strategies to keep those pennies coming in and stopping your gains from flying too high. Keep in mind, though, you won't be whispering in the ears of MSTR's decision-makers or marching in with voting rights (SEC Archives).

For some extra scoop on the monthly payout from this ETF, swing by our pages on monthly income and how it impacts income generation. Likewise, getting a handle on what goes down with dividend yield might lock in the mystery of steady income streams.

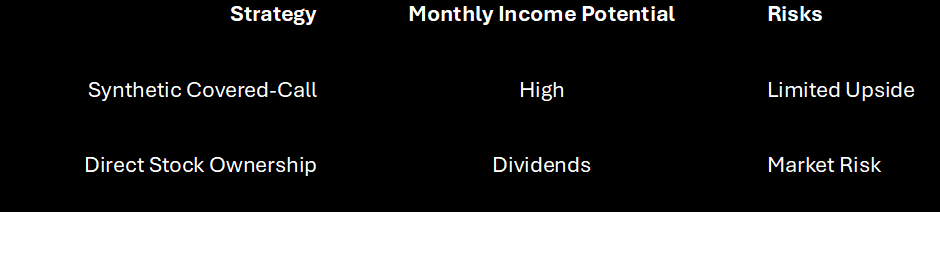

Strategies and Yield

These tidbits can help you figure out what matches your income dreams and how much curveball you're willing to take. For more on this, take a look at what goes down in covered-call ETF and option writing strategy.

By eyeballing these strategies and their workings, making smart moves to squeeze the most out of your investments while keeping a lid on risks like cash flow management becomes easier. Want more on this? Head over to how does MSTR's covered call strategy work? for a deeper dive.

Investing in YieldMax ETF

Considering jumping into the world of high-yield investments? The YieldMax MSTR Option Income Strategy ETF might just be your golden ticket. Dive in with me as I share what I've dug up on its connection to MSTR's performance and the finer points about its fee waiver.

Exposure to MSTR's Performance

Now, when you hop on the YieldMax ETF train, you're essentially riding on the coattails of MicroStrategy Incorporated (MSTR) without actually holding their stock. In simple terms, this ETF gives you a sneak peek into MSTR's performance by employing a nifty covered-call strategy—think of it as a way to enjoy the ups and downs without buying the stock outright. The fund's main aim? Current income and a taste of MSTR’s price action, albeit with a cap on the potential profits.

Here's the magic behind the curtains: it uses a synthetic covered-call trick—buys MSTR call options while at the same time selling MSTR put options. These have terms of six months to a year with strike prices that are customised just for you. It's like having your cake and eating it too, except there’s a limit to how much cake you get to scarf down. There’s a small hitch, though. I’m in for the price rises and falls, but not any say-so in the company like voting rights, dividends, or any influence over how MSTR is run.

Fee Waiver Details

Now, let's talk fees. Everyone hates them, right? Well, here's a silver lining—YieldMax ETF’s got a fee waiver going till February 28, 2025. Thanks to a generous 0.10% fee waiver, it’s a smooth sail for income chasers like me, lowering those pesky costs and boosting the returns, especially in the early years when every penny counts.

If you fancy keeping more cash in your pocket while ramping up your investment returns, this fee waiver is like hitting the jackpot.

Considerations for Earning More with Your Investments

When diving into income-bringing ETFs like MSTY ETF, it's all about getting a grip on the things that can boost your profits. I'm here to shed some light on past performance indicators and the nitty-gritty of getting your monthly income.

Past Performance Insights

So, you've got your eye on the MSTY ETF and you're wondering how it's done in the past. While peeking into the past gives you a sneak peek into how things might swing, remember, the past ain't always an echo of what's to come (YieldMax ETFs). By sifting through historical data, you can catch some trends, see how steady it’s been, and the bumpy rides it has faced. This is gold, especially if you're after a steady paycheck kind of income.

As you munch on these numbers, don't forget to think about what was cooking in the market kitchen. Like, a solid annual return might be thanks to a bull market, and those hefty losses might just be during stormy market weather.

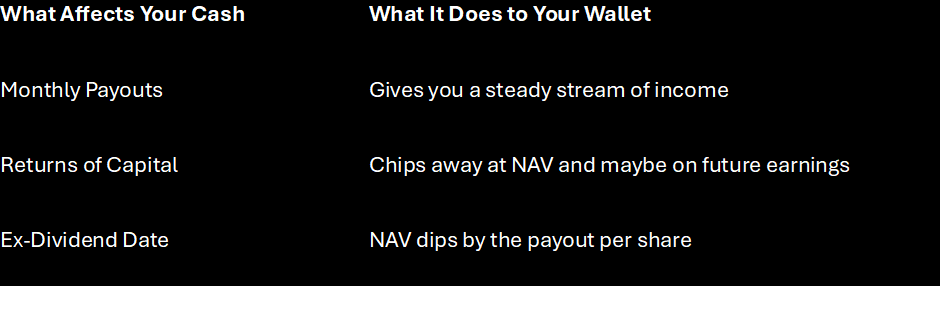

Monthly Cash Flow Stuff

Pulling in monthly dough is the name of the game with MSTY ETF. Each YieldMax™ ETF looks to dish out income every month, but remember, it's not always payday (YieldMax ETFs). Sometimes, the cash comes from returning capital, which can take a slice out of the ETF's NAV and its price tag.

Knowing these can help you keep your wallet happy and make wise choices, especially when your monthly paycheck depends on it. Like, spotting the ex-dividend date is crucial because that’s when NAV takes a little dive by the payout value (YieldMax ETFs).

You’d also want to think about how those payouts shape your total gains, especially when you’re into dividend reinvestment plans (DRIPs). With these nuggets of wisdom, you can squeeze the most out of your MSTY ETF while keeping an eye on potential risks and performance numbers. For a deeper dive into your monthly earnings, have a glance at msty dividend yield and monthly distribution rate.

By tuning into these thoughts, I can start piecing together how to grow my income and make smarter moves with my MSTY ETF investments.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.